Brazil: Congress passes new tax incentives for chemical sector

Brazil’s Federal Senate has approved Bill 892/2025 on 18 November 2025, establishing the Special Sustainability Programme for the Chemical Industry (PRESIQ) and amending the existing Special Regime for the Chemical Industry (REIQ). The bill

See MoreBrazil: RFB allows Simplified National Tax System taxpayers prepay all instalment plans, including RELP-SN

Brazil’s Federal Revenue Service (RFB) announced on 26 November 2025 that it expanded the functionalities available to taxpayers under the Simplified National Tax System (Simples Nacional) by allowing taxpayers to prepay instalments across all

See MoreBrazil: RFB to implement tax administration module (MAT) from December

Brazil’s tax authority, the Federal Revenue Service (RFB), has announced that the Tax Administration Module (MAT) will be implemented on 27 November 2025. The RFB calls the MAT’s implementation an essential advancement in the country’s tax

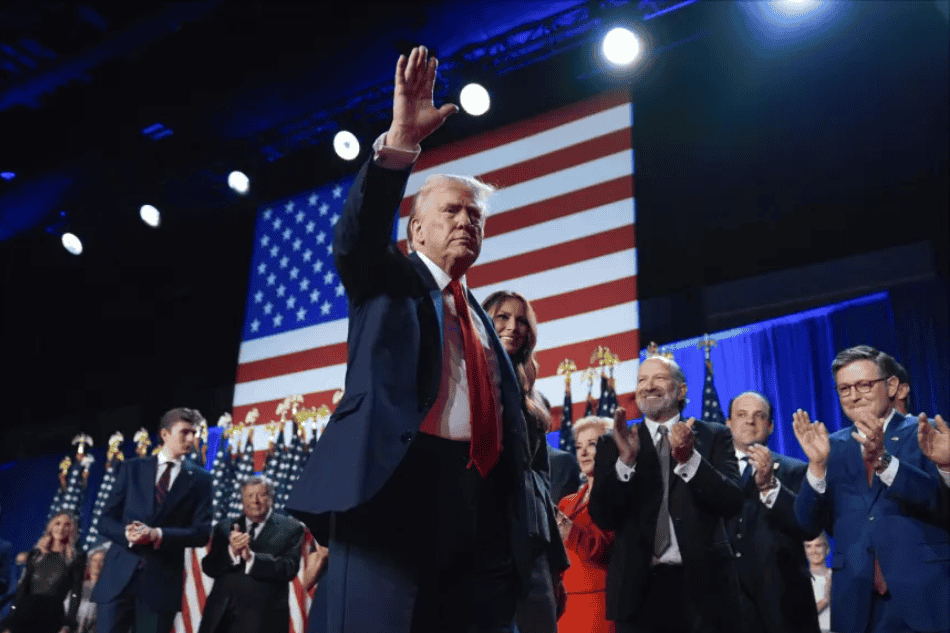

See MoreUS: Trump postpones tariffs on Brazil beef, coffee

US President Donald Trump lifted the 40% tariffs on Brazilian food products, including beef, coffee, cocoa, and fruits, on 20 November 2025, which were imposed in July in response to Brazil’s legal actions against former President Jair Bolsonaro,

See MoreBrazil: Congress greenlights budget cuts, limits corporate tax credits

Brazil’s Congress approved a bill on 18 November 2025 aimed at curbing public spending and tightening rules on companies' use of tax credits. Among its key provisions, the law bars tax credit compensations that are not linked to a company's

See MoreOECD highlights achievements and obstacles in Brazil’s consumption tax reform

The OECD has published a report titled “The reform of Brazil's consumption tax system" on 10 November 2025, outlining both the milestones reached and the ongoing challenges in reforming Brazil's consumption tax system. Brazil’s 2023

See MoreBrazil: Senate passes corporate minimum tax, dividend withholding measures

Brazil’s Senate passed Bill 1087/25 on 5 November 2025, which includes various tax measures for companies regarding corporate minimum tax and withholding tax. The tax measures are as follows: Reduction rules for minimum tax Bill 1087/25

See MoreSingapore, Brazil: Amending protocol to tax treaty enters into force

The Inland Revenue Authority of Singapore (IRAS) announced that the Protocol amending the income tax treaty between Singapore and Brazil, formally titled the Agreement for the Elimination of Double Taxation with Respect to Taxes on Income and the

See MoreBrazil extends tax payment deadlines for Rio Bonito do Iguacu, Parana

Brazil’s Federal Revenue Service (RFB) has issued an Ordinance on 13 November 2025, extending the deadlines for the payment of federal taxes, including instalment payments, and fulfilling ancillary obligations. The measure also suspends

See MoreBrazil: RFB extends deadline for tax settlement programs

Brazil’s Federal Revenue Service (RFB) has extended the deadline for taxpayers to join tax settlement programs under Public Notices RFB No. 4/2025 and 5/2025 on 10 November 2025. The extension was formalised by Ordinance RFB No. 600/2025,

See MoreBrazil to make electronic tax domicile mandatory for all companies from 2026

As part of the Consumption Tax Reform (RTC), Brazil’s Federal Revenue Service announced that all legal entities will be required to use the Electronic Tax Domicile (DTE) as their official communication channel beginning 1 January 2026. Under

See MoreBrazil to apply 10% dividend withholding tax

Brazil’s Federal Senate has approved Bill 1.087/2025, introducing a 10% withholding tax on dividends paid to foreign entities, effective for fiscal years starting after 1 January 2026. Exemptions include profits calculated until 2025 and

See MoreBrazil mandates disclosure of ultimate beneficial owners of investment funds, companies

Brazil’s Federal Revenue Service published an update to the rule on 31 October 2025, which deals with the identification of the ultimate beneficiaries of investment funds, companies, and legal arrangements operating in the country. This measure

See MoreBrazil: President Lula says US guarantees trade agreement, Trump remains cautious

Regfollower Desk During the ASEAN summit in Malaysia, Brazilian President Luiz Inácio Lula da Silva shared insights into his recent meeting with US President Donald Trump, expressing optimism about a potential trade agreement between the two

See MoreUS: Senate approves bill to overturn Trump’s tariffs on Brazilian imports

Regfollower Desk The US Senate, led by Republicans, has passed a bill to overturn President Donald Trump's tariffs on Brazil by ending the national emergency he declared in July. This emergency was in response to Brazil prosecuting its

See MoreBrazil: MDIC sets new tax waivers to boost investment in manufacturing, infrastructure

Brazil’s MDIC has set new tax waiver limits and accelerated depreciation rules to incentivise investment in machinery, equipment, and fixed assets across key industries. Regfollower Desk Brazil’s Ministry of Development, Industry, Trade,

See MoreBrazil: National Congress nullifies provisional measures on equity interest, financial entities taxes

Proposed tax changes under PM No. 1.303 will not take effect after the required approval is not secured by the deadline. Brazil's National Congress issued Declaratory Act No. 67 on 15 October 2025, which officially confirmed that Provisional

See MoreBrazil joins BEPS MLI

This makes Brazil the 106th jurisdiction to join the landmark agreement to strengthen tax treaties, which now covers around 2,000 bilateral tax treaties. The OECD has announced that Brazil signed the Multilateral Convention to Implement Tax

See More