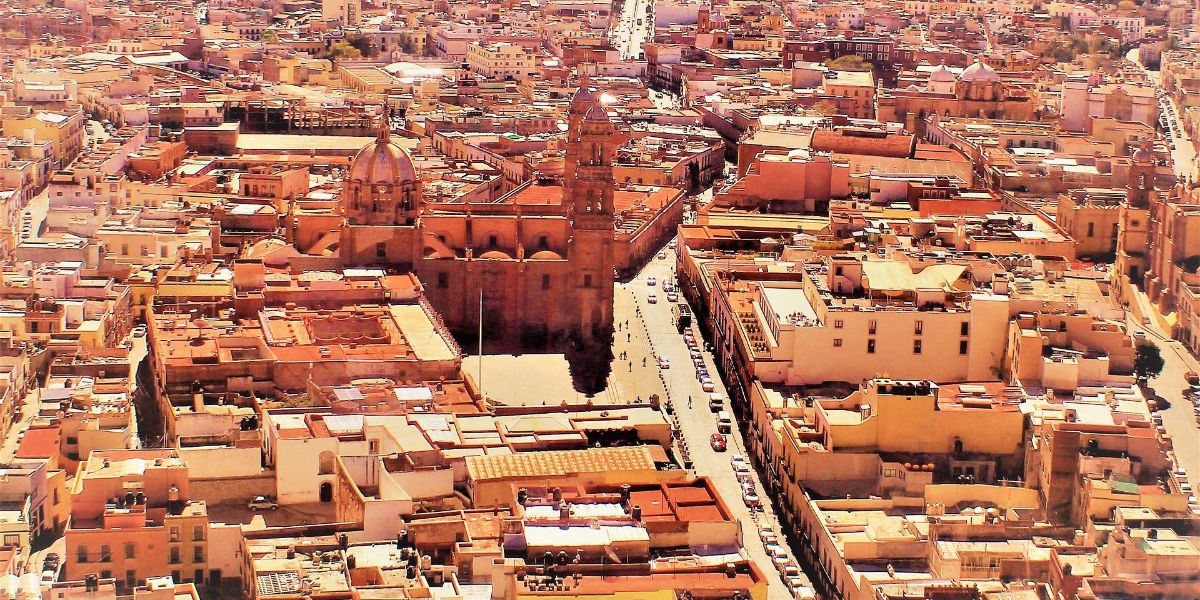

Mexico: President to impose tariffs on China

President Claudia Sheinbaum announced that her government may impose tariffs on imports from countries without trade agreements, including China, under the "Plan Mexico" initiative. Mexican President Claudia Sheinbaum stated on 4 September 2025

See MoreMexico plans tariffs on Chinese imports

Mexico plans higher tariffs on Chinese imports to protect domestic industries and support a US-backed “Fortress North America” strategy. Mexico is planning to raise tariffs on Chinese imports as part of its 2026 budget proposal, aiming to

See MoreMexico increases tariffs on goods via simplified customs scheme

The ad valorem tariff for goods imported by courier under the simplified regime has increased to 33.5%, while USMCA goods over USD 117 face a 19% tariff, effective 15 August 2025. Mexico’s tax authority (SAT) has updated tariffs for imported

See MoreMexico updates list of registered foreign digital service providers

Mexico’s July update lists 266 foreign digital providers registered for VAT as of 30 June 2025. Mexico’s tax administration released an updated list on 25 July 2025, identifying 266 foreign digital service providers registered for tax

See MoreMexico updates final lists of taxpayers linked to fake transactions

The updated lists of taxpayers suspected of issuing invalid invoices due to non-existent transactions require affected parties to provide proof or amend tax returns within 30 days. Mexico’s Tax Administration (SAT) has revised the final lists

See MoreUS imposes 17% tariff on Mexico tomato imports

The 17% duty on Mexican tomatoes was imposed after the US withdrew from a 2019 agreement that suspended an antidumping investigation on Mexican tomatoes. The Trump administration announced a 17% duty on Mexican fresh tomato imports on 14 July

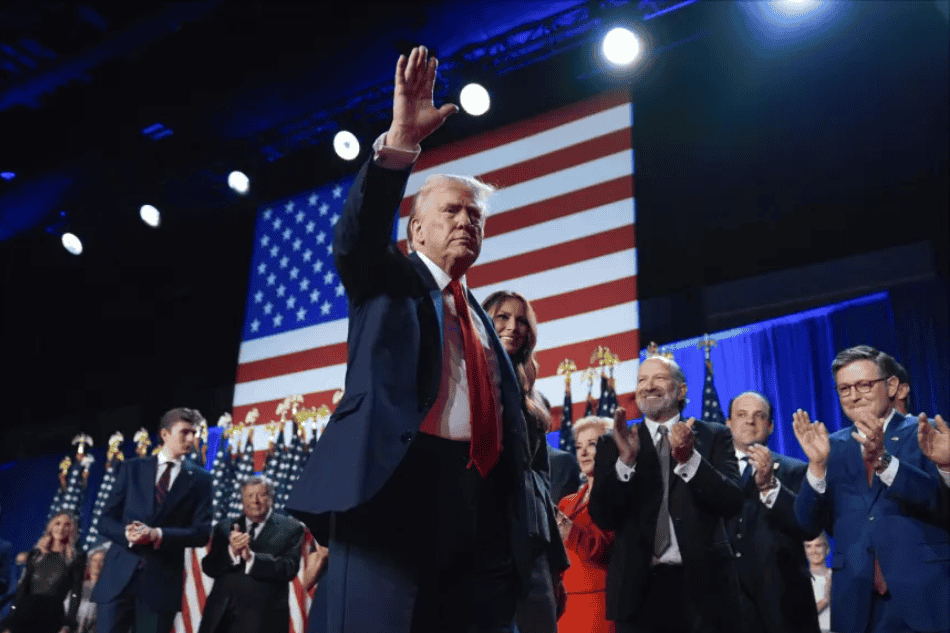

See MoreUS: Trump to impose higher tariffs on major trading partners including Canada, EU, Mexico starting August ’25

Trump announced 35% tariffs on Canadian imports, 30% on imports from Mexico and the EU, and 20% to 50% tariffs on 23 other trading partners, including Japan and Brazil. US President Donald Trump announced a 35% tariff on Canadian imports and

See MoreUS: Trump considering imposing 50% tariff on copper imports

The tariffs are expected to take effect by late July or 1 August 2025, with Chile, Canada, and Mexico being impacted the most by the increases. US President Donald Trump announced plans for a 50% tariff on copper imports during a White House

See MoreMexico releases updated list of 260 registered foreign digital service providers

Between January 2024 and April 2025, 59 foreign digital service providers were added to Mexico's Federal Taxpayer Registry (RFC), increasing the total from 201 as of 31 December 2023. Mexico’s tax authority published a new list of foreign

See MoreMexico objects US tax on cross-border remittances

The One, Big, Beautiful Bill (Act), which is now under Senate review, proposes a 3.5% tax on all remittances sent by non-US citizens to foreign countries, regardless of the transfer amount. The US House of Representatives passed the One,

See MoreMexico reports higher tax revenue from transfer pricing audits during FY 2019-24

SAT announced results from its audit strategies, highlighting increased tax collection from large taxpayers for the periods 2013-2018 and 2019-2024. Mexico’s Tax Administration Service (SAT), in a press release dated 26 May 2025, highlighted

See MoreMexico unveils tax incentives for new economic development zones

Mexico has introduced tax incentives for businesses operating in newly designated SEZs, including full deductions for fixed asset investments and additional relief for spending on training and innovation from 2025 to 2030. Mexico has issued a

See MoreMexico mandates select companies must also submit tax status report to National Housing Fund for Workers

Mexican taxpayers who are required, or have opted, to submit a tax audit report to the Tax Administration Service (SAT) for the 2024 fiscal year must also provide a copy of the corresponding tax situation report to the Institute of the National

See MoreMexico announces 2025 property tax relief program for eligible companies

The State of Mexico has approved a property tax exemption for businesses that meet specific requirements. Companies must own property in the state, provide proof of recent operations, and show compliance with tax obligations. The exemption was

See MoreMexico announces tax incentive guidelines under ‘Mexico Plan’ decree with new evaluation committee

Mexico published a resolution detailing the guidelines for tax incentives under the “Mexico Plan” decree on 21 March 2025, effective from 24 March 2025. The resolution establishes the role of a new Evaluation Committee, composed of members

See MoreUS: Trump halts tariffs on USMCA products

US President Donald Trump signed executive orders halting the recently imposed tariffs on imports from Canada and Mexico covered under the United States-Mexico-Canada Agreement (USMCA) yesterday, on 6 March 2025. The USMCA allows goods to move

See MoreUS: Trump exempts automakers from Mexican, Canadian tariffs for a month

According to the White House, on 5 March 2025, US President Donald Trump has decided to exempt automakers from his 25% tariffs on Canada and Mexico for one month if they follow existing free trade rules. Following discussions with the three

See MoreUS postpones new tariffs on Canada, Mexico for 30 days

US President Donald Trump has agreed on Monday, 3 February 2025, to halt tariffs on Canada and Mexico for 30 days – which was set to take effect Tuesday, 4 February 2025 – after both countries pledged to step up efforts to stop illicit drugs and

See More