Morocco, Kenya continue tax treaty negotiations

Any resulting treaty will be the first of its kind between the two nations, and must be finalised, signed, and ratified before it can take effect. Officials from Morocco and Kenya are continuing negotiations to enhance economic collaboration and

See MoreKenya, Cyprus negotiating income tax treaty

An income treaty from these negotiations will be the first between Kenya and Cyprus. Kenya’s Ministry of Foreign Affairs announced that officials from Kenya and Cyprus convened on 7 July 2025 to discuss strengthening bilateral relations,

See MoreKenya repeals digital assets tax, expands economic presence tax under Finance Act 2025

The Finance Act 2025 introduces a 10% excise duty on virtual asset transaction fees, expanded SEP tax, a 5-year loss carry forward limit, AMT, and new APA guidelines. Kenya’s President William Ruto signed the Finance Act 2025 into law on 26

See MoreKenya reduces market rates for fringe benefit tax, non-resident loans

For July to December 2025, the rate has been reduced to 8% (from 9%), and the low-interest loan benefit rate has dropped to 9% (from 14%). The Kenya Revenue Authority (KRA) released a public notice on 10 July 2025 regarding updates to the market

See MoreFrance, Kenya and allies push global airline ticket tax to fund climate adaptation

A coalition including France, Kenya, Barbados, and others aims to expand air travel taxes to raise billions for climate resilience in developing countries ahead of the 2025 UN climate summit. A coalition of countries including France, Kenya,

See MoreKenya enacts Finance Act 2025, reduces corporate tax rates

The Finance Act 2025 allows NIFCA-certified companies to benefit from reduced corporate tax rates, tax exemptions on dividends with reinvestment conditions. Kenya’s President William Ruto signed the Finance Act 2025 into law on 26 June

See MoreKenya, Japan consult on proposed tax treaty

Comments are due by 23 July 2025. Kenya's National Treasury announced on 23 June 2025 that it is consulting on a proposed income tax treaty with Japan. Any resulting agreement will be the first treaty between the two countries and aims to

See MoreKenya: National Treasury publishes budget statement 2025-26, reduces corporate and digital tax rates

Kenya's National Treasury has released the 2025-26 Budget Statement on 12 June 2025. Kenya's National Treasury published the 2025-26 Budget Statement on 12 June 2025, outlining key tax measures aligning with proposals highlighted in the 2025

See MoreMorocco, Kenya discuss first income tax treaty

Morocco and Kenya met on 26 May 2025 to discuss economic cooperation and a first-ever income tax treaty. Morocco's Ministry of Foreign Affairs announced on 26 May 2025 that Moroccan and Kenyan officials met to advance economic cooperation and

See MoreCzech Republic approves signing tax treaty with Kenya

The Czech Republic government has approved the signing of an income tax treaty with Kenya on 30 April 2025. This follows after negotiations for the agreement started on 22 January 2025 between the countries. It aims to eliminate double taxation

See MoreATAF launches working party to revise model tax agreement

The African Tax Administration Forum (ATAF) has revealed the formation of a specialised working group tasked with reviewing and updating its Model Tax Agreement. This announcement was made by ATAF on 29 April 2025. The African Tax

See MoreKenya enforces BEPS Multilateral Instrument (MLI)

The Multilateral Convention to Implement Tax Treaty Measures to Prevent Base Erosion and Profit Shifting (MLI) took effect in Kenya on 1 May 2025. For tax treaties between Kenya and countries where the MLI is already in force, it applies from 1

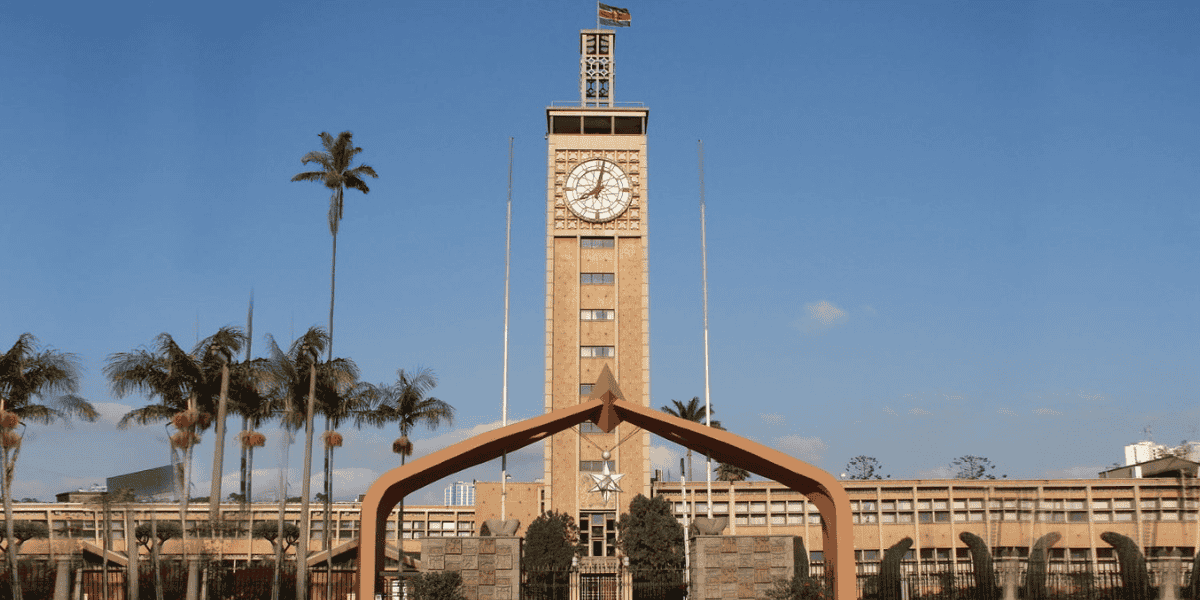

See MoreKenya presents 2025 Finance Bill, aims to reduce cost of living

Kenya's Cabinet Secretary for National Treasury and Economic Planning, John Mbad,i has presented the Finance Bill 2025 before the National Assembly on 30 April 2025. The government says it has not introduced any new taxes in the Finance Bill

See MoreKenya reduces market rates for fringe benefit tax, non-resident loans

The Kenya Revenue Authority released a public notice on 8 April 2025 regarding updates to the market interest rate for fringe benefit tax and the deemed interest rate on specific non-resident loans. Effective for April, May, and June 2025, the

See MoreKenya proposes scrapping excise duty on imported electric transformers, parts

Kenya’s government published a bill in the Official Gazette on 3 March 2024, proposing the scrapping of the 25% excise duty on imported electric transformers and parts under the Excise Duty (Amendment) Bill 2025. The bill was made public on 18

See MoreKenya: KRA urges taxpayers to benefit from tax amnest

The Kenya Revenue Authority announced on 3 March 2025 the success of the tax amnesty program for debts accrued up to 31 December 2023 and urges taxpayers to take advantage before the 30 June 2025 deadline. The KRA is offering taxpayers an

See MoreKenya introduces new income tax exemption rules for charities

The Kenya Revenue Authority has published a notice on 13 February 2025 regarding the implementation of the Income Tax (Charitable Organisations and Donations Exemption) Rules, 2024. These rules, which came into force on 18 June 2024, outlines the

See MoreKenya seeks public input on draft 2024 tax rules for unassembled motor vehicles, motorcycles, and trailers

The Commissioner General of the Kenya Revenue Authority (KRA), in a public notice issued on 6 February 2025 on behalf of the Cabinet Secretary for National Treasury and Economic Planning, is inviting public feedback on two draft regulations: the

See More