Japan and Monaco continue negotiations on tax treaty agreement

Japan and Monaco continue talks on a bilateral tax treaty during diplomatic engagements in Osaka. Monaco’s Acting Minister of State and Foreign Affairs, Ms Isabelle Berro-Amadeï, visited Japan alongside Monaco Day celebrations at Expo 2025

See MoreAustralia: ATO announces FX Rates for year ending June 2025

The ATO has updated its foreign exchange rate guidance, including monthly rates for July 2024 to June 2025. The Australian Taxation Office (ATO) has updated its guidance on foreign exchange rates, incorporating rates for the financial year ending

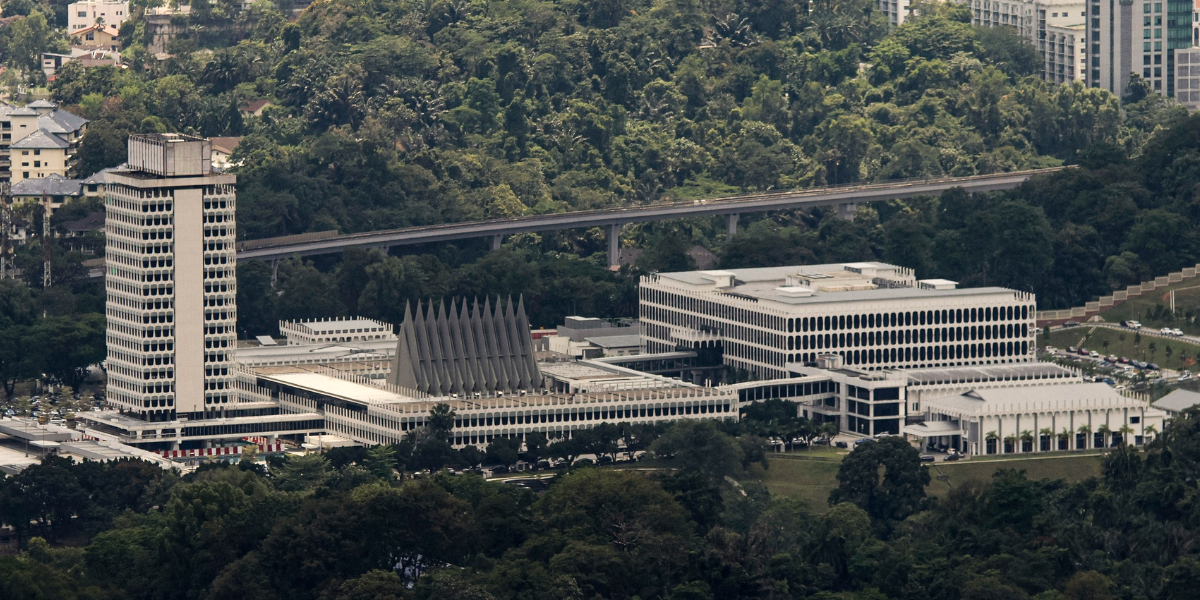

See MoreMalaysia imposes anti-dumping duties on iron and steel from China, South Korea, and Vietnam

Import duties ranging from 3.86% to 57.90% are imposed on galvanized iron and steel coils or sheets from these countries. Malaysia’s Ministry of Trade and Industry has announced provisional anti-dumping duties on certain iron and steel imports

See MoreAustralia: ATO consults public CbC reporting exemptions

Comments on this draft PS LA are due by 5 September 2025. The Australian Taxation Office (ATO) has initiated a public consultation on the Draft Practice Statement Law Administration (PS LA 2025 /D1) on 3 July 2025. This draft sets out the

See MoreChina imposes medical device import restrictions in response to EU ban

China has announced restrictions on government purchases of EU medical devices worth over CNY 45 million. China's finance ministry has announced restrictions on government purchases of EU medical devices worth over CNY 45 million (USD 6.3

See MoreIndonesia proposes tariff cuts, USD 500m wheat purchase in talks with US

Indonesia has proposed reducing import duties on US goods to nearly zero and committing to purchasing USD 500 million worth of US wheat in ongoing tariff negotiations. Indonesia's Coordinating Minister for Economic Affairs, Airlangga Hartarto,

See MoreSingapore updates GST e-tax guides on prospective registration and gross margin scheme

The updated GST e-Tax Guides will revise registration timelines and ease GMS adoption requirements. The Inland Revenue Authority of Singapore (IRAS) has revised multiple Goods and Services Tax (GST) e-Tax Guides, effective from 1 July 2025,

See MoreThailand proposes US trade deal to avert 36% tariffs

Thailand proposed to reduce its USD 46 billion trade surplus and increase imports of American goods before a 9 July deadline. Thailand has proposed a trade deal to the US to avoid a 36% tariff on its exports, aiming for a lower rate of

See MorePakistan: Federal Board of Revenue publishes Finance Act 2025

Finance Act 2025 introduces new digital taxes, revised income tax rates, and expanded enforcement measures effective from 1 July 2025. Pakistan's Federal Board of Revenue (FBR) has enacted the Finance Act 2025 on 27 June 2025, introducing major

See MoreAustralia: PM expects 10% US tariff to remain

Australia will continue to face 10% US export tariffs but will continue negotiating for an exemption. Australia’s Prime Minister Anthony Albanese said, on 4 July 2025, that the country is likely to remain subject to a 10% tariff on all exports

See MoreJapan issues FAQs on foreign SSA application amid non-adoption

Japan’s NTA clarifies tax treatment for foreign SSA adoption, reaffirming the use of existing transfer pricing rules. Japan’s National Tax Agency (NTA) issued FAQs addressing the Simplified and Streamlined Approach (SSA) on 30 June 2025, also

See MoreVietnam extends VAT reduction until 2026

The National Assembly has extended the 2% VAT cut for eligible goods and services from 1 July 2025 to 31 December 2026. Vietnam’s National Assembly passed Resolution No. 204/2025/QH15 on 17 June 2025, extending the reduced VAT rate of 8% (down

See MoreHong Kong, Morocco end first round of tax treaty talks

Negotiations for the tax treaty began on 23 June 2025 and ended on 27 June 2025. Hong Kong and Morocco concluded the first round of negotiations of their first-ever income tax treaty on 27 May 2025. Negotiations for the tax treaty began on 23

See MoreChina grants tax credit for reinvested dividends by foreign investors

A new corporate income tax credit for foreign investors reinvesting dividends from Chinese companies, retroactive from 1 January 2025 to 31 December 2028, offers a 10% credit to offset current-year tax payable. China's State Administration of

See MoreUS to impose 20% tariff on Vietnamese exports

The US will impose a 20% tariff on many Vietnamese exports, with trans-shipped goods facing 40%. President Donald Trump announced on 2 July 2025 that the US will apply a 20% tariff on many Vietnamese exports instead of the previously proposed

See MoreUzbekistan to refund 50% VAT to livestock and poultry farmers

Uzbekistan is offering a 50% VAT refund to livestock and poultry farms from April 2025 to January 2028 under Cabinet Resolution No. 362, aiming to boost domestic meat, milk, and egg production. Uzbekistan is implementing a 50% VAT refund for

See MoreMalaysia exempts imported fruits from sales and service tax

Malaysia exempts imported apples, oranges, mandarin oranges, and dates from sales tax as part of revised sales and service tax changes aimed at easing living costs and supporting small businesses. Malaysia's Ministry of Finance revised the Sales

See MoreSingapore: IRAS issues 8th edition e-tax guide on income tax treatment of REIT ETFs

IRAS’s eighth edition of its e-tax guide outlines the income tax treatment of REIT ETFs receiving distributions from S-REITs and qualifying for tax concession schemes. Singapore’s Inland Revenue Authority (IRAS) released the eighth edition

See More