US: IRS updates Form 1099-K guidance under the One, Big, Beautiful Bill

The IRS clarified that under the One, Big, Beautiful Bill, third-party payment processors must file Form 1099-K only if a payee receives over USD 20,000 and more than 200 transactions, reinstating the pre-ARPA threshold. The US Internal Revenue

See MoreIndia, US near deal to slash import tariffs

India and the US near deal to cut tariffs, with energy and agriculture in focus. India and the US are reportedly nearing a trade deal that would cut US tariffs on Indian imports from 50% to about 15–16%. The agreement is expected to focus on

See MoreColombia: DIAN closes businesses for electronic invoice non-compliance

DIAN closed 47 Bogotá businesses in October for failing to issue electronic invoices and meet tax obligations. Colombia’s Tax Authority (DIAN) continues to strengthen its control measures in the capital. As part of the operations carried out

See MoreArgentina: ARCA extends deadline for accessing income tax payment facility

The new deadline is set at 28 November 2025. Argentina's tax authority (ARCA) has announced an extension for taxpayers to join the payment facility regime on 22 October 2025, aimed at regularising income tax balances, including adjustments for

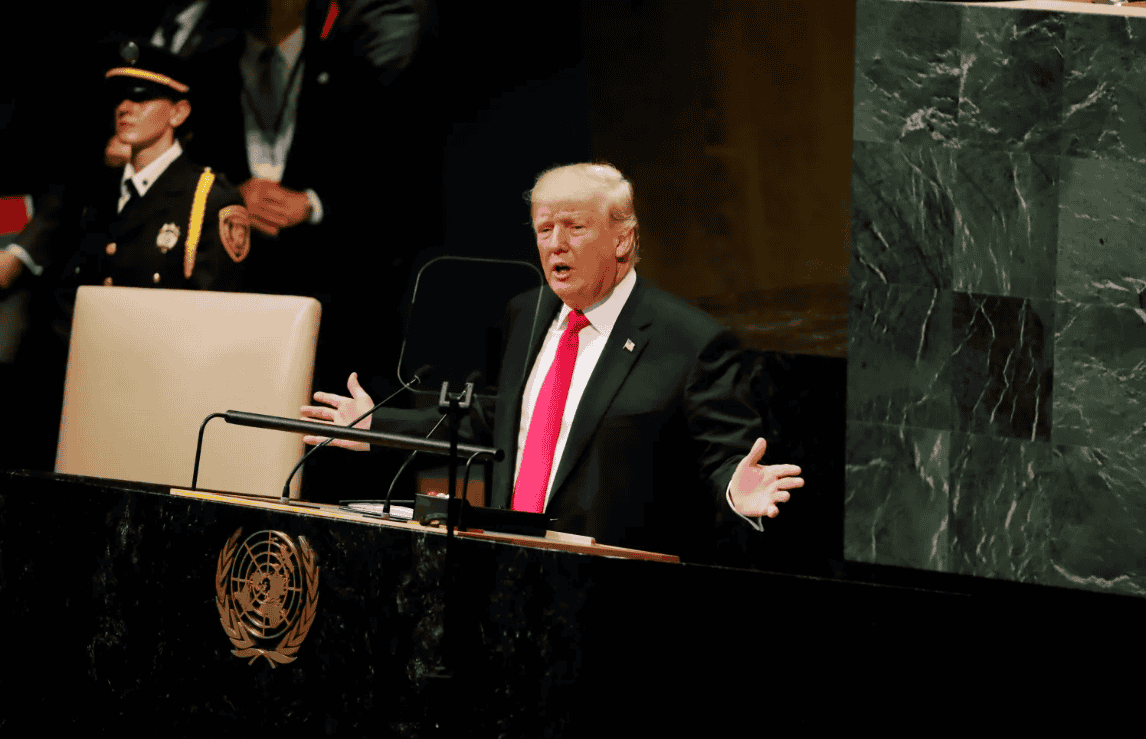

See MoreUS: Trump anticipates trade agreement with China, including soybean exports

President Trump expressed confidence in reaching agreements with President Xi during their upcoming South Korea meeting, covering trade issues, including China’s Russian oil imports. U.S. President Donald Trump expressed his optimism on

See MoreBolivia: SIN extends agricultural unified tax system obligations deadline for 2024 fiscal year

The deadline was extended because agricultural associations requested more time. Bolivia’s tax authority (SIN) has issued Resolution RND 102500000039 on 10 October 2025, granting an extension for obligations related to the Unified

See MoreUS: Treasury, IRS provide transition relief for 2025 for businesses reporting car loan interest under the One, Big, Beautiful Bill

The notice provides penalty relief and guidance to certain lenders for new information reporting requirements for car loan interest received in 2025 under the OBBB. The Department of the Treasury and the Internal Revenue Service (IRS) issued

See MoreUS: USTR moves to impose 100% tariffs on Nicaragua imports over labour violations, seeks public comments

The USTR is considering tariffs of up to 100% on Nicaraguan goods over alleged labour and human rights violations affecting US trade. The US Trade Representative's office announced that the Trump administration is considering imposing tariffs of

See MoreDominican Republic: DGII announces inflation adjustments for September 2025 tax year

The Dominican Republic’s DGII issued Resolution No. DDG-AR1-2025-00007 on 15 October 2025, setting inflation multipliers and exchange rates for the fiscal year ending September 2025. The Dominican Republic’s General Directorate of Internal

See MoreUS: Trump considers increasing tariffs on Colombia amid drug trade feud

President Trump announced plans to raise US tariffs on Colombian imports and suspend financial aid, citing alleged Colombian involvement in drug trafficking. US President Donald Trump announced on Truth Social, on 19 October 2025, plans to

See MoreUS: Maryland court blocks digital Ad tax pass-through

Maryland’s Digital Advertising Tax “pass-through provision” was ruled unconstitutional by US District Court. The US District Court for the District of Maryland issued a final judgment on 15 October 2025 in the case Chamber of Commerce of

See MoreBrazil: National Congress nullifies provisional measures on equity interest, financial entities taxes

Proposed tax changes under PM No. 1.303 will not take effect after the required approval is not secured by the deadline. Brazil's National Congress issued Declaratory Act No. 67 on 15 October 2025, which officially confirmed that Provisional

See MoreHungary, US considering reinstatement of tax treaty

The US ended its 1979 tax treaty with Hungary, effective 1 January 2024, while a 2010 treaty between the two was never ratified. Representatives from Hungary and the US held discussions on strengthening bilateral relations on 17 October 2025. A

See MoreCanada grants tariff exemptions on select US and Chinese steel, aluminium products

The tariff relief on certain US and Chinese steel and aluminium imports is aimed at supporting local industries and advancing trade negotiations with both countries. Canada has introduced tariff relief measures on certain steel and aluminium

See MoreBrazil joins BEPS MLI

This makes Brazil the 106th jurisdiction to join the landmark agreement to strengthen tax treaties, which now covers around 2,000 bilateral tax treaties. The OECD has announced that Brazil signed the Multilateral Convention to Implement Tax

See MoreUS: Trump approves more tax credits for US automakers, imposes 25% tariff on truck imports

Starting 1 November, a 25% tariff will apply to medium and heavy-duty trucks and parts, with a 10% tariff on imported buses. President Donald Trump has signed orders to boost US auto and engine production while imposing new tariffs on imported

See MoreUS: Trump pledges to keep ‘massive’ tariffs on India until Russian oil imports stop

Trump said Modi had assured him India would stop buying Russian oil, warning New Delhi it would face “massive” US tariffs if it did not comply. US President Donald Trump said on Sunday, 19 October 2025 that Indian Prime Minister Narendra

See MoreBrazil: Federal Revenue Service amends QDMTT rules

Brazil’s Federal Revenue Service issued Normative Instruction 2282 on 3 October 2025, updating rules for the additional CSLL to align with OECD GloBE standards and confirming its status as a qualified domestic minimum top-up tax effective from

See More