New Zealand consults tax framework for off-market share cancellations

New Zealand's Inland Revenue has released a draft Operational Statement for public consultation addressing the bright line tests used to classify off-market share cancellations as either taxable dividends or non-taxable capital returns. This

See MoreAustralia: ATO publishes 2026 supplementary annual GST return

The Australian Taxation Office has published the 2026 Supplementary annual GST return along with its supporting instructions on 16 February 2026. The supplementary annual GST return (SAGR) is an annual reporting requirement for Top 100 and Top

See MoreIndia: Tax Authority appeals ITAT ruling on Ireland aircraft leasing treaties

The Indian tax authority has filed an appeal before the High Court against the Mumbai bench of the Income Tax Appellate Tribunal’s (ITAT) consolidated order of August 2025, which granted treaty benefits to several Irish aircraft leasing

See MoreAustralia: ATO updates monthly foreign exchange rates for the 2025–26 income year

The Australian Taxation Office (ATO) has updated its foreign exchange rate guidance, which includes Monthly exchange rates for 1 July 2025 to 30 June 2026, and monthly rates for October, November, and December 2025, and January 2026. As per the

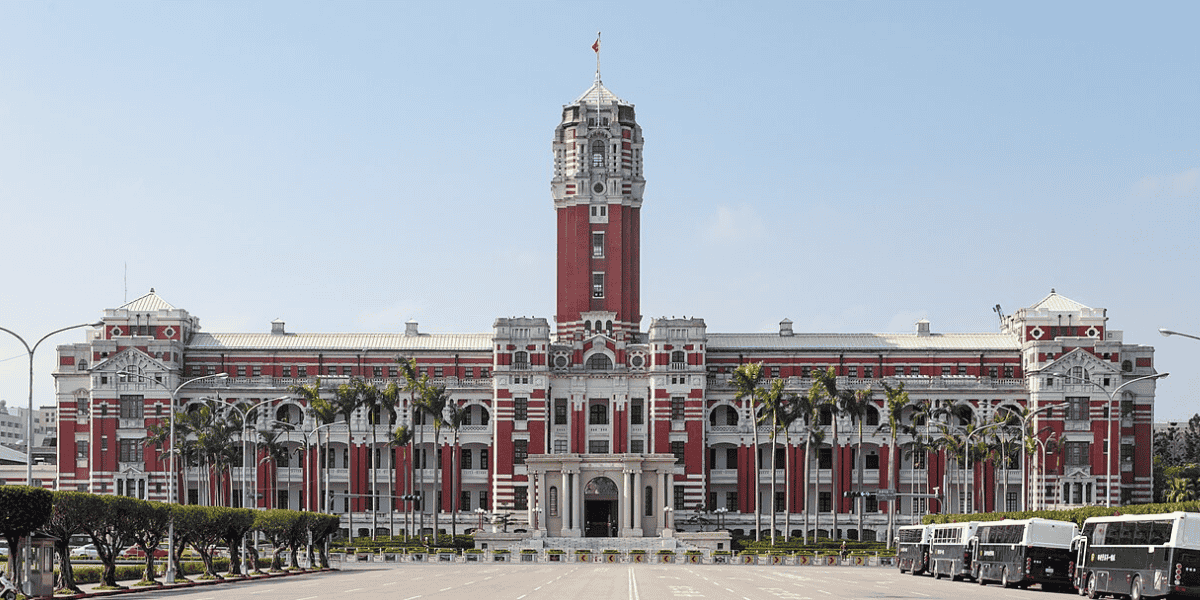

See MoreUS, Taiwan sign reciprocal trade agreement

The Office of the US Trade Representative (USTR) announced, on 12 February 2026, that the Trump administration finalised a reciprocal trade agreement with Taiwan. The Trump Administration also released a fact sheet on the agreement. The

See MoreNew tax treaty between Singapore, Taiwan enters into force

The tax treaty between Singapore and Taiwan for the elimination of double taxation with respect to income taxes and the prevention of tax evasion and avoidance was signed on 31 December 2025 and entered into force on 13 February 2026. It was

See MoreJ5 warns OTC crypto desks and processors enable tax evasion, money laundering

The Joint Chiefs of Global Tax Enforcement (J5) published two law enforcement advisories on 11 February 2026 that detail how over-the-counter (OTC) cryptocurrency trading desks and cryptocurrency payment processors may be used to obfuscate and move

See MoreTaiwan: Tax bureau clarifies input tax credit rules for mixed business operations

Taiwan’s Northern Region National Taxation Bureau announced on 13 February 2025 that businesses selling both taxable and tax-exempt goods must follow specific regulations when claiming input tax credits on fixed assets like factory buildings and

See MoreTaiwan: Tax bureau clarifies contract penalties taxation, late interest exemption

The Central Taiwan National Taxation Bureau has clarified, on 13 February 2026, that breach of contract penalties and late payment interest receive different tax treatments. Penalties collected for contract breaches are subject to business tax

See MoreEU imposes tariffs on Chinese-made electric vehicles

The European Commission has implemented additional import duties on electric vehicles manufactured in China, with rates varying significantly by manufacturer. These charges come on top of the EU's standard 10% import duty on cars. Chinese EV

See MoreUS issues new tax rules to limit Chinese clean energy components

The US Treasury Department released interim guidelines on 12 February 2026 addressing how companies can qualify for clean energy tax credits while restricting reliance on Chinese-made equipment under President Donald Trump's tax legislation. The

See MoreTaiwan: Tax bureau clarifies sole proprietors on invoice rules during change of responsible person

The Northern Taiwan National Taxation Bureau of the Ministry of Finance has clarified on 13 February 2026 that sole proprietorships that change in the responsible person may trigger business tax obligations if inventory and fixed assets are

See MoreBangladesh: NBR extends January VAT return deadline

The National Board of Revenue (NBR) has extended the deadline for submitting online VAT returns for the January 2026 tax period through its e-VAT system until 22 February, citing public interest. An official order said the move followed a

See MoreKazakhstan opens consultation on tax protocol with Norway

The government of Kazakhstan published a draft resolution on 10 February 2026 for consultation on a protocol to amend its 2001 income and capital tax treaty with Norway. The draft was released through the Republic of Kazakhstan’s official Open

See MoreTaiwan: Taipei Tax Bureau urges compliance with branch reporting rules

Taiwan’s National Taxation Bureau of the Ministry of Finance has reiterated that business entities approved to pay business tax on a consolidated basis through their head office must ensure that their branch offices continue to fulfill reporting

See MoreTaiwan: Tax Authority warns against misreporting foreign dividends

Taiwan’s Taipei National Taxation Bureau of the Ministry of Finance stated that profit‑seeking enterprises headquartered domestically which invest in shares of foreign companies, issued under foreign law and approved by the securities authority

See MoreThailand: Revenue Department raises SME tax deduction for digital investments

The Thai Revenue Department issued Royal Decree No. 802 on 10 February 2026, granting higher tax deductions for SMEs investing in digital tools and services. Under the decree, SMEs can claim an additional 100% deduction, bringing the total

See MoreVietnam: MoF proposes interim tax rules for crypto assets

Vietnam’s Ministry of Finance (MoF) has released a draft circular outlining a tax framework for crypto and tokenised asset transactions, following Government Resolution No. 05/2025/NQ-CP issued on 9 September 2025. The initiative, set for early

See More