Brazil: Senate approves tax treaty protocol with China

Brazil’s Senate has approved the protocol amending the Brazil-China Income Tax Treaty (1991) through Draft Legislative Decree No. 343/2024 on 8 April 2025. Signed on 23 May 2022, this protocol is the first amendment to the treaty. It will come

See MoreCanada: Newfoundland and Labrador announces 2025 budget, introduces no changes to tax rates

Canada province Newfoundland and Labrador finance minister Siobhan Coady has presented the province’s 2025 budget on 9 April 2025. The minister mentioned the province’s deficit has decreased from CAD 1.5 billion in 2020-21 to CAD 372 million

See MorePanama updates CRS participating jurisdictions list

Panama published Resolution No. 201-3013 of 26 March 2025 in the Official Gazette on 1 April 2025 updating the list of participating jurisdictions for the automatic exchange of financial account information under the Common Reporting Standard

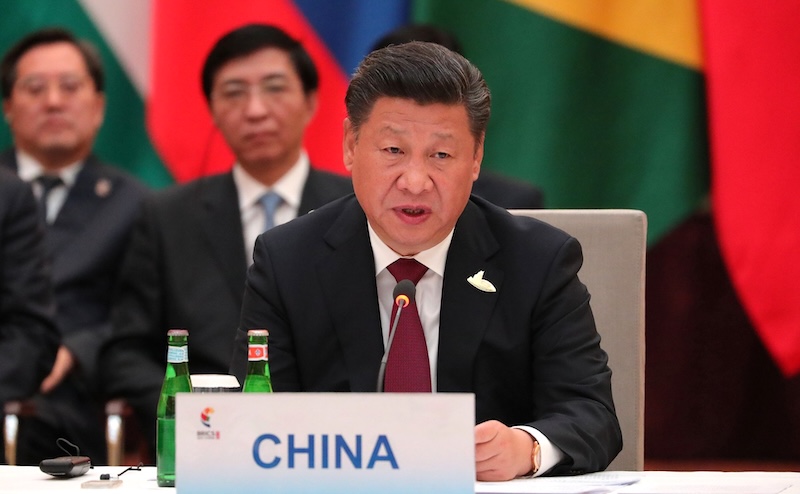

See MoreTrade war escalades: China imposes 125% tariffs on US imports

Beijing announced it has increased its tariffs on US imports to 125% earlier today, 11 April 2025. "The US side's imposition of excessively high tariffs on China seriously violates international economic and trade rules, runs counter to basic

See MoreCanada: Countermeasures against auto imports from the US enters into force

Canada’s finance minister François-Philippe Champagne confirmed on 8 April 2025 that Canada’s new countermeasures, announced on 2 April 2025, in response to the unjustified tariffs imposed by the US on the Canadian auto industry came into force

See MoreUS: IRS announces Q1 deadline for estimated tax payments for 2025

The US Internal Revenue Service (IRS) issued IR-2025-45 on 10 April 2025 reminding self-employed individuals, retirees, investors, businesses and corporations that 15 April is the deadline for first quarter estimated tax payments for tax year

See MoreLuxembourg: Chamber of Deputies approve tax treaty with Colombia

Luxembourg's Chamber of Deputies gave its approval for the ratification of the tax treaty with Colombia concerning income and capital on 2 April 2025. The agreement was signed on 19 January 2024. It seeks to eliminate double taxation with respect

See MoreMexico announces tax incentive guidelines under ‘Mexico Plan’ decree with new evaluation committee

Mexico published a resolution detailing the guidelines for tax incentives under the “Mexico Plan” decree on 21 March 2025, effective from 24 March 2025. The resolution establishes the role of a new Evaluation Committee, composed of members

See MoreUS: Trump pauses tariffs for 90 days for all countries, hits China harder with 125%

US President Donald Trump announced a three-month suspension of all “reciprocal” tariffs that took effect on 9 April 2025, excluding those applied to China. The sweeping tariffs will remain for China, the world’s second largest economy and

See MoreEcuador extends 0% remittance tax on essential imports amid energy crisis

The Ecuadorian government issued Executive Decree No. 589 on 29 March 2025 to extend the 0% tax rate on foreign currency outflows (ISD) for essential imports. The measure continues the temporary relief first introduced for January to March 2025

See MoreChile updates fair market value of assets subject to luxury tax

Chile's tax administration Internal Revenue Service (SII) has published Resolution No. 39 in the Official Gazette on 27 March 2025, introducing updated asset lists along with their fair market values for the implementation of the luxury

See MoreUS: IRS updates guidance on branch-level interest tax

The US Internal Revenue Service (IRS) has released an updated practice unit on Branch-Level Interest Tax Concepts. Below is a general overview of the key points covered in this publication: Note: This Practice Unit was updated to remove

See MoreChile announces new VAT liability estimate process

Chile’s tax administration (SII) published Resolution Ex. SII No. 38-2025 in the Official Gazette on 27 March 2025. This Resolution allows taxpayers with maximum sales revenue up to 2,400 tax units (around USD 97,000) from the previous year to

See MoreUS: Michigan, Texas offer state tax relief after disasters

In response to recent natural disasters that have heavily impacted communities, Michigan and Texas have announced tax filing and payment relief for individuals and businesses. Michigan: Relief for people and businesses hit by severe winter

See MoreBrazil updates rules on social contribution top-up tax for Pillar 2

Brazil has issued Normative Instruction RFB No. 2.259 of 24 March 2025, which amends the regulations for the Additional Social Contribution on Net Profit (CSLL) contained in Normative Instruction RFB No. 2,228 of 3 October 2024. The Additional

See MoreChile waives penalties for late filings due to IT glitch

Chile’s tax administration (SII) has waived the fine for the late filing of tax return No. 1948 (DJ 1948) through Resolution Ex. SII 34-2025 was published in the Official Gazette on 19 March 2025. This return reports dividend distribution by

See MoreUS: IRS extends 2024 tax deadline for disaster victims in 12 states

The US Internal Revenue Service (IRS) issued IR-2025-41 on 4 April 2025, in which it reminded individuals and businesses in areas covered by 2024 disaster declarations that their 2024 federal income tax returns and tax payments for tax year 2024 are

See MoreCanada: Northwest Territories abolishes consumer carbon tax

The Government of the Northwest Territories (GNWT) will remove the Northwest Territories' carbon tax for all consumers except large emitters on 1 April 2025. The GNWT has taken this step to align with the Government of Canada’s carbon pricing

See More