Italy implements emergency tax revisions on CFC, hybrid mismatch penalty rules

Urgent tax measures include revising the domestic CFC rules, tax loss carry-forward provisions, and the penalty protection regime for hybrid mismatch assessments. Italy’s parliament converted Law Decree No. 84 of 17 June 2025 into law with

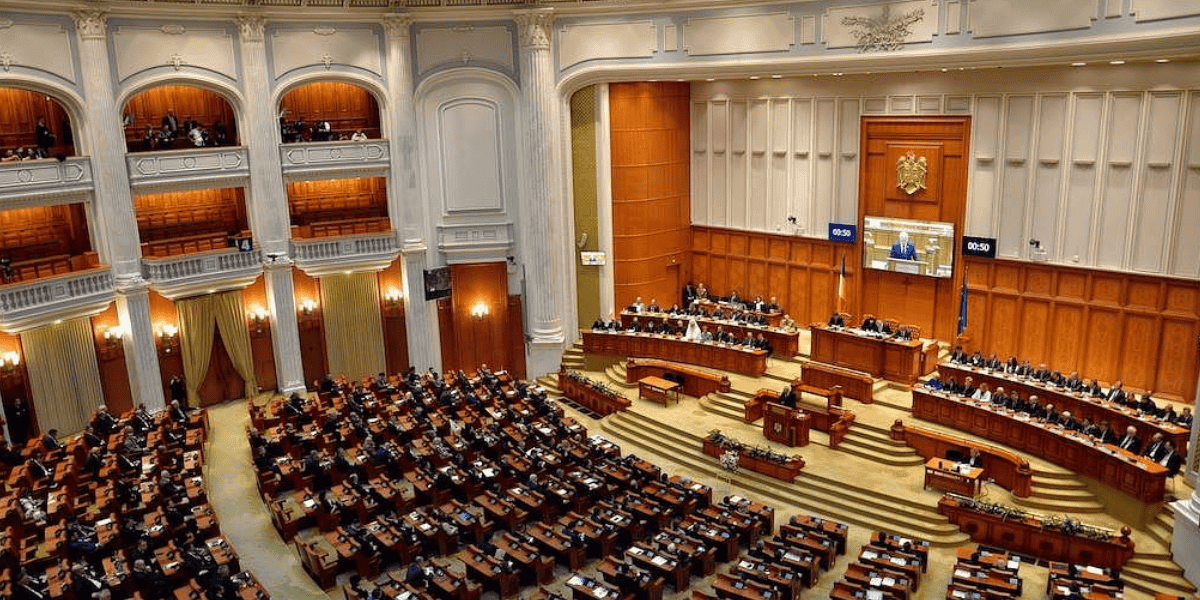

See MoreRomania gazettes application norms after VAT increase

Government Decision No. 602/2025 reflects the VAT rate increase effective 1 August 2025. Romania has published Government Decision No. 602/2025 (GD No. 602/2025) in the Official Gazette No. 715 on 31 July 2025. Government Decision No.

See MoreItaly issues VAT rules for transportation and logistics sector

The new VAT rules mandate customers in the transportation, freight handling, and logistics sectors to pay VAT on behalf of suppliers for subcontracting, consortiums, or similar contracts. Italy’s director of tax authorities has enacted

See MoreIreland: Irish Revenue issues updated partnership taxation guidelines

The Tax and Duty Manual details the types, taxation, administrative rules, returns, appeals, and penalties applicable to Irish partnerships. Irish Revenue has released eBrief No. 149/25 introducing a new Tax and Duty Manual (TDM) Part 43-00-03,

See MoreEU halts trade countermeasures following US agreement

The suspension is effective from today, 6 August 2025. The European Union has published Commission Implementing Regulation (EU) 2025/1727 of 5 August 2025 in the Official Journal of the European Union on 5 August 2025, which suspends the

See MoreIreland issues revised GMT guidelines for MNEs, domestic groups

The updated guidance on OECD Pillar Two global minimum tax clarifies rules for insurance investment entities, intra-group financing adjustments, pre-transition tax changes, and transitional CbC reporting safe harbor rules. The Irish Revenue

See MoreLuxembourg: Government proposes bill to enforce DAC9, align Pillar Two with OECD standards

DAC9 introduces new rules for sharing top-up tax information and filing obligations under the Pillar Two GMT Directive (Directive (EU) 2022/2523). Luxembourg’s government submitted a draft bill to the parliament to implement Council Directive

See MoreGreece amends corporate, VAT, personal tax laws

Law 5222/2025 introduces changes to VAT, income tax, customs and real estate rules, following public consultation and EU alignment efforts. Greece enacted Law 5222/2025 on 28 July 2025, introducing changes to corporate income tax, VAT, income

See MoreGreece expands and strengthens rules for alternative tax regimes

The amended tax regimes revise inheritance and gift tax exemptions and expand provisions for skilled employees. Greece has amended its alternative tax regimes for incoming tax residents introduced under Law 5222/2025, which were published on 28

See MorePoland: KAS intensifies measures against tax avoidance, profit outflows

The Ministry of Finance intends to set up a dedicated centre at the Małopolska Customs and Tax Office in Kraków to carry out its plans. Poland’s Ministry of Finance announced a new initiative on 31 July 2025 to address aggressive tax planning

See MoreGreece updates tax incentives for family wealth management entities

The new law has halved the minimum annual operating expenditure for family offices from EUR 1 million to EUR 500,000, easing financial entry requirements. Greece has enacted Law 5222/2025, introducing enhanced tax incentives for Special Purpose

See MoreEU to remove tariffs on UK steel under restored quota system

The initiative will allow the UK to export up to 27,000 tonnes of steel to the EU per quarter, tariff-free, restoring its quota to pre-2022 levels. The EU will remove tariffs on key British steel products under a quota system starting 1 August

See MoreSlovak Republic: MoF consults on introducing mandatory e-invoicing

The deadline for sending feedback is 19 August 2025. The Slovak Republic’s Ministry of Finance is consulting on a Draft Law No. LP/2025/396 on 30 July 2025, to amend the Value Added Tax Act and related laws, aimed at introducing mandatory

See MoreAmending protocol France, Switzerland tax treaty enters into force

The amending protocol to the 1966 France–Switzerland tax treaty, has entered into force on 24 July 2025. The agreement is designed to prevent double taxation and prevent tax evasion between the two nations. Earlier, France published Law No.

See MoreGreece: Parliament approves bill mandating B2B e-invoicing

Greece’s parliament approved a new bill titled “National Customs Code and Other Provisions – Pension Regulations” on 25 July 2025, which introduces mandatory electronic invoicing (e-invoicing) for business-to-business (B2B)

See MoreRomania gazettes legislation to amend APA, MAP

The legislation updates rules for Advance Pricing Agreements (APAs) and Mutual Agreement Procedures (MAPs) Romania’s government published Emergency Ordinance 11/2025 (GEO 11/2025) in the Official Gazette No. 695 on 24 July 2025, to amend the

See MoreRomania increases standard and reduced VAT rates, effective starting tomorrow

Starting 1 August 2025, Romania will unify the 5% and 9% VAT rates into a single 11% rate and raise the standard VAT rate from 19% to 21%. Effective from tomorrow, 1 August 2025, Romania’s reduced VAT rates of 5% and 9% have been unified and

See MoreEU: Council adopts new rules simplifying tax collection for imports

The directive will be published in the EU Official Journal and take effect 20 days later, with rules applying from 1 July 2028. The EU Council has formally adopted new value added tax (VAT) rules for distance sales of imported goods on 18 July

See More