Andorra, EU protocol to AEOI agreement enters into force

The amending protocol to the Andorra–European Union Automatic Exchange of Information Agreement, signed on 13 October 2025, will come into effect on 1 January 2026. The key measures involve updating the Common Reporting Standard (CRS) to align

See MoreNorway: Parliament approves 2026 budget bill, corporate tax rate unchanged

Norway’s parliament passed the proposed 2026 Budget bill on 5 December 2025. This follows Norway’s government's presentation of its 2026 state and national budget proposals on 15 October 2025. The bill boosts welfare, defence, and climate

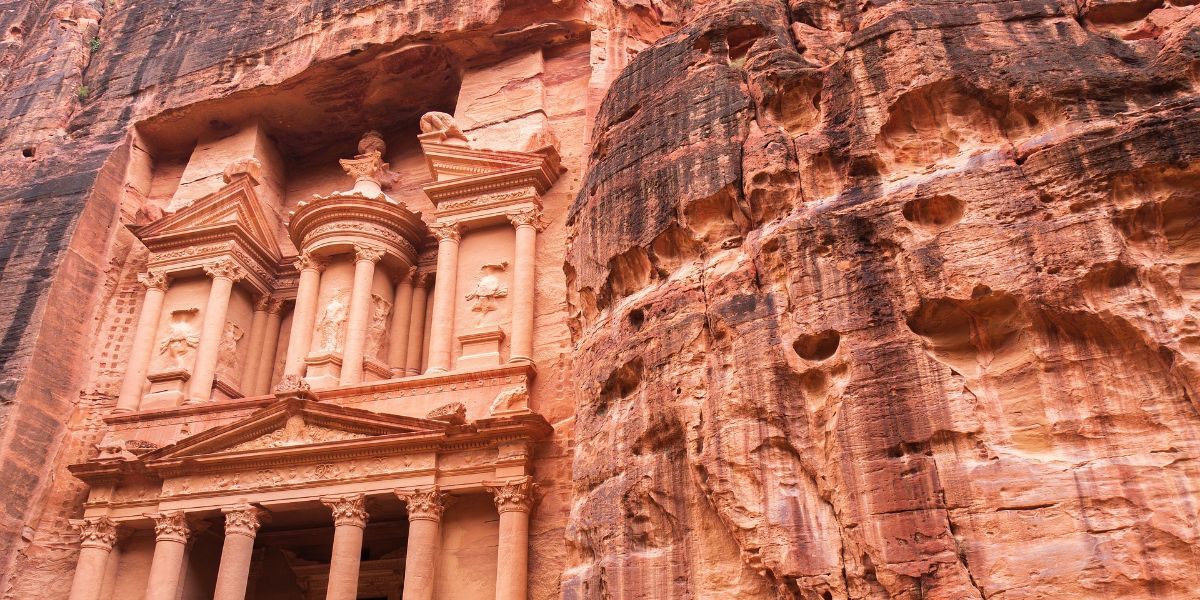

See MoreJordan, Switzerland income tax treaty enters into force

The income tax treaty between Jordan, Switzerland entered into force on 4 December 2025. Signed on 13 December 2023, the agreement aims to prevent double taxation on income and curb tax evasion between Jordan and Switzerland. It applies to

See MoreUK to adopt OECD framework for real estate information exchange

The UK and 24 other jurisdictions have announced their intention to implement the OECD’s latest tax transparency framework for the automatic exchange of information on immovable property (real estate). This announcement was made on 4 December

See MoreUK increases taxable benefits for company cars, vans and fuel for 2026/27

The UK has increased the taxable benefits for company cars, vans, and fuel for the 2026/2027 tax year. The changes are outlined in the Van Benefit and Car and Van Fuel Benefit Order SI 2025/1254, made on 1 December 2025. From 6 April 2026, the

See MoreUK: HMRC publishes guidance on transferring a business out of a company

The UK’s HM Revenue & Customs (HMRC) has published a guidance, on 1 December 2025, for business owners on how to disincorporate a company and continue running its business directly, either as a sole trader or partnership. The guidance also

See MoreUK: Government pushes Pillar One implementation to 2027

The UK government has confirmed that implementation of the OECD’s Pillar One rules will be delayed until 2027, extending its earlier 2024 target as international agreement on the reforms remains out of reach. The decision is detailed in the

See MoreBosnia and Herzegovina updates withholding tax rules, introduces new compliance forms for 2026

The Federation of Bosnia and Herzegovina has introduced updated withholding tax legislation, effective 1 January 2026, aimed at clarifying taxpayer obligations and strengthening reporting requirements. The amendments refine the definition of a

See MoreMalaysia, Russia income tax treaty enters into force

The new income tax treaty between Malaysia and Russia entered into force on 3 September 2025. The agreement covers Malaysian income tax and petroleum income tax, as well as Russian corporate profit and individual income taxes. Withholding tax

See MoreUK: Parliament considers Finance Bill containing 2025 budget proposals

The UK Parliament is currently reviewing the Finance (No. 2) Bill (Bill 342 for 2024–26), which was introduced to the House of Commons on 4 December 2025. The bill has completed its first reading and outlines the key tax and financial measures

See MoreUK to maintain duty-free access for Bangladeshi exports until 2029

The UK will continue to allow Bangladeshi products to enter its market duty-free until 2029, British High Commissioner to Dhaka Sarah Cook announced. She made the statement during the HSBC Export Excellence Award 2025 event on 7 December in

See MoreUK: HMRC updates making tax digital guidance for income tax

The UK’s HM Revenue and Customs (HMRC) updated its guidance on Making Tax Digital (MTD) for income tax on 26 November 2025 as part of preparations for mandatory digital reporting from 6 April 2026. The revisions clarify penalty rules,

See MoreSwitzerland: Federal Council announces CRS update, new crypto reporting rules

Switzerland’s Federal Council has announced amendments to the Ordinance on the International Automatic Exchange of Information in Tax Matters (AEOI Ordinance), updating rules to align with the OECD’s Common Reporting Standard (CRS) and

See MoreRussia simplifies tax registration for foreign companies

The Russian State Duma has approved amendments to Articles 83 and 84 of the Russian Tax Code to simplify the tax registration process for foreign companies. Under the new rules, foreign organisations no longer need to submit separate applications

See MoreGeorgia expands BEPS MLI coverage through 22 additional treaties

According to an OECD update, Georgia submitted an updated consolidated position for the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent BEPS (MLI) on 27 November 2025. The update notably expands the list of Georgia’s

See MoreUK: Secretary of State approves anti-dumping duties on Chinese biodiesel

The UK’s Secretary of State has approved the Trade Remedies Authority’s (TRA) final recommendation to impose a new anti-dumping duty on biodiesel imports from China on 24 November 2025. This announcement was made on 25 November 2025. The

See MoreUK: HMRC outlines reforms to transfer pricing, PE rules, DPT for 2026

The UK’s HM Revenue & Customs (HMRC) on 26 November published a policy paper outlining extensive reforms to the UK’s transfer pricing framework, permanent establishment (PE) rules and the Diverted Profits Tax (DPT). The update follows a

See MoreUS, UK strike agreement for tariff free pharmaceuticals

The US and the UK reached an agreement on 1 December 2025 that eliminates tariffs on British pharmaceutical products and medical technology. In exchange, the UK has committed to increasing its spending on medicines and reforming how it determines

See More