Sri Lanka: Cabinet reapproves income tax treaty with Austria

Sri Lanka’s Cabinet has reapproved the signing of its first income tax treaty with Austria, requiring signature and ratification to take effect. Sri Lanka’s Cabinet reapproved the signing of an income tax treaty with Austria on 7 July 2025,

See MoreGeorgia, Luxembourg sign protocol to amend 2007 tax treaty

Georgia and Luxembourg signed their first amending protocol to the 2007 tax treaty on 3 July 2025, with entry into force ratification. Georgia and Luxembourg signed a protocol amending their 2007 income and capital tax treaty on 3 July 2025. This

See MoreNetherlands : Senate approves box 3 Rebuttal scheme

The Dutch Senate approved the Box 3 Rebuttal Scheme on 8 July 2025, allowing taxpayers to prove actual returns on savings and investments. The Dutch Senate approved the Box 3 Rebuttal scheme on 8 July 2025, allowing taxpayers to prove the actual

See MoreIreland updates carbon tax and horticultural relief rates from May 2025

The eBrief updates tax guides to reflect revised mineral oil, solid fuel carbon, and natural gas carbon tax rates, including updated relief rates, contact details, and manual titles. The Irish Revenue has published Revenue eBrief No. 132/25,

See MoreEU, Switzerland to amend agreement on automatic financial information exchange

The agreement enables automatic financial account information exchange between EU Member States and Switzerland under the OECD's Common Reporting Standard (CRS). The European Commission has proposed a Council Decision on 10 July 2025 to amend the

See MoreHungary updates tax rates on retail, financial entities, and insurance sectors

Act LIV of 2025 introduces updated tax rates, increased VAT thresholds, and new regulations across retail, financial, insurance, and energy sectors, along with enhanced R&D deductions. Hungary has published Act LIV of 2025 in the Official

See MoreRomania gazettes form for top-up tax declaration, payment

This order was published in the Official Gazette No. 646 on 9 July 2025. Romania’s tax authority has issued Order No. 1729/2025, which establishes the notification form for declaring and paying the top-up tax. This order was published in the

See MoreNetherlands ratifies tax treaty between Curacao, San Marino

The tax treaty aims to prevent double taxation and curb tax evasion in cross-border transactions between Curacao and San Marino. The Netherlands has published the Law of 2 July 2025 in its Official Gazette on 10 July 2025, ratifying the first

See MoreRomania 2025–28 tax reforms include increased VAT, dividend tax

The proposed draft bill aims to simplify VAT rates from three (19%, 9%, and 5%) to two, starting 1 August 2025. Romania’s government submitted an amended draft bill to parliament on 4 July 2025, proposing changes to the VAT provisions of the

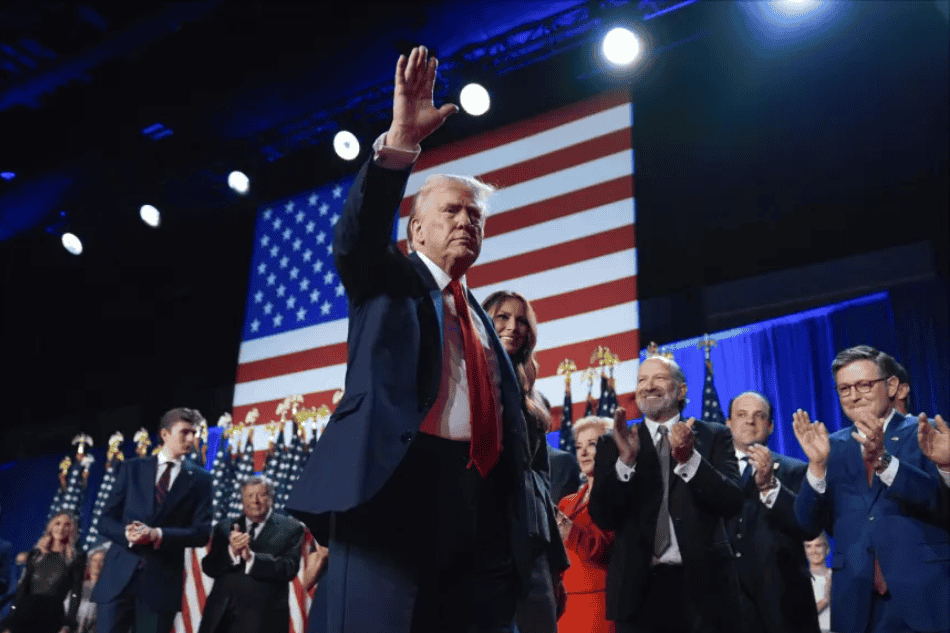

See MoreUS: Trump to impose higher tariffs on major trading partners including Canada, EU, Mexico starting August ’25

Trump announced 35% tariffs on Canadian imports, 30% on imports from Mexico and the EU, and 20% to 50% tariffs on 23 other trading partners, including Japan and Brazil. US President Donald Trump announced a 35% tariff on Canadian imports and

See MoreLiechtenstein, Estonia sign income tax treaty

Liechtenstein and Estonia signed their first income tax treaty on 10 July 2025, exempting withholding tax on dividends, interest, and royalties. Liechtenstein and Estonia signed an income tax treaty on 10 July 2025. The agreement seeks to

See MoreDenmark, Faroe Islands sign agreement for automatic exchange of tax information

The Danish Tax Agency announced on 8 July 2025 that it signed an agreement with the Faroe Islands to automatically exchange country-by-country tax reports. The Danish Tax Agency announced on 8 July 2025, it had signed a Competent Authority

See MoreItaly clarifies VAT split-payment exemption effective date for listed companies

Italy has abolished the VAT split-payment system for FTSE MIB-listed companies, effective 1 July 2025. Italy has abolished the VAT split-payment system requirement for companies listed on the FTSE MIB index, as per Decree-Law No. 84 of 17 June

See MoreBelgium: Government submits tax reform proposals to parliament, includes investment gains tax, participation exemption

Key proposals include a 5% capital gains tax, a participation exemption for group contributions, revised deductions, and revised statute of limitations rules. Belgium’s Chamber of Deputies is reviewing a draft law submitted on 3 July 2025 to

See MoreSpain announces 2024 VAT refund deadline

Spanish and EU businesses have until 30 September 2025 to claim VAT and IGIC refunds for 2024, subject to applicable procedures and reciprocity conditions. Spanish companies and foreign businesses have until 30 September 2025 to claim refunds for

See MoreLuxembourg ratifies tax treaty protocol with Argentina

Luxembourg ratifies 2024 protocol amending 2019 tax treaty with Argentina through Law of 4 July 2025, published on 9 July 2025. Luxembourg published the Law of 4 July 2025 in the Official Gazette on 9 July 2025, approving the ratification of the

See MoreBelgium revises CRS list, adds Armenia and Uganda

The updated CRS exchange list for 2024 now includes Armenia and Uganda. Belgium’s government has published the Royal Decree of 2 July 2025 in Official Gazette No. 2025004947 of 8 July 2025. The Royal Decree updates the list of jurisdictions

See MoreNigeria, Netherlands to amend income tax treaty

Both countries have agreed to either negotiate a new treaty or amend the existing treaty. Officials from Nigeria and the Netherlands met on 7 July 2025 to discuss revising the 1991 income and capital tax treaty between the two nations,

See More