Argentina: ARCA updates rules for lowering income tax advance payments

Argentina's tax and customs agency (ARCA) announced on 27 October 2025 that it has modified the parameters for companies to request a reduction in their advance income tax payments. The measure establishes that companies may request a

See MoreUS: Trump administration releases factsheet on US-China trade deal

The Trump Administration released a fact sheet detailing the trade agreement reached between the US and China on 30 October 2025, on 1 November 2025. This follows the announcement by US Treasury Secretary Scott Bessent on 26 October 2025 that the

See MoreBrazil mandates disclosure of ultimate beneficial owners of investment funds, companies

Brazil’s Federal Revenue Service published an update to the rule on 31 October 2025, which deals with the identification of the ultimate beneficiaries of investment funds, companies, and legal arrangements operating in the country. This measure

See MoreUruguay: Economy, Tourism Ministries reintroduce VAT cut for foreign tourists

The Ministry of Economy and Finance and the Ministry of Tourism issued a joint decree on 23 October 2025, announcing the reintroduction of a significant tax benefit for foreign tourists. The measure provides for a reduction of the Value Added Tax

See MoreCanada: Bank of Canada cuts rate amid US tariff hike

The Bank of Canada lowered its key interest rate to 2.25% on Wednesday, 29 October 2025, citing ongoing economic weakness, but emphasised that monetary policy cannot reverse the structural damage caused by the US trade war. The central bank

See MoreEcuador: SRI extends VAT, withholding tax filing deadlines for Imbabura taxpayers

The Internal Revenue Service of Ecuador (SRI) has issued Resolution NAC-DGERCGC25-00000033, extending the deadlines for filing September 2025 Value Added Tax (IVA) and Withholding at the Source (retenciones en la fuente) returns, including their

See MoreUS: IRS announces tax relief for North Dakota and South Dakota storm, flood victims

The US Internal Revenue Service (IRS) released ND-2025-01 and SD-2025-01 on 29 October 2025, announcing tax relief for individuals and businesses in parts of North Dakota and South Dakota affected by severe storms and flooding that began on 12 June

See MoreUS: IRS announces tax relief to Alaska storm and flood victims

The US Internal Revenue Service (IRS) in a notice (AK-2025-0) on 30 October 2025 announced tax relief for individuals and businesses in the Lower Kuskokwim Regional Educational Attendance Area, Lower Yukon Regional Educational Attendance Area, and

See MoreUS: Texas issues new franchise tax rates, threshold caps for 2026–27

The Texas Comptroller of Public Accounts has released the franchise (margin) tax rates, thresholds, and deduction limits for 2026 and 2027. The tax rates remain unchanged from 2024 to 2025, while both the no-tax-due threshold and the compensation

See MoreUS: California enacts law for IRC provisions conformity, introduces R&D tax credits

California Governor Gavin Newsom signed Senate Bill 711 (SB 711) into law on 1 October 2025, bringing the state’s tax code into conformity with various Internal Revenue Code (IRC) provisions from 1 January 2015 through 1 January 2025. SB 711,

See MoreChile: Tax Authority updates IVA rules for digital platform operators

RF Report The Chilean Tax Authority (Servicio de Impuestos Internos, SII) issued Resolution Ex. SII No. 145-2025 on 16 October 2025, setting out the obligations of digital platform operators with residence or domicile in Chile regarding Value

See MoreUS and Korea (Rep.) sign trade deal, reduces auto tariffs

RF Report The US and Korea (Rep.) signed a major trade agreement on 29 October 2025. The key aspect of this agreement is the reduction of US tariffs on automobiles and auto parts imported from Korea (Rep.), from 25% to 15%. In exchange for

See MoreArgentina tightens reporting rules on cross-border transaction

RF Report Argentina published Decree 767/2025 in the Official Gazette on 28 October 2025, introducing significant updates to its cross-border transaction reporting rules, effective for fiscal years ending on or after 29 October 2025. The

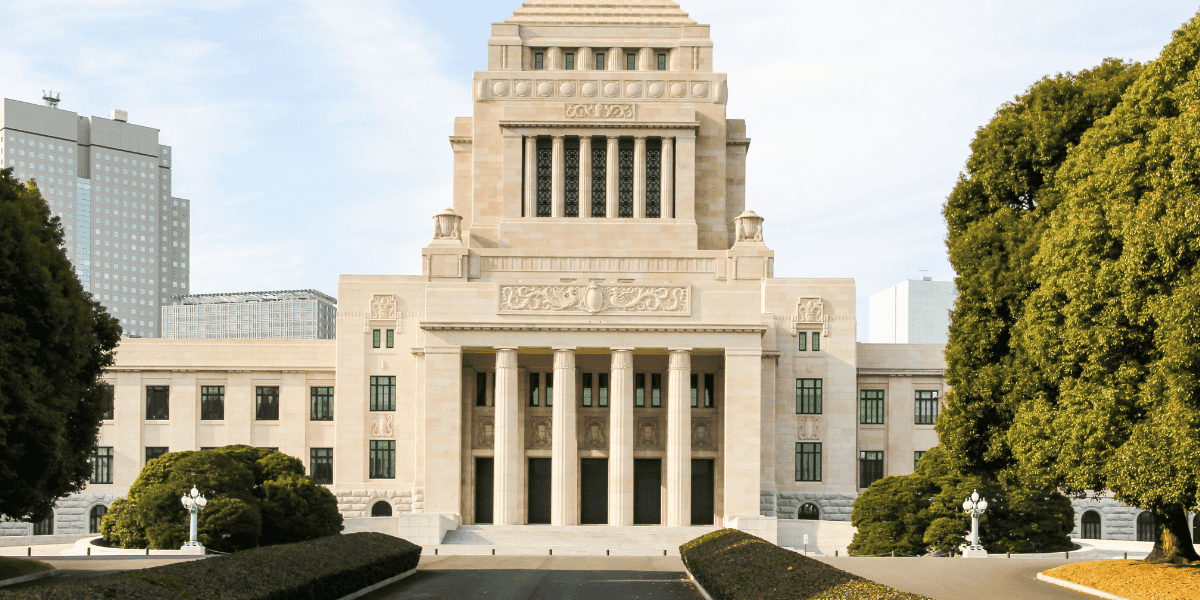

See MoreUS and Japan sign trade deal, critical minerals pact

RF Report The US and Japan finalised a new trade agreement on 28 October 2025 that implements the terms of a July deal, easing tariff tensions and deepening economic cooperation. Under the arrangement, the US will apply a reduced 15% tariff on

See MoreUS: IRS announces reduced services amid federal shutdown

RF Report The US Internal Revenue Service (IRS) announced on 21 October 2025 that, despite its limited operations during the ongoing US government shutdown, taxpayers are still required to meet all regular tax obligations. Tax refunds will

See MoreUS reduces Chinese tariffs post Trump-Xi meeting

RF Report US President Donald Trump announced a significant agreement with Chinese President Xi Jinping during their meeting at the APEC summit in South Korea on 30 October 2025. The two leaders agreed to reduce tariffs and address key trade

See MoreCambodia, Malaysia, Thailand sign agreement to scrap implementation of digital services taxes on US firms

Regfollower Desk The White House recently announced trade agreements with Cambodia, Malaysia, and Thailand, which include commitments from these nations to avoid imposing digital services taxes (DSTs) or similar measures that could unfairly

See MoreArgentina: ARCA issues new guidelines for safeguarding foreign trade information

Regfollower Desk Argentina’s tax authority (ARCA) announced new guidelines for safeguarding foreign trade information on 27 October 2025. The tax agency also updated existing regulations regarding the disclosure and confidentiality of data

See More