Japan, Bangladesh hold fourth round of EPA negotiations

The Ministry of Foreign Affairs of Japan announced, on 7 February 2025, that the fourth round of negotiations for an Economic Partnership Agreement (EPA) between Japan and Bangladesh took place in Dhaka from 2 to 6 February 2025, in a hybrid

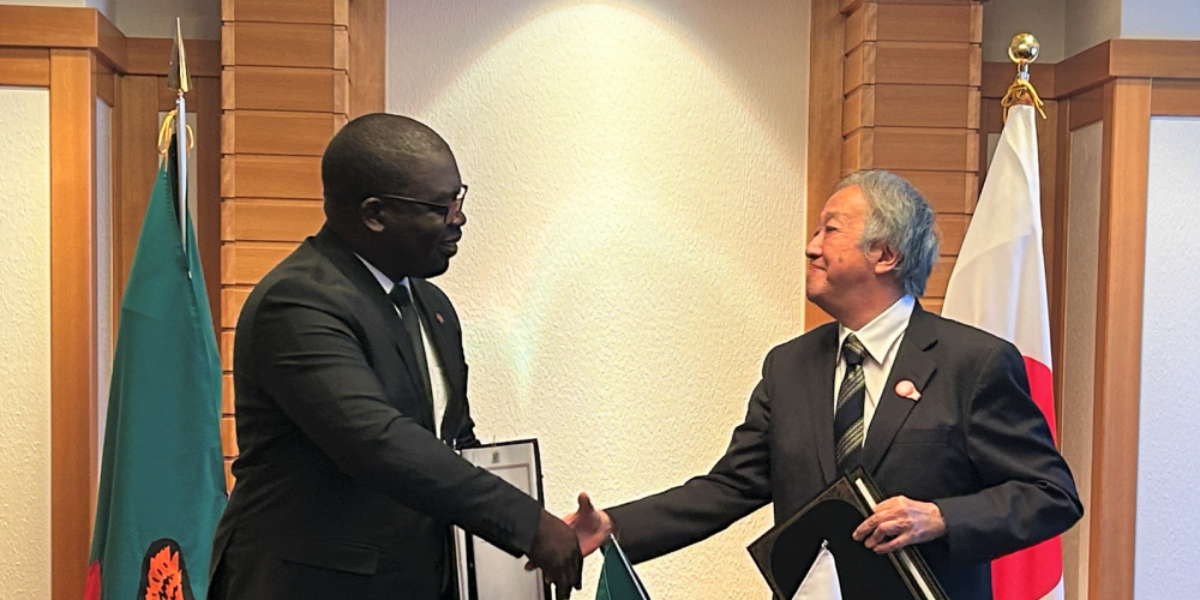

See MoreJapan, Zambia sign investment agreement

The “Agreement between Japan and the Republic of Zambia for the Promotion and Protection of Investment” (Japan-Zambia Investment Agreement) was signed in Tokyo by H.E. Mr. TAKEUCHI Kazuyuki, Ambassador Extraordinary and Plenipotentiary of Japan

See MoreIMF Report Makes Tax Policy Recommendations for Japan

On 7 February 2025 the IMF published a report following discussions with Japan under Article IV of the IMF’s articles of agreement. The report notes that Japan’s economy contracted in the first half of 2024 as a result of temporary supply

See MoreJapan: MOF presents tax reform bill to parliament

Japan's Ministry of Finance has released the legislative proposals submitted during the 217th session of the National Diet (parliament) – which includes the draft tax reform bill for 2025 and related materials – on 4 February 2025. The key

See MoreArmenia approves tax treaty with Japan

Armenia’s government has approved the signing of a new income tax treaty with Japan on 19 December 2024. This follows after Armenia and Japan have agreed in principle on the new income tax treaty between the two countries on 16 October

See MoreJapan: Cabinet approves Resolution for 2025 Tax Reform Outline, extends reduced corporation tax for SMEs

The Japanese approved the extension of the duration of the reduced corporation tax for small and medium-sized enterprises (SMEs) by an additional two years on 27 December 2024, as part of the resolution regarding the 2025 Tax Reform Outline. The

See MoreJapan, Turkmenistan sign tax treaty

Japan and Turkmenistan signed the tax treaty “Convention between Japan and Turkmenistan for the Elimination of Double Taxation with respect to Taxes on Income and the Prevention of Tax Evasion and Avoidance” in Ashgabat on 16 December

See MoreJapan tax revenue expected to reach record high

Japan’s tax revenues are set to hit a record high for the fifth straight year. Projections estimate revenue rising from JYP 69.6 trillion to around JPY 73.4 trillion for the current fiscal year ending in March 2025. The increase, driven by

See MoreJapan announces JPY 13.9 trillion stimulus budget

Japan's Ministry of Finance has announced a JPY 13.9 trillion (USD 92 billion) additional budget to support Prime Minister Shigeru Ishiba’s stimulus package. According to NHK (state broadcaster), the budget will be partially funded by JPY 3.8

See MoreMoldova, Japan discuss investment, tax treaty

Moldova's Ministry of Foreign Affairs announced that officials from Japan and Moldova met on 12 November 2024, to explore investment opportunities and discuss Moldova's interest in concluding negotiations for an income tax treaty. If an agreement

See MoreJapan, Greece tax treaty enters into force

Japan's Ministry of Finance has confirmed that the income tax treaty with Greece will take effect on 5 December 2024. The exchange of diplomatic notes between Japan and Greece for the entry into force of the “Convention between Japan and the

See MoreArmenia, Japan agree to sign tax treaty

Japan and Armenia have agreed in principle on the new income tax treaty between the two countries. The announcement was made in a press release by Japan’s Ministry of Foreign Affairs on 16 October 2024. This follows after Japan announced that

See MoreJapan, Armenia to negotiate new tax treaty

The Japanese Ministry of Foreign Affairs announced yesterday that tax treaty negotiations between Japan and Armenia are set to begin on 9 October 2024. The two nations will initiate negotiations for the new convention replacing the current tax

See MoreJapan, UAE initiates negotiations for CEPA

Japan’s Ministry of Foreign Affairs announced that it has launched negotiations with Japan for a comprehensive economic partnership agreement (CEPA) on 18 September 2024. “I hope that concluding an ambitious, balanced, and comprehensive EPA

See MoreGreece ratifies tax treaty with Japan

The Greek parliament approved the ratification of the income tax treaty with Japan on 18 September 2024. Signed on 1 November 2023, it is the first of its kind between the two nations. It will enter into force 30 days after the exchange of

See MoreJapan updates FAQs on global minimum tax regulations

The Japanese tax authority has updated the FAQs regarding the country's global minimum tax regulations, known as the income inclusion rule (IIR), on 13 September 2024. This update introduces two new FAQs about the QDMTT Safe Harbour requirements,

See MoreJapan proposes tax reform to ease foreign tax credit rules

The Japanese Financial Services Agency (FSA) has presented a tax reform proposal to the Ministry of Finance, which includes relaxing the rules for foreign tax credits in Japan. The proposal explains that Japan typically uses the credit method to

See MoreJapan publishes guidance on consumption tax rules for online platforms

Japan's National Tax Agency (NTA) has issued new rules for the collection of consumption tax by online platform operators, which will apply from 1 April 2025. Businesses who provide electronic services such as application distribution for the

See More