US: Customs and Border Protection imposes new tariffs on Chinese imports

The US Customs and Border Protection (CBP) issued an amended notice on 24 April 2025 announcing additional duties on products from China and Hong Kong following President Donald Trump's Executive Orders 14256, 14259, and 14266. The notice was

See MoreChina reportedly exempts select US imports from tariffs

China has reportedly exempted certain US imports from its 125% tariffs and is urging companies to identify essential goods that should be exempt from tariffs. However, they are yet to make any public statements regarding the matter. The Trump

See MoreEU, US remain far from reaching a tariff agreement

The EU Economic Commissioner, Valdis Dombrovskis, stated on Friday, 25 April 2025, that the United States and the European Union still have work to do to reach a deal that avoids tariffs on each other's goods. The US has imposed 25% tariffs on EU

See MoreIndia to impose safeguard duty on steel to curb imports from China, South Korea, Japan

India plans to introduce a temporary 12% safeguard duty on certain steel imports to address a rise in low-cost shipments; mainly from China, South Korea, and Japan; according to a government source. The measure, recommended by the Directorate

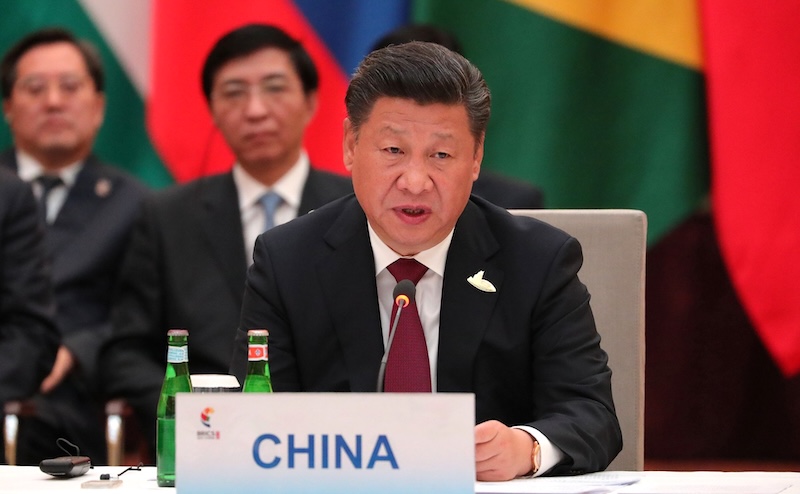

See MoreChina cautions countries signing trade deals favouring the US

China has cautioned nations on Monday, 21 April 2025, that are affected by US President Donald Trump’s “reciprocal tariffs” that it will strongly oppose any party attempting to strike trade deals with the US at its expense. The warning

See MoreUS: Trump administration plans to impose 245% tariff on China

The tariff wars between two of the world's largest economies, the US and China, show no signs of slowing down. In the latest move, the Trump Administration said that China could face tariffs as high as 245% in response to its retaliatory measures.

See MoreUS: Trump administration grants reciprocal tariff exceptions for smartphones, computers, and electronics from China

The Trump Administration released a memorandum titled “Clarification of Exceptions Under Executive Order 14257 of April 2, 2025, as Amended” on 11 April 2025. The clarification broadens the reciprocal tariff exception for "semiconductors" to

See MoreBrazil: Senate approves tax treaty protocol with China

Brazil’s Senate has approved the protocol amending the Brazil-China Income Tax Treaty (1991) through Draft Legislative Decree No. 343/2024 on 8 April 2025. Signed on 23 May 2022, this protocol is the first amendment to the treaty. It will come

See MoreTrade war escalades: China imposes 125% tariffs on US imports

Beijing announced it has increased its tariffs on US imports to 125% earlier today, 11 April 2025. "The US side's imposition of excessively high tariffs on China seriously violates international economic and trade rules, runs counter to basic

See MoreCameroon: Senate approves tax treaty with China

Cameroon’s Senate has approved the ratification of the income tax treaty with China on 8 April 2025. Signed on 17 October 2023, this treaty is the first of its kind between the two nations and aims to eliminate double taxation on income and

See MoreUS: Trump pauses tariffs for 90 days for all countries, hits China harder with 125%

US President Donald Trump announced a three-month suspension of all “reciprocal” tariffs that took effect on 9 April 2025, excluding those applied to China. The sweeping tariffs will remain for China, the world’s second largest economy and

See MoreUS imposes 104% tariffs on Chinese imports, China retaliates with 84%

US President Donald Trump's "reciprocal" tariffs on numerous countries, including a steep 104% duties on Chinese goods, officially took effect today, 9 April 2025. In response, China is raising its tariff on the United States to 84%, up from 34%,

See MoreChina responds with additional tariffs on imports from US

China's Ministry of Finance announced the implementation of additional tariffs as a direct response to the reciprocal tariffs previously imposed by the Trump Administration on 4 April 2025. “This practice of the US is not in line with

See MoreChina, Italy new tax treaty enters into force

The new income tax agreement between China and Italy was enacted on 19 February 2025. Signed on 23 March 2019, it replaces the 1986 treaty between China and Italy. The agreement aims to eliminate double taxation on income and prevent tax

See MoreBelarus ratifies trade and investment agreement with China

Belarus' House of Representatives approved the ratification of a trade and investment agreement with China on 10 January 2025, following its submission by the Council of Ministers in December 2024. Originally signed in Minsk on 22 August 2024, the

See MoreChina retaliates with new tariffs, export restrictions, import ban on select US products

China's Ministry of Finance has released Tax Commission Announcement No. 2 of 2025 on 4 March detailing the implementation of additional tariffs on select US products. The additional measures include a 15% tariff on US imports of chicken, wheat,

See MoreUS raises tariffs on Chinese goods

US President Donald Trump signed an Executive Order on 3 March 2025, increasing tariffs on Chinese products from 10% to 20%. The order amends previous actions targeting the synthetic opioid supply chain and cites China's insufficient efforts to curb

See MoreUS may suspend tax treaty with China under America First Policy

The US President Donald Trump has signed a memorandum on the "America First Investment Policy" on 21 February 2025. The policy seeks to boost foreign investment in the US to create jobs and grow the economy, especially from allies, while

See More