Australia, Canada sign customs mutual assistance agreement

Canada Border Services Agency (CBSA) announced on 19 November 2025 that officials from Australia and Canada signed a Customs Mutual Assistance Agreement. CBSA announces Customs Mutual Assistance Agreement with Australia Strong partnerships

See MoreArgentina, US customs agencies establish cooperation agreement

Argentina’s tax and customs agency (ARCA) has signed a cooperation agreement with US Customs and Border Protection (CBP) on 26 November 2025. The framework agreement aims to continue modernising and automating processes in bilateral trade and

See MoreUS: Treasury and IRS consult on implementing new federal tax credit for donations to scholarship organisations

The US Department of the Treasury and the Internal Revenue Service (IRS) issued Notice 2025-70 on 25 November 2025, stating that it is requesting comments on the implementation of a new tax credit for individuals established under the One, Big,

See MoreArgentina: ARCA further extends deadline for settling tax debts from miscalculated losses

Argentina’s tax authority (ARCA) has issued General Resolution 5788/2025 on 13 November 2025, extending the deadline for taxpayers to access the payment plan facility for outstanding tax debts arising from miscalculated tax losses. Introduced

See MoreUS: IRS, Treasury publishes 2025 tax guidance for tip, overtime income for individuals

The US IRS and the Department of the Treasury issued guidance on 21 November 2025 for individuals eligible to claim the deduction for tips and overtime compensation for the tax year 2025. Notice 2025-69 clarifies for workers how to determine the

See MoreColombia: DIAN proposes new legislation to modernise customs regime

Colombia’s government has submitted Bill 312 of 2025 to the General Secretariat of the Colombian Senate on 30 October 2025. The bill seeks to update and streamline the customs sanctions regime by redefining infractions as grave, serious, or

See MorePeru ratifies 2025 income tax treaty with UK

Peru approved the 2025 Income Tax Treaty with the UK through Supreme Decree No. 051-2025-RE on 20 November 2025, with the ratification published in the Official Gazette on 21 November 2025. The agreement aims to mitigate tax base erosion and

See MoreCosta Rica: MoF raises interest rate for late payments, penalties

Costa Rica’s Ministry of Finance has published Resolution MH-DGH-RES-0063-2025/MH-DGA-RES-1766-2025 in the Official Gazette on 19 November 2025. Resolution MH-DGH-RES-0063-2025/MH-DGA-RES-1766-2025 repeals Resolution

See MoreUS: IRS resumes normal operations following 2025 appropriations lapse

The US Internal Revenue Service (IRS) has announced the resumption of regular operations following the 2025 government funding lapse on 19 November 2025. As full operations recommenced, it is important for taxpayers and tax professionals to be aware

See MoreUS: Treasury releases final guidance governing the 1% tax on corporate share repurchases

The US Treasury Department and IRS have issued final regulations (T.D. 10037) that clarify how the 1% excise tax on corporate stock repurchases applies to transactions occurring after December 31, 2022. This tax was initially introduced in the

See MoreColombia: Government moves forward with customs sanctions reform bill

The Colombian Government has formally submitted a bill to create a new customs sanctions regime, fulfilling requirements set by the Constitutional Court under ruling C-072 of 2025. The initiative, filed as No. 312, must be enacted no later than 20

See MoreEcuador updates tax haven list, removes UAE

Ecuador has removed the UAE from its list of tax havens under Resolution No. NAC-DGERCGC25-00000037, published in the Official Registry on 17 November 2025. As a result, anti-tax-haven measures, including higher withholding tax rates and

See MoreMexico: SAT expands taxpayer services with two new offices

Mexico’s Tax Administration Service (SAT) has opened two new Tax Service Modules (MST) in Tulum, Quintana Roo, and Tekax, Yucatán, expanding its nationwide network to 164 offices. This announcement was made on 18 November 2025. The Tulum

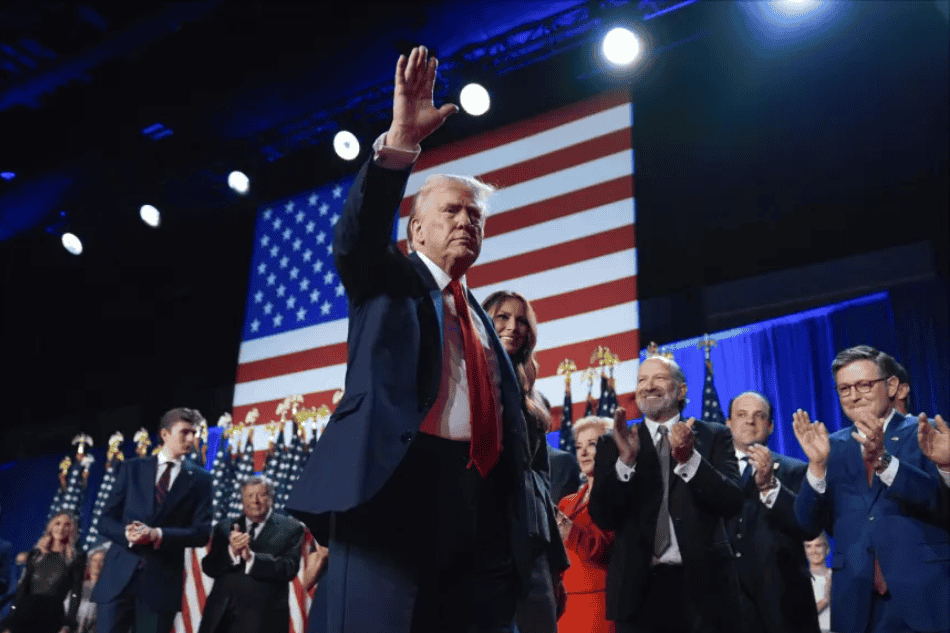

See MoreUS: Trump postpones tariffs on Brazil beef, coffee

US President Donald Trump lifted the 40% tariffs on Brazilian food products, including beef, coffee, cocoa, and fruits, on 20 November 2025, which were imposed in July in response to Brazil’s legal actions against former President Jair Bolsonaro,

See MoreUS: Treasury, IRS issue interim guidance on tax benefit for lenders on farm and rural property loans under the One Big Beautiful Bill, initiates public consultations for final draft

The US Department of the Treasury and the Internal Revenue Service issued guidance on 20 November 2025 for a new tax benefit for certain lenders that make loans secured by rural or agricultural real property. Notice 2025-71 provides interim

See MoreBrazil: Congress greenlights budget cuts, limits corporate tax credits

Brazil’s Congress approved a bill on 18 November 2025 aimed at curbing public spending and tightening rules on companies' use of tax credits. Among its key provisions, the law bars tax credit compensations that are not linked to a company's

See MoreArgentina introduces export rebate refunds, lowers export duties on select oils

Argentina’s government published two key measures in the Official Gazette to support exporters and reduce trade costs. The initiatives allow accumulated export rebates and certain tax balances to be expressed in US dollars and remove export duties

See MoreFinland announces BEPS MLI implementation for tax treaty with Argentina

Finland issued Notice 51/2025 on 3 November 2025, announcing that the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting (MLI) will enter into force for its 1994 income and capital tax treaty

See More