Canada: DoF releases 2025 budget, includes corporate tax and transfer pricing measures

Canada’s Department of Finance released the details of the Budget 2025 on 4 November 2025. The main tax measures of the budget are as follows: Business Income Tax Measures Immediate Expensing for Manufacturing and Processing

See MoreCanada: Government presents 2025 Budget to the House of Commons

Canada’s government has presented the Budget 2025 to the House of Commons on 4 November 2025. It emphasised a strategy to build major infrastructure, housing, and key industries to support economic growth and long-term prosperity. The

See MoreCanada: Bank of Canada cuts rate amid US tariff hike

The Bank of Canada lowered its key interest rate to 2.25% on Wednesday, 29 October 2025, citing ongoing economic weakness, but emphasised that monetary policy cannot reverse the structural damage caused by the US trade war. The central bank

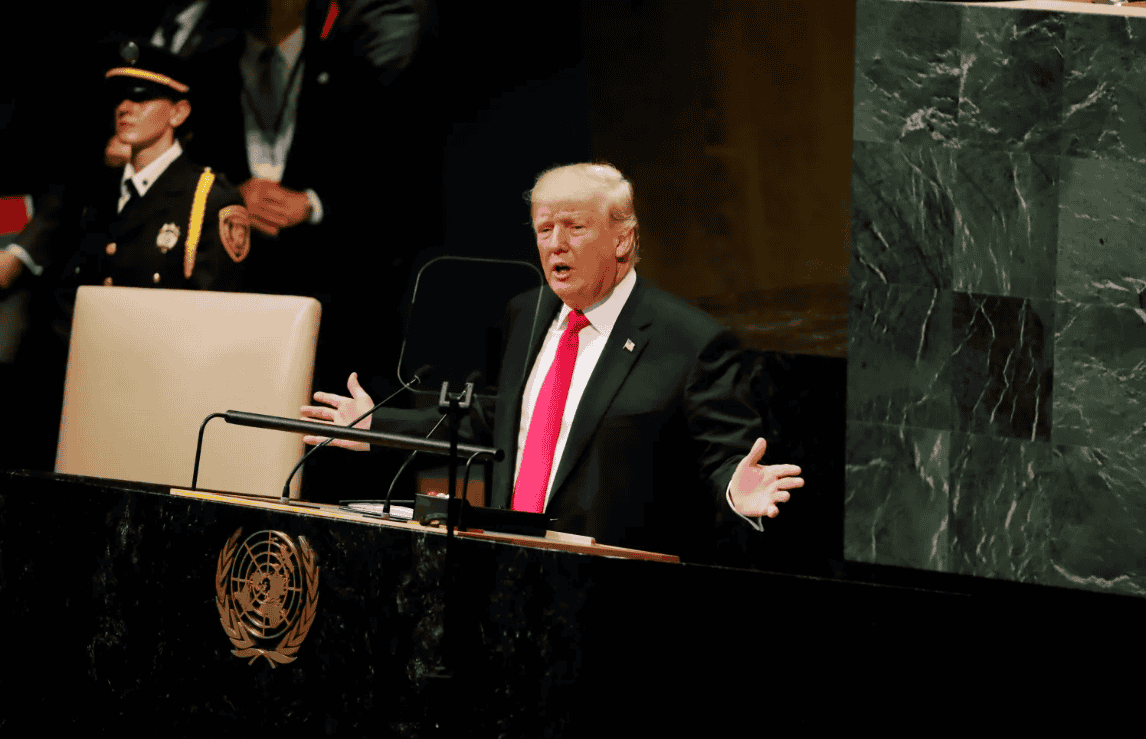

See MoreUS: Trump imposes 10% tariff increase on Canada following World Series ad

US President Donald Trump announced a 10% tariff increase on Canadian goods after criticising an Ontario government ad he deemed misleading, escalating trade tensions and halting negotiations despite Canada’s move to pause the ad campaign. US

See MoreCanada limits tariff-free imports of US vehicles by automakers Stellantis, General Motors

Canada will impose 25% tariffs on non-compliant US vehicle imports but will allow limited tariff-free imports for manufacturers maintaining local production and planned investments. Canada’s Finance Minister Francois-Philippe Champagne and

See MoreUS: Trump administration terminates trade talks with Canada

President Trump halted all trade talks with Canada, citing a “fraudulent” Ontario government and misrepresenting former President Reagan’s views. US President Donald Trump announced on Thursday, 23 October 2025, that his administration has

See MoreCanada: Government to introduce anti-fraud plan, financial crimes agency

The government plans to strengthen Canada’s fight against financial fraud by requiring banks to implement anti-fraud policies, exploring broader sector-wide measures, and establishing a new Financial Crimes Agency. Canada’s Department of

See MoreCanada grants tariff exemptions on select US and Chinese steel, aluminium products

The tariff relief on certain US and Chinese steel and aluminium imports is aimed at supporting local industries and advancing trade negotiations with both countries. Canada has introduced tariff relief measures on certain steel and aluminium

See MoreCanada: CRA simplifies tax adjustments through revised voluntary disclosures program

The VDP lets taxpayers voluntarily correct past tax errors for potential penalty and interest relief, but only for tax years overdue by at least one year. The Canada Revenue Agency (CRA) announced, on 10 September 2025, that it will update the

See MoreCanada: PM Carney confirms US trade discussions to shift into USMCA review stage

Prime Minister Mark Carney stated that trade talks with the U.S. are ongoing, with several unresolved issues set to be addressed in the upcoming USMCA review. Canada’s Prime Minister Mark Carney announced yesterday, 23 September 2025, that

See MoreCanada announces GST/HST filing deadlines for distributed investment plans

These rules also impose responsibilities on both investors and securities dealers. Canada’s government announced that distributed investment plans, such as mutual fund trusts and investment limited partnerships are required to reach out to

See MoreCanada: Central bank cuts interest rate to 2.50%

Bank of Canada lowered interest rate amid economic slowdown Canada’s central bank, the Bank of Canada, lowered its key interest rate by 25 basis points to 2.50% on Wednesday, 17 September 2025, marking its first rate cut since March. The

See MoreCanada: CRA outlines updates to voluntary disclosures program

CRA will implement changes to its Voluntary Disclosures Program, which covers disclosures related to various taxes and charges, including income tax, GST/HST, excise duties, luxury tax, digital services tax, effective 1 October 2025. The Canada

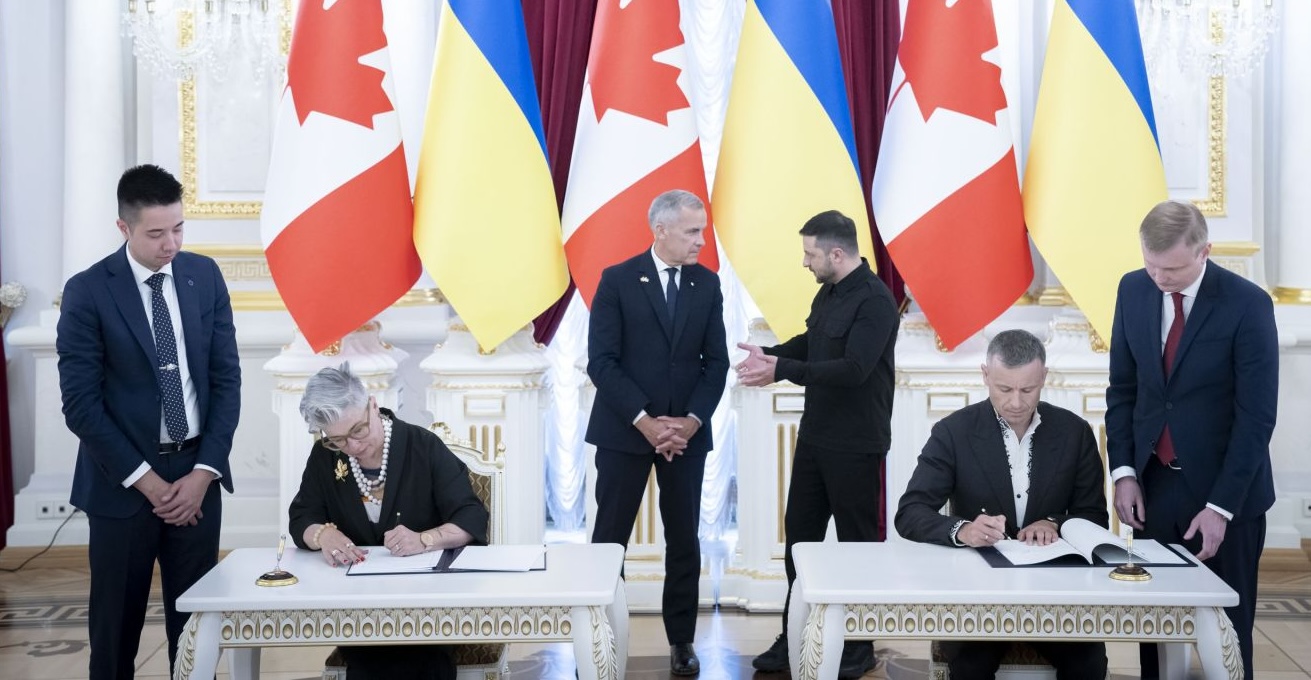

See MoreCanada, Ukraine sign agreement on mutual administrative assistance in customs matters

This agreement aims to address customs violations amid growing bilateral trade between the two countries. Canada and Ukraine signed an agreement on mutual administrative assistance in customs matters on 24 August 2025. The signing took place

See MoreCanada: CRA extends withholding tax relief for nonresident subcontractor reimbursements to June 2026

Taxpayers reimbursing non-residents for services in Canada via subcontracting can defer the 15% withholding tax and related interest or penalties until 30 June 2026. The Canada Revenue Agency (CRA) has extended its administrative relief policy

See MoreCanada consults draft tax legislation, includes several previously announced measures including amendments to global minimum tax Act

The government invites all interested Canadians and stakeholders to provide feedback on these draft legislative proposals by emailing their comments to consultation-legislation@fin.gc.ca by 12 September 2025. Canada’s Department of Finance

See MoreCanada to exempt retaliatory tariffs on US imports under CUSMA

Canada’s government decision to abolish all tariffs on US goods under CUSMA will take effect on 1 September 2025. Canada’s Prime Minister Mark Carney announced on 22 August 2025 that Canada will eliminate tariffs on US goods covered under the

See MoreCanada: DoF consults previously announced draft tax rules

The deadline for sending feedback is 12 September 2025. Canada’s Department of Finance has unveiled draft legislation for consultation on 15 August 2025, aimed at implementing various previously announced and additional tax measures. The

See More