Poland: Senate approves bill to ease corporate tax rules

The legislation repeals the requirement for large corporate income taxpayers to publish a report on their executed tax strategy. Poland’s Senate passed two tax legislation amendments without changes on 17 July 2025. Corporate Income Tax

See MoreFrance: Council of Ministers approves tax treaty protocol with Sweden

The protocol updates the 1990 France–Sweden Income and capital tax treaty with OECD BEPS standards. France’s Council of Ministers approved the amending protocol to the 1990 France–Sweden Income and Capital Tax Treaty on 11 July

See MoreFrance, Uganda begin negotiations on income tax treaty

French and Ugandan officials started negotiations in June 2025 for their first bilateral income tax treaty to prevent double taxation. French and Ugandan officials held the first round of negotiations for an income tax treaty in Kampala, Uganda,

See MoreGermany, Japan formalise tax treaty arbitration rules

The agreement details the procedures for the arbitration of their 2015 tax treaty between the two countries. The German Ministry of Finance released an agreement on 4 June 2025, signed with Japan, detailing the application of arbitration

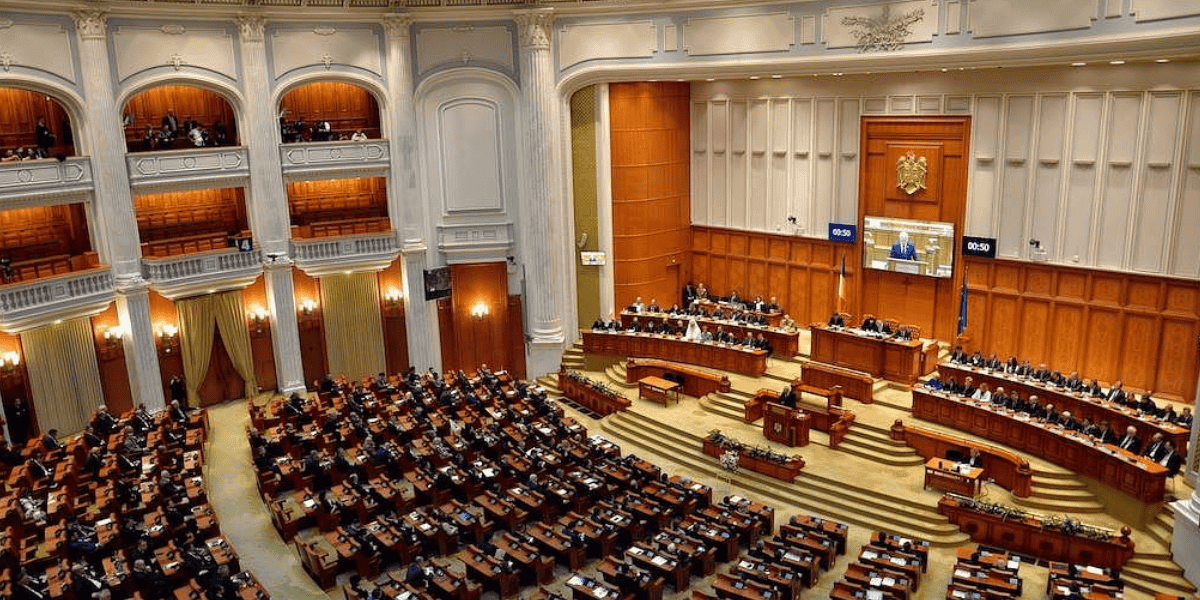

See MoreRomania: Parliament approves increases to VAT, bank levy, and dividend tax

The law introduces significant tax reforms, including increased VAT rates, a new reduced VAT rate, higher turnover tax for banks, and an increased dividend tax rate. Romania's parliament has passed the Law on certain fiscal-budget measures on 14

See MoreKenya, Cyprus negotiating income tax treaty

An income treaty from these negotiations will be the first between Kenya and Cyprus. Kenya’s Ministry of Foreign Affairs announced that officials from Kenya and Cyprus convened on 7 July 2025 to discuss strengthening bilateral relations,

See MoreBrazil: Senate approves tax treaty with Poland

The treaty becomes effective three months after the exchange of ratifications and applies from 1 January of the following year. Brazil's Senate (upper house of the National Congress) approved the ratification of its first income tax treaty with

See MoreItaly: Council of Ministers approves draft VAT consolidation code

The new consolidated VAT law has been structured into 18 sections and 171 articles. Italy’s Council of Ministers, in a press release on 14 July 2025, has given preliminary approval to a Legislative Decree aimed at consolidating and reorganising

See MoreIreland: Irish Revenue revises schedule of revenue powers

The brief confirms the updates to the Tax and Duty Manual (TDM) as of July 2025. The Irish Revenue has published eBrief No. 135/25 on 15 July 2025 about updates to Tax and Duty Manual (TDM) 38-04-15 Schedule of Powers. Revenue eBrief No.

See MorePoland: MoF issues guidance on beneficial ownership for withholding tax

The guidance provides clarification of the application of the beneficial owner clause for withholding tax under Corporate and Individual Income Tax Laws. Poland’s Ministry of Finance has issued guidance on 3 July 2025, regarding the application

See MoreEU halts retaliatory tariffs on US imports until 6 August ‘25

This follows EU's warning on 14 July 2025 that it may implement countermeasures if ongoing trade negotiations with the US fail to prevent the imposition of 30% tariffs scheduled to begin on 1 August. The European Union has decided to halt the

See MoreFrance: Council of Ministers approves new income tax treaty with Finland

The new treaty will replace the existing 1970 tax agreement between France and Finland. The French Council of Ministers gave approval to the updated income tax agreement with Finland on 11 June 2025. Signed on 4 April 2023, this treaty will

See MoreBelgium issues clarification on 2026 B2B e-invoicing rules

The Decree mandates the use of structured e-invoicing for B2B transactions between VAT-registered taxpayers, starting in 2026. Belgium has published Decree of 8 July 2025 in the Official Gazette, mandating structured electronic invoicing

See MoreSlovak Republic adopts DAC8 law

The bill will take effect on 1 January 2026. The Slovak Republic has published a bill amending the Act on Automatic Exchange of Information on Financial Accounts for Tax Administration purposes in the Collection of Laws on 10 July 2025. This

See MoreDenmark updates DAC7 guidance for platform reporting obligations

Revised guidance outlines 2024 platform income reporting rules and updates for rental platforms. Denmark’s tax authorities have released revised guidance on implementing the Amending Directive to the 2011 Directive on Administrative Cooperation

See MoreNetherlands: Tax authority clarifies software distribution payments not royalties under Korea (Rep.) tax treaty

The royalty payments are exempt from withholding tax in Korea (Rep.), granting the Netherlands exclusive taxing rights over the income. The Netherlands tax authority clarified on 10 July 2025 that payments for software distribution licenses by a

See MoreBelgium extends 6% VAT rate for residential demolition and reconstruction pending legal implementation

Due to a delay in the approval of the reform law, the standard 21% VAT rate will apply from 1 July 2025, with a potential adjustment to 6% once the law is enacted. Belgium's Federal Public Service (SPF) Finance announced on 10 July 2025 that the

See MoreEU warns of retaliation if US proceed with tariffs from August

Following a meeting in Brussels, EU foreign and trade ministers expressed frustration with Washington’s lack of agreement and signalled readiness to respond if negotiations break down. The European Union (EU) on 14 July 2025 warned that it may

See More