New Zealand: Revenue Minister unveils updated tax and social policy plan

New Zealand’s Revenue Minister Simon Watts unveiled an updated Tax and Social Policy Work Programme aimed at boosting economic growth by enhancing the country’s appeal to investors, skilled professionals, and small businesses on 29 October

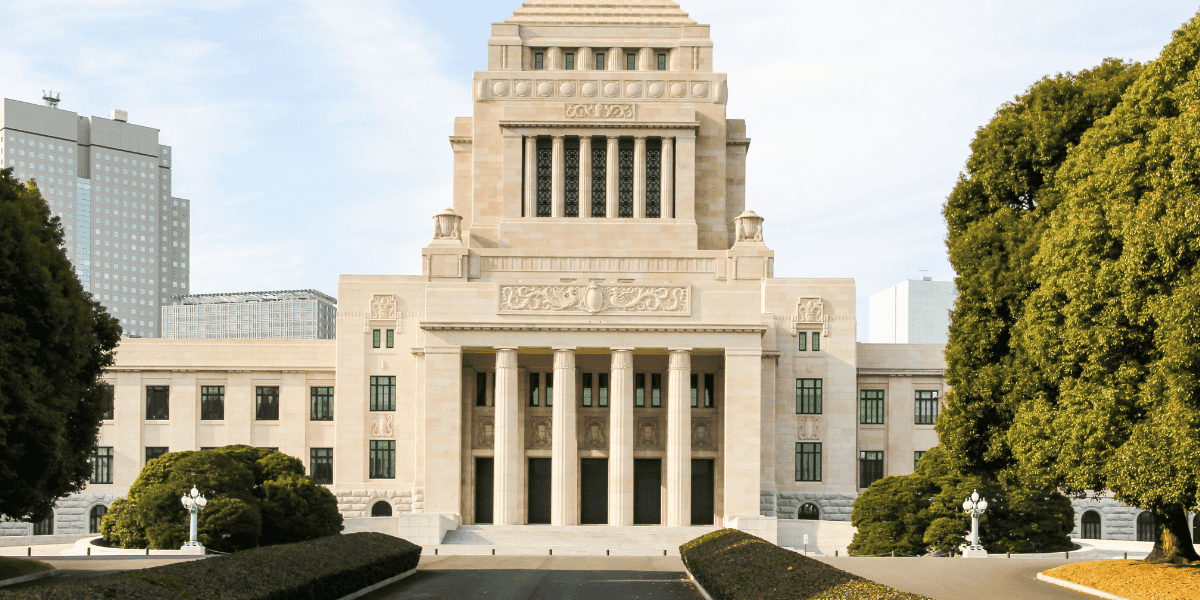

See MoreJapan: Tax authorities publish updated corporate tax guide for 2025

Japan’s tax authorities released a detailed guide to corporate tax law and filing procedures on 1 October 2025. The guide explains how to calculate taxable income and outlines different types of taxpayers, including ordinary and public interest

See MoreUS: Trump administration releases factsheet on US-China trade deal

The Trump Administration released a fact sheet detailing the trade agreement reached between the US and China on 30 October 2025, on 1 November 2025. This follows the announcement by US Treasury Secretary Scott Bessent on 26 October 2025 that the

See MoreBangladesh: Central Bank may lower policy rate in January 2026

Bangladesh’s central bank, Bangladesh Bank, has hinted at a potential adjustment to its policy rate in the upcoming monetary policy, which is anticipated for January 2026, following a meeting with the visiting IMF Fifth Review Mission on 30

See MoreVietnam: MoF releases pillar 2 tax procedures, forms

Vietnam’s Ministry of Finance has issued Decision 3563/QD-BTC introducing new tax administrative procedures and forms on 21 October 2025, under the management of the Tax Management Department of Large Enterprises, in line with Decree

See MoreIndia: CBDT extends income tax returns, audit report deadlines for AY 2025-26

The Central Board of Direct Taxes (CBDT), operating under the Government of India's Ministry of Finance, Department of Revenue, has announced an extension of deadlines for filing Income Tax Returns (ITRs) and various reports of audit for the

See MoreNew Zealand: Opposition party proposes targeted capital gains tax to fund free doctor visits

RF Report The Labour Party of New Zealand, the leading opposition party in parliament, has announced a proposal which targets capital gains tax on profits from the sale of commercial or residential properties, excluding the family home,

See MoreTaiwan: Tax Bureau clarifies making up past losses in undistributed earnings

RF Report HuWei Office, National Taxation Bureau of the Central Area, Ministry of Finance, Taiwan, stated, pursuant to Article 66-9 of the Income Tax Act, when a profit-seeking enterprise files its undistributed earnings, its surplus earnings can

See MoreIndia to impose import duty on yellow peas from November

RF Report The Indian government will impose a 30% import duty on yellow peas from 1 November 2025 to support domestic pulse prices ahead of the rabi season. Shipments dated on or before 31 October are exempt from this levy. Pulse prices,

See MoreUS and Korea (Rep.) sign trade deal, reduces auto tariffs

RF Report The US and Korea (Rep.) signed a major trade agreement on 29 October 2025. The key aspect of this agreement is the reduction of US tariffs on automobiles and auto parts imported from Korea (Rep.), from 25% to 15%. In exchange for

See MoreUS and Japan sign trade deal, critical minerals pact

RF Report The US and Japan finalised a new trade agreement on 28 October 2025 that implements the terms of a July deal, easing tariff tensions and deepening economic cooperation. Under the arrangement, the US will apply a reduced 15% tariff on

See MoreUS reduces Chinese tariffs post Trump-Xi meeting

RF Report US President Donald Trump announced a significant agreement with Chinese President Xi Jinping during their meeting at the APEC summit in South Korea on 30 October 2025. The two leaders agreed to reduce tariffs and address key trade

See MoreAustralia: ATO updates APA guidance

The Australian Taxation Office (ATO) updated Law Administration Practice Statement PS LA 2015/4 to reflect enhancements to its advance pricing arrangement (APA) programme. The changes incorporate recommendations from the ATO’s 2023 APA Programme

See MoreJapan,Turkmenistan tax treaty to enter into force in November

Regfollower Desk Japan and Turkmenistan exchanged diplomatic notes in Ashgabat to bring into force the “Convention between Japan and Turkmenistan for the Elimination of Double Taxation with respect to Taxes on Income and the Prevention of Tax

See MoreThailand: Cabinet approves temporary tourism tax incentives for Q4 2025

Regfollower Desk The Thai Cabinet approved a series of tax measures to promote domestic tourism, as announced by the Thai Revenue Department. The initiatives include incentives for individual travellers, corporate tax deductions for domestic

See MoreCambodia, Malaysia, Thailand sign agreement to scrap implementation of digital services taxes on US firms

Regfollower Desk The White House recently announced trade agreements with Cambodia, Malaysia, and Thailand, which include commitments from these nations to avoid imposing digital services taxes (DSTs) or similar measures that could unfairly

See MoreChina strengthens trade ties with ASEAN

Regfollower Desk China and the ASEAN bloc signed an upgraded free trade agreement on 28 October 2025, marking a significant step in their economic partnership. The new deal, referred to as the 3.0 version, focuses on emerging sectors such as

See MoreTaiwan revises customs consultation rules to protect taxpayer rights

Regfollower Desk Taiwan’s Customs Administration, Ministry of Finance, announced that it revised and promulgated the Operation Directions for the Consultation of Customs Cases (the “Directions”) on 15 July 2025. The update aims to protect

See More