Kenya: Cabinet approves new tax treaty with Singapore

Kenya's Cabinet has approved a new income tax treaty with Singapore on 11 February 2025. Signed on 23 September 2024, this treaty replaces the 2018 version, which never took effect. The tax treaty aims to eliminate double taxation on income

See MoreKenya issues guide on tax amnesty applications

The Kenya Revenue Authority (KRA) has released a step-by-step guide to help taxpayers navigate the process of applying for the tax amnesty covering tax periods up to 31 December 2023. The tax amnesty offers relief from penalties and interest on

See MoreCzech Republic, Kenya conclude tax treaty negotiations

Officials from the Czech Republic and Kenya have announced the conclusion of negotiations for a first-ever income tax treaty between the two countries on 22 January 2025. The treaty aims to eliminate double taxation of income and prevent tax

See MoreKenya lowers rates for fringe benefit tax, non-resident loans, low-interest loans

The Kenya Revenue Authority (KRA) has issued a public notice on revised market interest rates – lowered to 13% – for fringe benefit tax and deemed interest on certain non-resident loans for January to March 2025. It also sets the low-interest

See MoreCzech Republic, Kenya holds third round of income tax treaty talks

The Czech Republic and Kenya held their third round of income tax treaty negotiations from 20 to 23 January 2025. Any resulting income tax treaty will prevent double taxation and pertain to taxes on income and prevent tax evasion between the

See MoreKenya ratifies BEPS MLI deposit instrument

Kenya has deposited its instrument of ratification for the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting (MLI) on 8 January 2025. This follows after Kenya’s National Assembly

See MoreKenya consults implementation of new sugar development levy

The Kenya Sugar Board has released a draft legal notice inviting public feedback on the proposed sugar development levy as outlined in the Sugar Act (Act No. 11 of 2024), which was published in November 2024. The levy, introduced under Section 40

See MoreKenya introduces tax amnesty for periods up to 31 December 2023

The Kenya Revenue Authority (KRA) has released a public notice informing taxpayers that the Tax Procedures (Amendment) Act 2024 has introduced a tax amnesty on interest, penalties or fines on tax debt for periods up to 31 December 2023. The tax

See MoreKenya: KRA updates PAYE rules under Tax Laws (Amendment) Act 2024

The Kenya Revenue Authority has published a notice outlining changes to the PAYE computation following the enactment of the Tax Laws (Amendment) Act, 2024. The following changes shall be applicable in the computation of PAYE for December 2024 and

See MoreKenya enacts Tax Laws (Amendment) Bill, Tax Procedures (Amendment) (No.2) Bill 2024

Kenya’s President William Ruto has signed the Tax Laws (Amendment) Bill 2024 and the Tax Procedures (Amendment) Bill 2024 into law on 11 December 2024. Key provisions of the Tax Laws (Amendment) Bill 2024 and the Tax Procedures (Amendment) Bill

See MoreKenya introduces pre-filled VAT returns for November 2024

The Kenya Revenue Authority (KRA) has issued a public notice announcing to all VAT registered taxpayers that the VAT return will be pre-filled with tax information available to KRA starting from the November 2024 tax period. This measure is being

See MoreKenya consults tax treaty with Romania

Kenya's National Treasury has released a public notice inviting feedback on a proposed double taxation agreement (DTA) with Romania. Written comments should be sent to the Cabinet Secretary of the National Treasury and Economic Planning at the

See MoreKenya proposes new economic presence and minimum top-up taxes in Tax Laws Bill 2024

Kenya's National Assembly presented the Tax Laws (Amendment) Bill 2024 along with the Tax Procedures (Amendment) (No.2) Bill 2024 on 1 November 2024. Both Tax Laws (Amendment) Bill 2024 along with the Tax Procedures (Amendment) (No.2) Bill 2024

See MoreKenya keeps market and deemed interest rates unchanged for Q4 2024

The Kenya Revenue Authority has released a public notice regarding the market interest rate applicable to fringe benefit tax and the deemed interest rate for specific non-resident loans for October, November, and December 2024, which has been

See MoreJordan to sign tax treaty with Kenya

Jordan’s Cabinet approved signing an income tax treaty with Kenya on 19 October 2024. This treaty, a first between the two nations, will require signing and ratification before it becomes effective. The tax treaty aims to eliminate double

See MoreKenya: KRA to leverage AI and tech to promote tax compliance

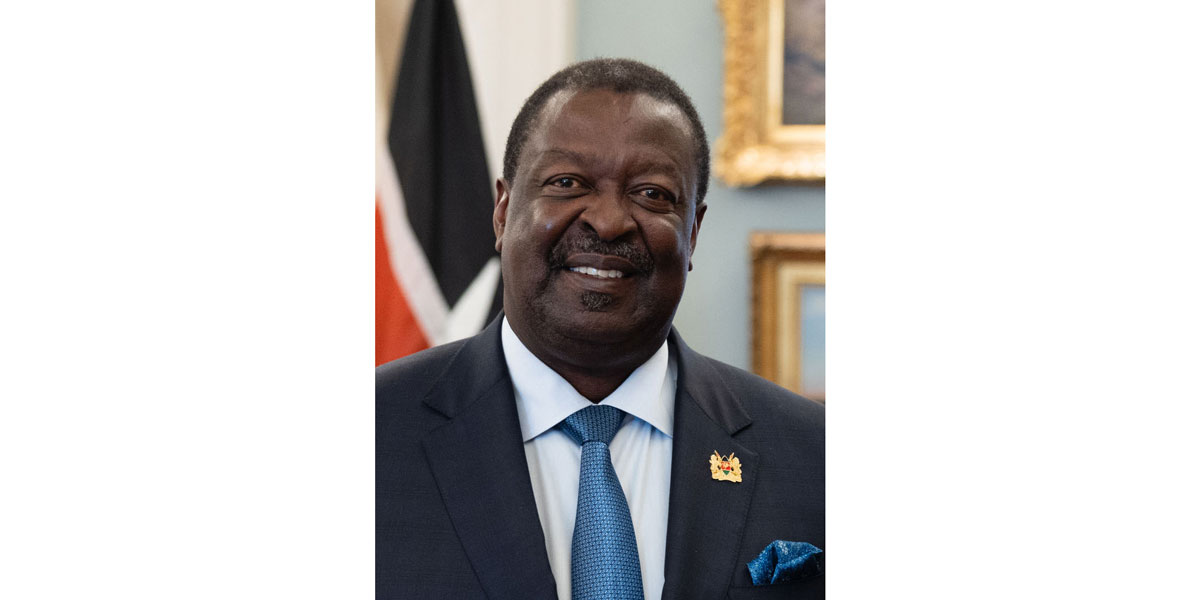

The Kenya Revenue Authority (KRA) Commissioner General (CG) HE Dr Musalia Mudavadi plans to use artificial intelligence (AI), the Internet of things (IoT), big data, and blockchain to improve tax administration, enhance transparency, and tackle tax

See MoreKenya consults proposed income tax treaty with Iceland

Kenya has initiated a public consultation on the proposed income tax treaty with Iceland. The announcement was made in a public notice by the National Treasury on 2 October 2024. The consultation is set to conclude on 7 November 2024. The

See MoreSingapore, Kenya sign income tax treaty

Singapore’s government announced signing a new income tax treaty (DTA) with Kenya on 24 September 2024. This new DTA replaces the previous agreement signed on 12 June 2018 which never entered into force. The agreement establishes a 10%

See More