EU Commission authorises French aid package to expand clean tech production capacity

The European Commission announced that it approved a EUR 1.1 billion French scheme on 27 February 2026 to support strategic investments that add clean technology (cleantech) manufacturing capacity in line with the objectives of the Clean Industrial

See MoreRomania: Emergency Ordinance targets R&D, green tech, strategic investments

Romania has published Emergency Ordinance No. 8 of 24 February 2026 in the Official Gazette, which introduced a comprehensive package of fiscal and investment measures aimed at supporting economic recovery. Emergency Ordinance no. 8/2026

See MoreNetherlands tax authorities launch electronic filing for 2026 gift, inheritance tax returns

The Netherlands tax administration announced on 2 March 2026 that taxpayers can now submit their inheritance and gift tax returns electronically for the 2026 tax year. Taxpayers who receive gifts exceeding certain thresholds must file a return by

See MoreCroatia extends reduced VAT rate on natural gas, heating

Croatia’s government has presented an amendment to the Value Added Tax (VAT) Act on 27 February 2026, extending the 5% reduced VAT rate on key energy products beyond 31 March 2026. Without this extension, energy prices would rise from 1 April

See MoreGreece updates VAT rules on immovable property used for deductible, non-deductible activities

The Greek Public Revenue Authority (AADE) has issued Decision A. 1046 on 18 February 2026, introducing a specific method for the deduction of input VAT on immovable property used for both deductible and non-deductible activities. The decision covers

See MoreNetherlands issues tax guidance on permanent establishment requirements under Minimum Tax Act

The Dutch tax authorities issued guidance clarifying when a permanent establishment (PE) qualifies under the Minimum Tax Act 2024 (WMB 2024) on 26 February 2026, addressing critical questions about the Netherlands' implementation of the global

See MoreSweden consults R&D tax incentives under Pillar Two, aligns with Side-by-Side Package

Sweden’s Ministry of Finance (MoF) has launched a public consultation under Memorandum No. Fi2026/00105 on proposed tax incentives for research and development (R&D) personnel costs and its interaction with OECD Pillar Two rules on 24 February

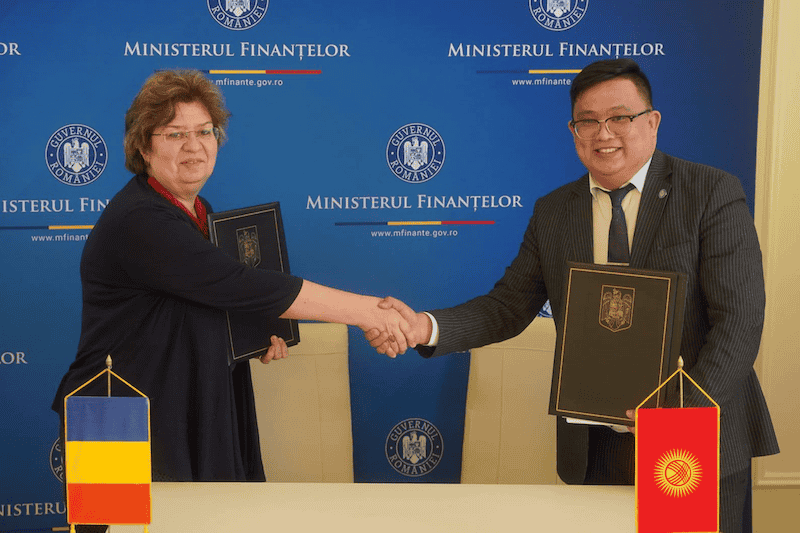

See MoreKyrgyzstan, Romania agree on income tax treaty

Kyrgyzstan's Ministry of Economy and Commerce announced on 27 February 2026 that officials from Kyrgyzstan and Romania reached an agreement in principle on a new income tax treaty during negotiations held in Bucharest from 23 to 26 February 2026.

See MoreBelgium approves new tax measures, includes deduction rules for purchased, leased vehicles

Belgium has published a tax bill in the Official Gazette No. 2026001286 on 27 February 2026, introducing various technical updates, notably revising the deduction rules for company cars purchased, leased, or rented before 1 January 2026. This

See MoreBelgium updates rules for monthly, quarterly VAT returns

Belgium’s Ministry of Finance has released Circular 2026/C/32 on 17 February 2026, outlining updated rules for monthly and quarterly VAT filings. A major change involves standardising the eligibility for quarterly filings, removing lower

See MoreSpain: Barcelona raises tourist tax to ease housing pressure

Spain’s Barcelona has increased its tourism levy, making it one of the highest in Europe, as authorities aim to curb visitor numbers and support affordable housing. From April, hotel guests will pay between EUR 10–15 per night, up from EUR 5

See MoreFrance consults on low-emission vehicle incentive tax

France’s tax authority has opened a public consultation on updates to the annual incentive tax for low-emission light vehicles (TAI), reflecting changes introduced by Law No. 2025-127 of 14 February 2025, Finance Law for 2025 on 25 February

See MoreHungary mandates digital receipt reporting for businesses without cash registers from September 2026

Hungary’s National Tax and Customs Administration (NAV) has announced that Hungarian businesses not using cash registers or e-cash registers must report receipt data to NAV, starting 1 September 2026. Companies already issuing receipts through

See MoreRomania: MoF launches blockchain-based fiscal receipt system to combat tax fraud

Romania’s Ministry of Finance, in a press release on 26 February 2026, announced that it is rolling out BF-CHAIN, an innovative project using blockchain technology to revolutionise how fiscal receipts from electronic cash registers are managed and

See MoreLuxembourg: Parliament approves tax treaty protocol with Georgia

Luxembourg’s parliament has approved the law ratifying the pending protocol to the 2007 income and capital tax treaty between Luxembourg and Georgia. The Council of State voted on 25 February 2026 to waive the second constitutional vote,

See MoreBulgaria enacts crypto-asset reporting framework, automatic exchange of financial account information

Bulgaria has published Decree No. 61 of 25 February 2026, enacting the law ratifying the Multilateral Competent Authority Agreement on Automatic Exchange of Information under the Crypto-Asset Reporting Framework (CARF MCAA) and the Addendum to the

See MoreLatvia ratifies income tax treaty with Liechtenstein

Latvia enacted legislation on 26 February 2026 to ratify its first income and capital tax agreement with Liechtenstein. The two countries signed this treaty on 2 October 2025. The agreement applies to Latvia’s enterprise income tax, personal

See MoreItaly releases final versions of 2026 tax return forms

Italy’s tax authorities announced that the final versions of Italy's 2026 tax declaration forms are now available following ministerial approval on 27 February 2026. These forms—including the 730, Income Tax, CNM, 770, and IRAP—will be used to

See More