US: IRS issues guidance on elimination of one-month deferral for specified foreign corporations

The US Internal Revenue Service (IRS) issued Notice 2025-72 on 25 November 2025, stating that the Treasury Department and IRS plan to issue proposed regulations under section 70352 of the "One Big Beautiful Bill Act" (OBBBA), which repeals section

See MoreUruguay introduces temporary VAT relief for select tourism services

Uruguay issued Decree No. 220/025 on 30 October 2025, introducing a temporary exemption from value added tax (VAT) for specific tourism-related services aimed at non-resident visitors. The measure applies to payments made with foreign-issued debit

See MoreUS: Treasury, IRS provide guidance on Trump Accounts under working families tax cuts ahead of new regulations

The Department of the Treasury and the Internal Revenue Service (IRS) issued a notice on 2 December 2025, announcing upcoming regulations and providing guidance regarding Trump Accounts, which are a new type of individual retirement account (IRA)

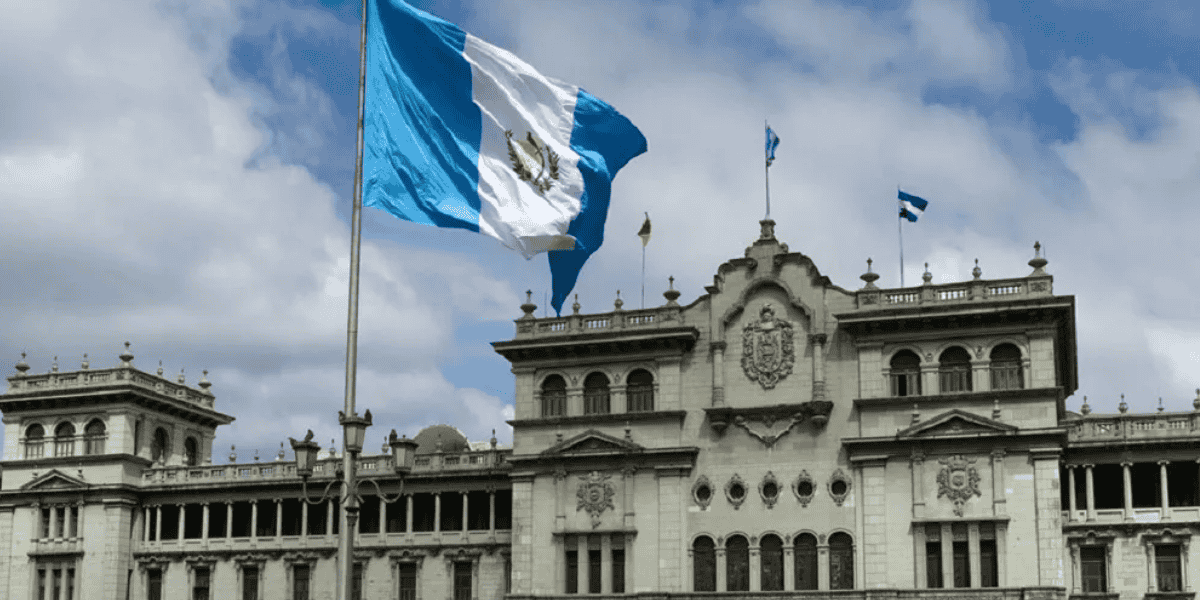

See MoreGuatemala revises regulations on tax credit offsets, refund procedures

Guatemala issued Decree No. 17-2025 in the Official Gazette, introducing amendments to the Tax Code, the Value Added Tax Law, and the Law on Legal Provisions for Strengthening Tax Administration. Decree 17-2025 establishes a new law intended to

See MoreUS maintains tariff exemptions on select Chinese industrial products

The US has announced a one-year extension of tariff exemptions on certain Chinese industrial and medical goods, including equipment used to produce solar-energy products, following a recent US-China trade agreement. These exemptions, originally

See MoreUS, UK strike agreement for tariff free pharmaceuticals

The US and the UK reached an agreement on 1 December 2025 that eliminates tariffs on British pharmaceutical products and medical technology. In exchange, the UK has committed to increasing its spending on medicines and reforming how it determines

See MoreUS reduces tariffs on Korea (Rep.) vehicles to 15%

The US will reduce import duties on Korea (Rep.) automobiles to 15%, retroactive to 1 November, aligning with the tariffs applied to Japan and the EU, Commerce Secretary Howard Lutnick announced on 2 December 2025. The measure follows last

See MoreBrazil gazettes minimum tax on individuals, dividend withholding tax measures

Brazil published Law No. 15.270 in the Official Gazette, enacting several tax measures for companies, including a corporate minimum tax and withholding tax on dividends, on 27 November 2025. This follows after Brazil’s Senate passed Bill

See MoreBrazil: Congress passes new tax incentives for chemical sector

Brazil’s Federal Senate has approved Bill 892/2025 on 18 November 2025, establishing the Special Sustainability Programme for the Chemical Industry (PRESIQ) and amending the existing Special Regime for the Chemical Industry (REIQ). The bill

See MoreBrazil: RFB allows Simplified National Tax System taxpayers prepay all instalment plans, including RELP-SN

Brazil’s Federal Revenue Service (RFB) announced on 26 November 2025 that it expanded the functionalities available to taxpayers under the Simplified National Tax System (Simples Nacional) by allowing taxpayers to prepay instalments across all

See MoreBrazil: RFB to implement tax administration module (MAT) from December

Brazil’s tax authority, the Federal Revenue Service (RFB), has announced that the Tax Administration Module (MAT) will be implemented on 27 November 2025. The RFB calls the MAT’s implementation an essential advancement in the country’s tax

See MoreChile: SII clarifies procedure for income tax return software

Chile’s tax administration (SII) provided clarification about the software certification process for generating income tax returns on 24 November 2025. Instructions are now available for software manufacturers and distributors interested in

See MoreCanada: Quebec government proposes various tax measures in 2025 fall economic update

Quebec’s Finance Minister presented the 2025 Fall Economic Update on 25 November 2025, outlining proposed tax measures affecting both businesses and individuals. The 2025 Fall Economic Update does not introduce any corporate or personal tax

See MoreTaiwan: MoF imposes anti-dumping duties on Chinese beer, steel

Taiwan’s Ministry of Finance (MoF) announced on 27 November 2025 that it will impose anti-dumping duties on beer and certain hot-rolled flat steel products imported from China. The duties, retroactive to 3 July 2025, will remain in effect for five

See MoreArgentina expands use of signed document as customs guarantee across import, export regimes

The Argentine government has issued a decree extending the use of a signed document as a valid guarantee for both import and export procedures, including definitive and suspensive regimes. The measure, effective upon publication in the Official

See MoreUruguay: Senate continues detailed review of national budget 2025–2029

The Uruguayan Senate resumed the detailed consideration of the National Budget 2025–2029 on Wednesday, 26 November, following a temporary recess. Senator Sebastián Sabini reported proceedings in the Chamber. This announcement was made on 27

See MoreUS: IRS urges taxpayers to prepare early for 2026 filing season as major new tax law takes effect

The US Internal Revenue Service is encouraging taxpayers to begin preparing now for the 2026 tax filing season, highlighting key steps individuals can take to file accurate returns and avoid delays. In its first “Get Ready” reminder of the

See MoreColombia: DIAN plans crypto reporting under CARF

Colombia’s tax authority (DIAN) has proposed a draft resolution to implement the OECD’s Crypto-Asset Reporting Framework (CARF) to standardise tax reporting for crypto transactions. The resolution would require registered crypto-asset service

See More