Indonesia, Peru sign FTA

The FTA aims to strengthen cooperation on combating narcotics, illegal trade, and collaboration across food, mining, energy transition, fisheries, and defence sectors between Indonesia and Peru. Indonesia and Peru signed a free trade agreement

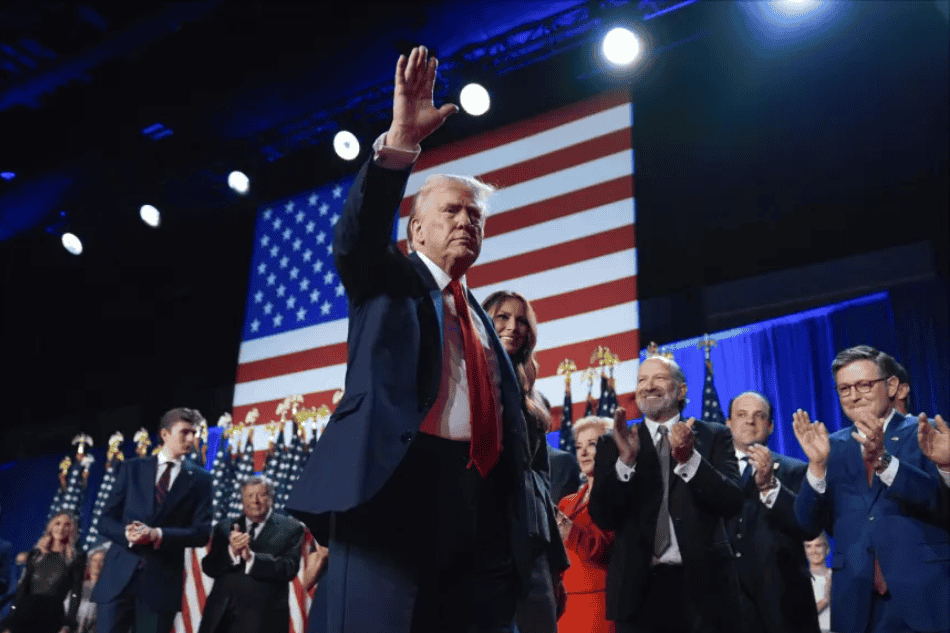

See MoreUS: Trump considering imposing 50% tariff on copper imports

The tariffs are expected to take effect by late July or 1 August 2025, with Chile, Canada, and Mexico being impacted the most by the increases. US President Donald Trump announced plans for a 50% tariff on copper imports during a White House

See MorePeru deposits instrument of ratification of the multilateral BEPS

Peru ratifies the OECD BEPS Convention, effective 1 October 2025, strengthening efforts to combat tax avoidance. Peru deposited its instrument of ratification for the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent

See MorePeru ratifies MLI, paving way for tax treaty updates

Peru has ratified the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting (MLI) through Supreme Decree No. 013-2025-RE, published in the Official Gazette on 27 May 2025. Following this

See MorePeru considers temporary reduction of standard VAT rate

The reduced VAT rates will apply to natural and legal persons engaged in business activities across any productive sector and subject to VAT. The Peruvian Congress is reviewing Bill No. 11228/2024-CR, introduced on 19 May 2025, which proposes a

See MorePeru mandates tax compliance training for microenterprises to avoid penalties

Peru now requires microenterprises to complete tax training for a first-time offence under a new law. Peru’s Congress passed Law No. 32335, which introduces mandatory tax training for microenterprises before they can be fined for a first-time

See MorePeru: SUNAT revises digital services definition, excludes human-driven support from withholding tax rules

Peru’s tax authority (SUNAT) updated its guidance on digital services in Report No.46-2025 issued on 29 April 2025. The updated report was made publicly available on 8 May 2025. It reversed its earlier 2024 position that classified online

See MoreChina commits to signing tax treaty with Peru

China's Ministry of Foreign Affairs announced that China and Peru officials convened on 12 May 2025 to discuss bilateral cooperation, including plans to negotiate and sign an income tax treaty. This treaty seeks to prevent double taxation and tax

See MorePeru and Switzerland conclude tax treaty protocol negotiations

Peru and Switzerland initialled a protocol to amend their 2012 tax treaty on 16 April 2025. The protocol, aimed at aligning the agreement with OECD BEPS standards, marks the first modification to the treaty. It will require formal signing and

See MorePeru advances tax treaty talks with Australia, France, Saudi Arabia, Singapore, UAE

The Peruvian Ministry of Economy and Finance announced that it is working to finalise tax treaty negotiations with Australia, France, Saudi Arabia, Singapore, and UAE on 20 March 2025. Peru has signed 10 agreements that provide a secure and

See MorePeru, UK sign income and capital gains tax treaty

Peru and the UK have signed an income and capital gains tax treaty on 20 March 2025. The agreement seeks to reduce tax base erosion and profit shifting by lowering withholding tax rates on cross-border income. It caps dividend withholding tax at

See MorePeru, Spain to resume tax treaty talks in March 2025

Peru and Spain will resume income tax treaty negotiations from 26 to 28 March 2025 in the fifth round of negotiations for an income tax treaty. Earlier, the announcement was made by Luis Ibérico, Peru’s ambassador to Spain, during an event on

See MorePeru: Congress approves bill for MLI ratification

The Peruvian Congress approved the bill for the ratification of the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting (MLI) on 13 March 2025. Following the internal ratification process,

See MoreOECD: Report on Simplified Peer Review of Peru under BEPS Action 14

On 4 March 2025 the OECD issued a stage one simplified peer review report on Peru under BEPS action 14. The report sets out the results of Stage 1 of the simplified peer review of the implementation of the minimum standard on making dispute

See MoreHong Kong, Peru commence first IPA talks

Peru’s government announced on 23 February 2025, that the first round of negotiations for an investment protection agreement (IPA) with Hong Kong will take place in Hong Kong from 10 to 12 March

See MorePeru extends reduced VAT rates for tourism sector Until 2027

Peru’s Congress has extended reduced VAT rates for hotels, restaurants, and tourist accommodations until 31 December 2027. The rates will remain at 8% for 2025 and 2026, before increasing to 12% in 2027. The measure, introduced under Law 32219,

See MorePanama and Peru to negotiate tax treaty

On 23 January 2025, officials from Panama and Peru met to discuss strengthening economic and trade relations, including negotiating an income tax treaty. The income tax treaty between the two countries would eliminate double taxation and prevent

See MorePeru publishes tax return filing deadlines for 2024

Peru has issued Superintendency Resolution No. 000304-2024/SUNAT on 30 December 2024, outlining the filing deadlines for annual tax returns for the 2024 tax year. For taxpayers covered by Law No. 31940, the filing deadlines range from May 26 to

See More