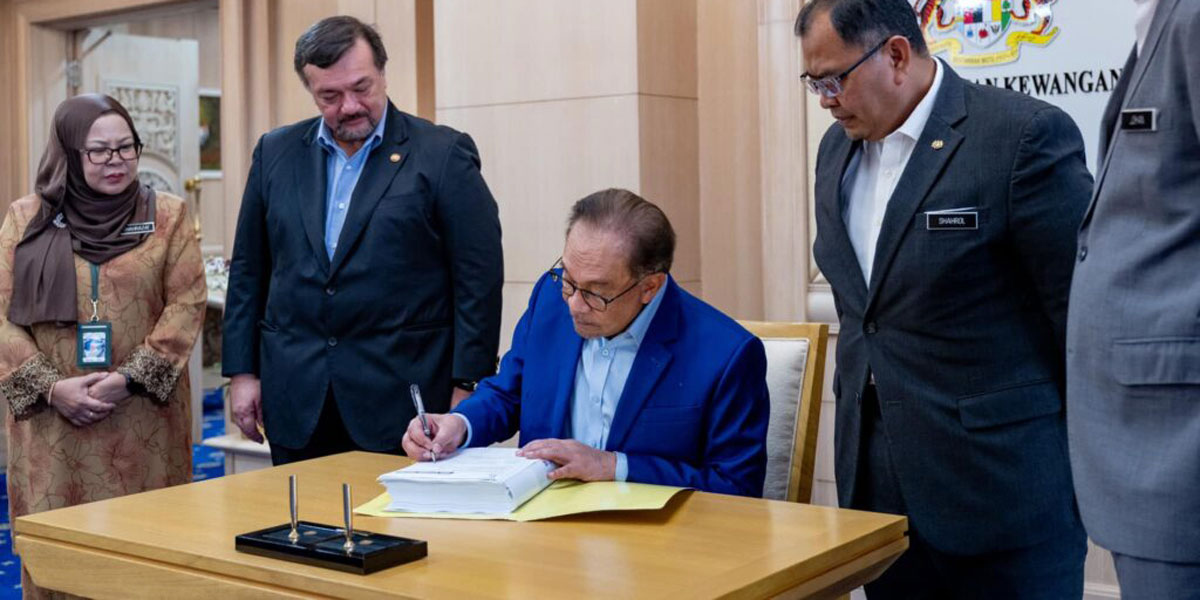

Malaysia likely to introduce subsidy cuts, new taxes in 2025 budget

Malaysia’s Prime Minister Anwar Ibrahim will announce the 2025 budget in parliament on Friday, 18 October 2024. Analysts and economists suggest the government is likely to implement additional new taxes and reduce subsidies for its 2025 budget,

See MoreMalaysia consults on tax treatment of local ships

The Inland Revenue Board of Malaysia (IRBM) initiated a public consultation on a draft ruling regarding the tax treatment of Malaysian ships and the exemption of shipping income for qualifying residents. The consultation is open for comments from

See MoreMalaysia exempts qualifying unit trusts from capital gains, foreign income tax

Malaysia has exempted qualifying unit trusts from capital gains and foreign income tax, issued the Income Tax (Unit Trust) (Exemption) Order 2024 and the Income Tax (Unit Trust in Relation to Income Received in Malaysia from Outside Malaysia)

See MoreMalaysia unveils tax incentives for Forest City special financial zone

Malaysia’s Deputy Finance Minister Amir Hamzah Azizan introduced proposed tax incentives during the announcement ceremony for the Forest City Special Financial Zone (SFZ) on 20 September 2024. The Forest City is situated within the Iskandar

See MoreMalaysia, Turkey FTA protocol enters into force

The amending protocol to the 2014 free trade agreement (FTA) between Malaysia and Turkey entered into force on 1 August 2024. The FTA covers trade in goods, including market access, rules of origin, customs procedures and facilitation, sanitary and

See MoreMalaysia ends consultation on extended tax incentives for BioNexus companies

The Inland Revenue Board of Malaysia (IRBM) concluded a brief public consultation regarding a draft public ruling on tax incentives for investments in BioNexus status companies (BSC) on 10 September 2024. The objective of this Public Ruling (PR) is

See MoreRussia approves income tax treaties with Abkhazia and Malaysia

The Russian government approved draft laws for the ratification of pending income tax treaties with Abkhazia and Malaysia on 4 September 2024. Previously, Russia and Abkhazia took a step towards economic cooperation by signing an income tax

See MoreOECD: Economic Survey of Malaysia

On 27 August 2024 the OECD published its latest Economic Survey of Malaysia. The survey notes that Malaysia’s economy has grown significantly since the 1960s, with a higher per capita income than other countries in the region. Malaysia is

See MoreOECD urges Malaysia to reintroduce GST to meet deficit target

According to a recent report published in the OECD Economic Surveys on Malaysia for 2024 on 27 August 2024, the OECD recommended Malaysia reinstate the goods and services tax (GST) at a low rate, coupled with targeted social transfers for vulnerable

See MoreMalaysia revises service tax policy for logistics services

The Royal Malaysian Customs Department (RMCD) released an update to the Service Tax Policy 4/2024 (Amendment No 1) on 23 August 2024 concerning logistics services, which went into force on 1 March 2024. All logistics services under Group J (First

See MoreMalaysia releases new reinvestment incentive guidelines under new industrial master plan 2030

The Malaysian Investment Development Authority (MIDA) has released guidelines for applying the new reinvestment incentive introduced in Budget 2024 on 30 July 2024. This initiative is aimed at existing manufacturing and agricultural companies that

See MoreMalaysia updates e-invoicing guidelines

Malaysia’s Inland Revenue Board (IRBM) released updates regarding electronic invoicing (e-invoicing) guidelines on 30 July, 2024. These include revised versions of the e-invoice guideline (version 3.2) and the e-invoice specific guideline (version

See MoreMalaysia updates e-invoicing guidance, confirms implementation timeline

Malaysia’s Inland Revenue Board (IRBM) has published updated Guidance and FAQs on 19 July, 2024, regarding its upcoming B2B e-Invoicing system. This follows after IRBM released updates regarding electronic invoicing (e-invoicing) on 28 June,

See MoreMalaysia revises tax rules on foreign income, exempts dividends

The Inland Revenue Board of Malaysia (IRBM) has published amended technical guidelines – Tax Treatment In Relation To Income Received From Abroad (Amendment) – on 20 June 2024. This guidance provides clarification regarding the tax treatment

See MoreLuxembourg ratifies Partnership and Cooperation Agreement with EU, Malaysia

Luxembourg has ratified the Partnership and Cooperation Agreement (PCA) between the European Union and Malaysia on 5 June, 2024. The agreement was signed on 14 December, 2022, at Brussels, and published in the Journal Officiel du Grand-Duché de

See MoreMalaysia publishes guidelines on tax treatment of hybrid instruments

The Inland Revenue Board of Malaysia (IRBM) has published guidelines on tax treatment of hybrid instruments, providing clarification about the general characteristics of hybrid instruments and how the tax treatment of distributions or profits from a

See MoreMalaysia updates e-invoice guidelines

The Inland Revenue Board of Malaysia (IRBM) released updates regarding electronic invoicing (e-invoicing) on 28 June, 2024. These include revised versions of the e-invoice guideline (version 3.0) and the e-invoice specific guideline (version

See MoreMalaysia updates tax investigation framework

The Inland Revenue Board (IRB) of Malaysia has unveiled its updated tax investigation framework for 2024, which includes more comprehensive investigative procedures amongst other methods. The new framework aims for a fair, transparent and

See More