Chile: SII revises UAE’s status on its preferential tax regimes list

This resolution repeals Resolution Ex. SII No. 61-2025, which had set 1 June 2023 as the removal date, and confirms that the UAE is not considered to have a preferential tax regime under the Income Tax Law (LIR). Chile’s tax administration

See MoreChile: SII revises 2026 luxury tax values for aircraft, yachts, vehicles

Resolution Ex. SII No. 121-2025 updates the fair market values for helicopters, airplanes, yachts, and vehicles subject to the 2% luxury goods excise tax for 2026. Chile’s tax administration (SII) has published Resolution Ex. SII No. 121-2025

See MoreCanada: CRA simplifies tax adjustments through revised voluntary disclosures program

The VDP lets taxpayers voluntarily correct past tax errors for potential penalty and interest relief, but only for tax years overdue by at least one year. The Canada Revenue Agency (CRA) announced, on 10 September 2025, that it will update the

See MoreUS: IRS extends filing, payment deadlines for taxpayers impacted by ongoing conflict in Israel

IRS is providing separate but overlapping relief to taxpayers who may be unable to meet a tax-filing or tax-payment obligation, or may be unable to perform other time-sensitive tax-related actions. The US Internal Revenue Service (IRS) announced,

See MoreUS: Treasury, IRS issue guidance on rural opportunity zone investments under the One, Big, Beautiful Bill

The guidance provides clarification on rural Qualified Opportunity Zone investments, which offer tax incentives to encourage economic growth and job creation in underserved areas. The US Department of the Treasury and the Internal Revenue Service

See MoreUS: IRS issues interim guidance on corporate alternative minimum tax (CAMT)

The two notices, Notice 2025-46 and Notice 2025-49, on 30 September 2025, provide interim guidance on the corporate alternative minimum tax (CAMT). The US Internal Revenue Service (IRS) issued two notices, Notice 2025-46 and Notice

See MorePeru: BEPS MLI enters into force

Peru’s BEPS MLI entered into force on 1 October 2025 to curb tax treaty abuse and base erosion by multinationals. The Multilateral Convention on Tax Treaty Measures to Counter Base Erosion and Profit Shifting (MLI) has entered into force in

See MoreChile: SII announces filing deadlines for FY 2026 annual tax return forms

Chile’s Tax Authority (Servicio de Impuestos Internos – SII) has issued Resolution Ex. SII No. 123-2025 on 25 September 2025, announcing the official filing schedule for annual tax return forms due in fiscal year (FY) 2026. Annual tax

See MoreMexico updates list of registered non-resident digital service providers

Under the rules, which have applied since 1 June 2020, non-resident digital service providers must register with the Federal Registry of Taxpayers (RFC) to supply services to Mexican users. The Mexican Tax Administration (SAT) issued Official

See MoreColombia: DIAN consolidates tax, customs, foreign exchange regulations

DIAN issued Resolution 000227 consolidating tax, customs and foreign exchange rules. The Colombian National Tax and Customs Directorate (DIAN) has issued Unified Resolution 000227 on 23 September 2025 consolidating tax, customs, and foreign

See MoreBrazil: Government introduces tax incentives framework for data centres

The REDATA regime is aimed at encouraging the growth of data centres in Brazil by fostering digital infrastructure development and attracting investments. Brazil’s government published Provisional Measure 1.318/2025 in the Official Gazette on

See MoreArgentina deposits BEPS MLI ratification instrument

The MLI is set to take effect in Argentina starting 1 January 2026. Argentina officially ratified the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting (MLI) by depositing its instrument

See MoreUS: IRS, Treasury announce reduced user fees for tax professionals applying for or renewing PTINs, initiates public consultations

The US Treasury and IRS announced interim final regulations and a proposed rule to lower the user fee for tax professionals applying for or renewing a PTIN. The Department of the Treasury and the Internal Revenue Service (IRS) issued IR-2025-95

See MoreUS: Trump imposes 10% tariff on lumber, 25% on furniture and cabinets

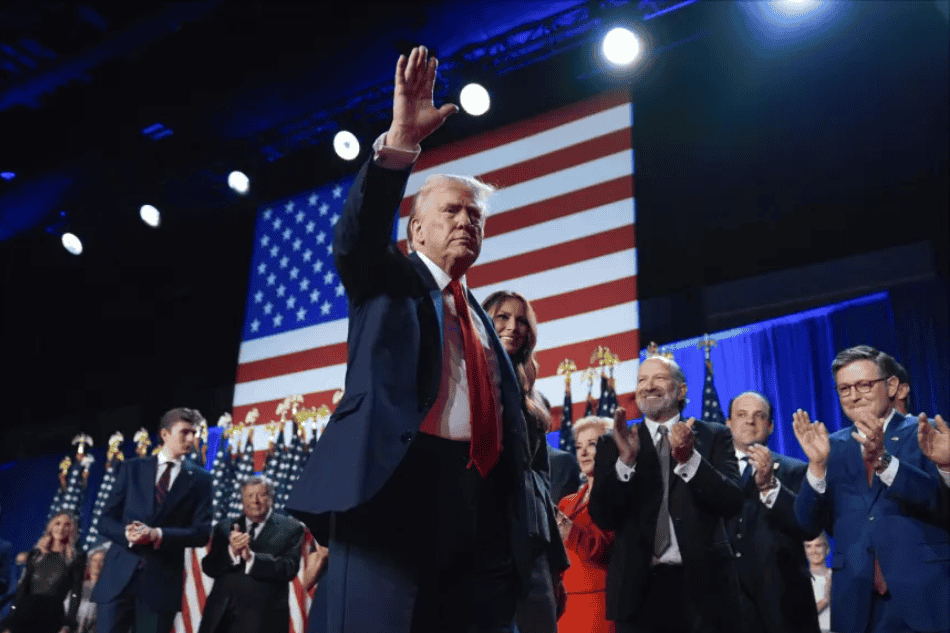

Trump argued that these imports were undermining the US economy by threatening domestic wood mills, disrupting supply chains, and reducing the utilisation of American wood industries. US President Donald Trump signed a presidential proclamation

See MoreWorld Bank: Analysis of Tax Data to Understand Job Creation

A World Bank blog on 16 September 2025 looked at how administrative data drawn from tax returns can reveal information about the businesses that are creating employment. The blog, written by V. Wiedemann, T. Scot, L. Zavala and L. Serrano Pajaro,

See MoreUS introduces ‘platinum card’ visa permitting 270-day stay with no foreign income tax

The Trump Platinum Card will allow individual applicants to reside in the US for up to 270 days per year without being subject to tax on non-US income. The US has unveiled plans for a "Platinum Card" that would enable foreign nationals to stay in

See MoreLesotho Trade Minister: US to extend Africa trade agreement for an additional year

This trade agreement provides African nations with preferential access to US markets. Lesotho's Trade Minister, Mokhethi Shelile, said, on 24 September 2025, that the US is planning to extend the African Growth and Opportunity Act (AGOA) by one

See MoreUS imposes 100% tariffs on branded pharmaceuticals, adds new tariffs on trucks and furniture

The Trump administration announced sweeping tariffs effective 1 October 2025, including a 100% duty on branded pharmaceuticals and 50% tariffs levied on trucks, cabinets, vanities, and 30% tariffs on upholstered furniture. President Donald

See More