France sets new interest rates for shareholder interest deductibility

France has published interest rates for entities whose financial year (FY) ended between 30 September and 30 December 2024, which are used to determine the deductibility of interest payments to shareholders. The applicable rates from 30 September

See MorePoland approves cash accounting scheme for eligible entrepreneurs

Poland’s parliament approved a new "Cash PIT" regime aimed at individual entrepreneurs who operate their businesses independently and whose revenue did not surpass the PLN 1 million (EUR 250,000) threshold in the previous tax year. The scheme

See MoreCyprus revises transfer pricing FAQs

The Cyprus Tax Department announced that it updated its Frequently Asked Questions (FAQs) (English version) on transfer pricing on 24 September 2024. New questions are added from 25 through 43. The main question is 25, which highlights that

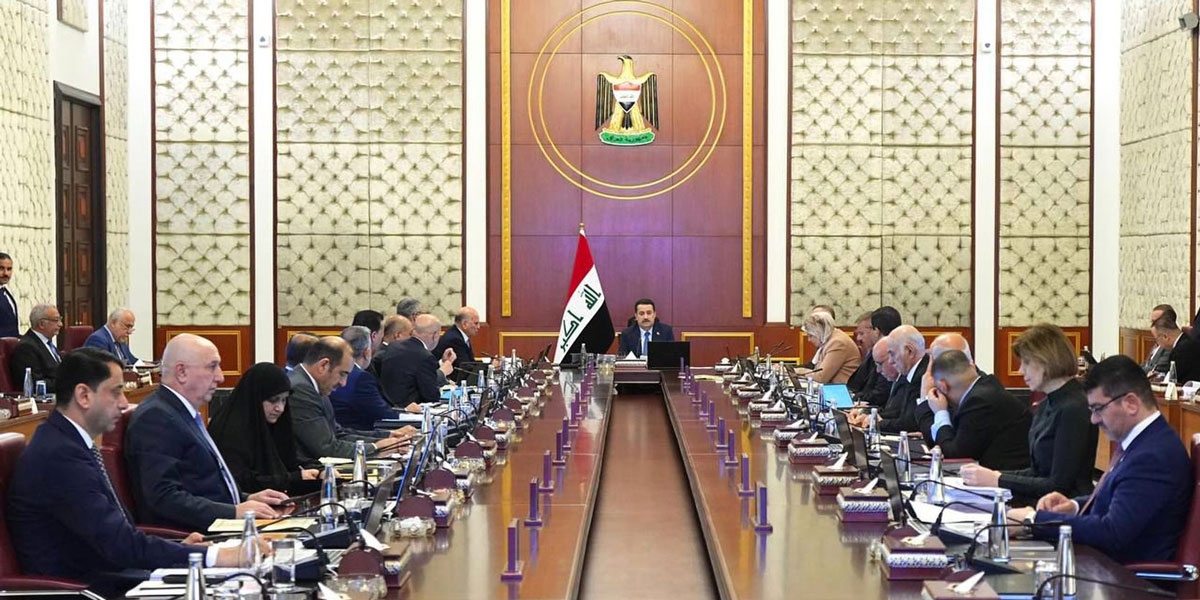

See MoreIraq: Council of Ministers terminate tax treaty negotiations with Croatia

Iraq’s Council of Ministers revoked its authorisation for tax treaty negotiations with Croatia on 1 October 2024. This decision nullifies earlier approvals granted under Decision No. 103 of 2023 and No. 23396 of 2023, which allowed the drafting

See MoreFrance: Finance Bill 2025 proposes new corporate and personal income tax regime

The French government presented the Finance Bill 2025 during a press conference in Paris on Thursday, 10 October 2024, with the goal of reducing the deficit from 6.1% of GDP this year to 5% next year. To achieve this, the government plans to

See MoreFinland consults TV Tax, VAT on broadcasting services, increases VAT rate on broadcasting from 10% to 14%

Finland’s Ministry of Finance initiated a public consultation on 4 October 2024 on a draft proposal to revise the TV Tax for individuals and businesses and to adjust the VAT on public broadcasting services. The consultation is set to conclude

See MoreSlovak Republic to amend anti-money laundering law

The Slovak Republic Parliament agreed to review the government's proposed draft bill, which seeks to amend the Anti-Money Laundering (AML) Law, on 4 October 2024. These amendments aim to address the European Commission's concerns regarding the

See MoreHungary, Serbia sign amending protocol to tax treaty

Hungarian and Serbian have signed an amending protocol to their income and capital tax treaty on 8 October 2024 in Budapest, as reported in a release from the Serbian Ministry of Finance on the same day. The protocol was signed by Norbert Izer,

See MoreSlovak Republic gazettes bill to tax sugary beverages

The Slovak Republic gazetted a new bill, “Act on Tax”, which imposes a sugar tax on sweetened soft drinks. The bill will take effect on 1 January 2025. The Slovak President signed the bill on 20 September 2024, and it was officially

See MoreEU publishes its stance on Terms of Reference for a United Nations Framework Convention on International Tax Cooperation

The Council of the European Union has declared its Position of the European Union and its Member States on the draft Terms of Reference for a United Nations Framework Convention on International Tax Cooperation. This follows after they abstained

See MoreIreland publishes updated Tax and Duty Manual, bank levy remains unchanged

Irish Revenue has released an updated Tax and Duty Manual concerning an additional levy on specific financial institutions on 7 October 2024, clarifying that the rate of bank levy to be applied for the year 2024 will remain at 0.112% as legislated

See MoreEuropean Commission releases revised list of non-cooperative tax jurisdictions, removes Antigua and Barbuda

The European Commission (EC) announced that European Union (EU) member states have updated the list of non-cooperative tax jurisdictions. The update confirmed that Antigua and Barbuda have been removed from Annex I (the blacklist), while Armenia and

See MoreIraq to negotiate income and capital tax treaty with Bulgaria

The Iraqi Council of Ministers approved the negotiation and signing of an income and capital tax treaty with Bulgaria on 1 October 2024. The council has authorised the Director General of the General Commission for Taxes to initiate discussions

See MorePoland to raise excise duty on tobacco products

Poland’s Council of Ministers approved a bill to raise excise duty rates on tobacco products on 1 October 2024. The tobacco products that are subject to increased excise duty include cigars, novelty tobacco products, raw tobacco, and electronic

See MoreItaly clarifies DAC7 platform and seller definitions

Italy’s tax authorities issued Law Principle No. 3/2024, on 3 October 2024, clarifying the definitions of "platform" and "seller" to enforce the data reporting obligations for qualifying platform operators, as established by Legislative Decree No.

See MoreCroatia consults amendments to General Tax Act: Shareholders to be considered as guarantors for failing to file

Croatia’s government has published proposed amendments to the General Tax Act and launched a public consultation. The consultation is set to conclude on 24 October 2024. Once enacted, the amendment will take effect on 1 January

See MoreCzech Republic ratifies tax treaty with Montenegro

Czech Republic’s President Petr Pavel enacted the law ratifying the pending income tax treaty with Montenegro on 1 October 2024. The treaty was signed by the two nations on 20 February 2024, aimed at preventing double taxation of income and

See MoreSlovak Republic: Parliament rejects plan to shorten property capital gains tax exemption to three years

The Slovak Republic parliament rejected a draft bill that proposed income tax exemptions on capital gains from the sale of immovable property for individuals and a suggestion to reduce the minimum holding period to three years. Earlier, on 16

See More