Canada, Qatar set to conclude tax treaty negotiations

Canadian and Qatari officials met on 8 January 2026 to discuss ways to strengthen bilateral cooperation, The Qatar News Agency (QNA) reported. HE Dr Ahmed bin Mohammed Al Sayed, Minister of State for Foreign Trade Affairs, welcomed HE Maninder

See MoreArgentina: ARCA extends VAT prepayment relief on essentials until mid-2026

Argentina’s tax and customs authority (ARCA) published General Resolution 5,807 in the Official Gazette on 30 December 2025, announcing an extension to the suspension of advance VAT collection on essential items, including food, medicines, and

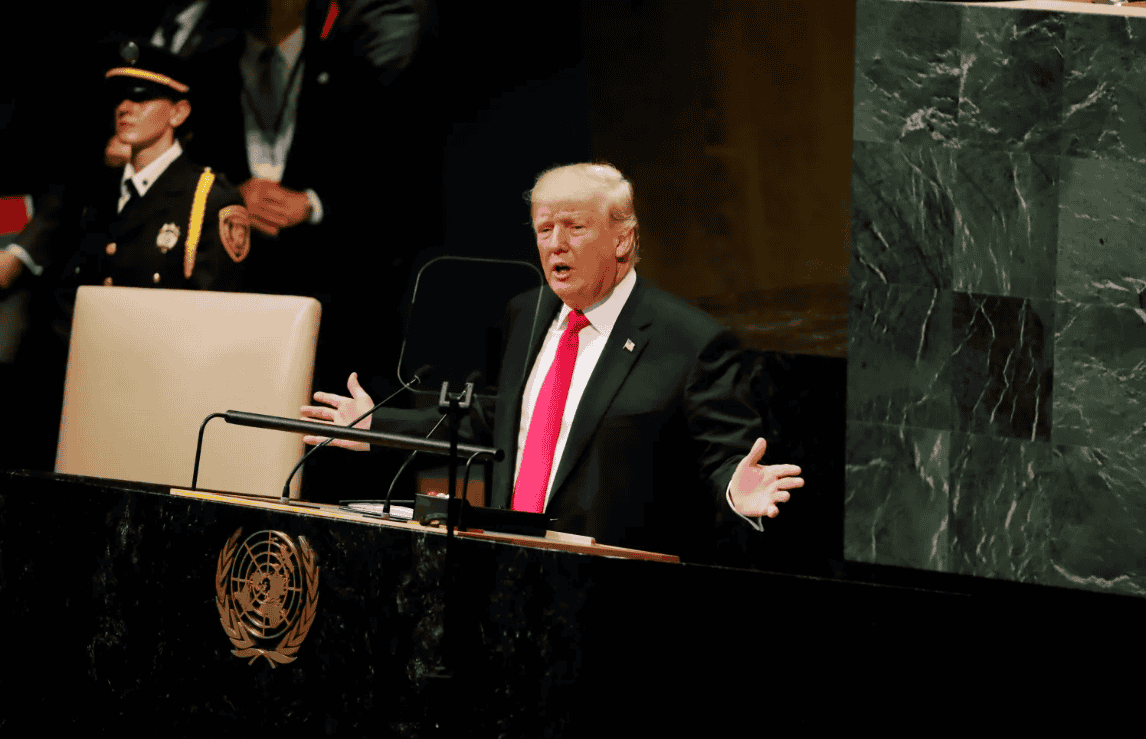

See MoreUS: Trump to imposes tariffs on Iran’s trade partners

Alongside military considerations, Trump has moved to sharply increase economic pressure on Iran. He announced on Monday, 12 January 2026, the immediate imposition of a 25% tariff on any country doing business with Iran, a step that could

See MoreArgentina raises statutory limit for tax evasion cases

Argentina has increased the thresholds for tax evasion and aligned the statute of limitations with civil and commercial regulations under Law 27,799, which was published in the Official Gazette on 2 January 2026. Law 27,799 introduces a

See MoreColombia: DIAN raises tax value unit for 2026

The Colombian Tax and Customs National Authority (DIAN) issued Resolution No. 000238 on 15 December 2025, setting the Tax Value Unit (Unidad de Valor Tributario – UVT) for 2026 at COP 52,374. This is an increase from COP 49,799 in 2025. The UVT

See MorePeru: Government raises tax unit value for 2026

Peru’s government, through Supreme Decree No. 301-2025-EF issued on 17 December 2025, has set the Tax Unit (Unidad Impositiva Tributaria – UIT) for 2026 at PEN 5,500, up from PEN 5,350. The UIT is a key reference in the country’s tax

See MoreArgentina: ARCA launches digital tax address system for taxpayers, customs operators

Argentina’s tax and customs collection agency (ARCA) announced on 8 January 2026 that it will implement a new tax address regime to replace the current system. The goal is to simplify procedures, reduce administrative burden, and provide greater

See MoreArgentina: Congress raises penalties for late, missing tax filings

Argentina’s Federal Congress has enacted Law 27,799, which raises penalties for formal tax violations under the Procedure Tax Law (Law 11,683). The law was published in the Official Gazette on 2 January 2026 and entered into force upon its

See MorePanama: DGI announces updated tax return forms

Panama’s tax authority (DGI) announced on 8 January 2026 several updates to the e-Tax 2.0 system, including the release of new versions of declaration forms. A new section has been added to Form F2 (Corporate Income Tax), which now

See MoreUS: Supreme Court to determine fate of Trump’s sweeping global tariffs on 14 January

The US Supreme Court is expected to deliver its latest round of decisions on 14 January 2026 on the legality of President Donald Trump’s global tariff policy. The court noted that its rulings may be announced when the justices convene for their

See MoreUS: IRS issues 2026 procedures for letter rulings, technical advice

The US Internal Revenue Service has issued Internal Revenue Bulletin 2026-01 on 29 December 2025, which includes five Revenue Procedures for 2026: letter rulings, determination letters, information letters and technical advice from the IRS. The

See MoreDominican Republic: DGII revises excise tax rates on alcohol, tobacco

The Dominican Republic’s tax authority (DGII) issued Resolution DDG-AR1-2025-00008 on 17 December 2025, revising the specific tax rates applicable to the selective consumption tax on alcohol and tobacco products. The resolution informs

See MoreColombia: DIAN publishes 2026 tax calendar with income tax, VAT, transfer pricing deadlines

Colombia’s National Directorate of Taxes and Customs (DIAN) published the 2026 tax calendar on 26 December 2025, outlining the deadlines and dates that individuals, legal entities and other taxpayers must follow to comply with their national tax

See MoreColombia: DIAN updates CRS reporting rules to include crypto, digital assets

The Colombian Tax and Customs Authority (DIAN) has revised its reporting framework for the automatic exchange of financial information under the OECD’s Common Reporting Standard (CRS) to include cryptocurrencies and digital currencies, published

See MoreBrazil: RFB opens registration for special asset update regime, corporate asset revaluation subject to 4.8% tax

The Federal Revenue Service (RFB), has opened the Declaration of Option for the Special Asset Update Regime (Deap), allowing individuals and legal entities to update asset values acquired with legally sourced funds up to 31 December 2024, with

See MoreColombia enacts several tax reforms amid economic emergency

Colombia’s government issued Legislative Decree No. 1474 on 29 December 2025, introducing several temporary tax measures to fund the national budget in response to the state of emergency declared earlier under Decree No. 1390 of 22 December

See MoreUruguay implements domestic minimum top-up tax exemption for qualifying fiscal stability entities

Uruguay Uruguay’s Ministry of Economy and Finance issued Decree No. 325/025 on 29 December 2025, detailing how fiscal stability clauses that existed before the introduction of the Pillar 2 Qualified Domestic Minimum Top-Up Tax (QDMTT), or Impuesto

See MoreEcuador: SRI maintains existing VAT for 2026

Ecuador’s Internal Revenue Service (SRI) has confirmed that the standard VAT rate of 15% will remain in effect for 2026. Circular NAC-DGECCGC25-00000006, issued on 26 December 2025, specifies that the 15% rate, established under Executive

See More