Algeria: 2026 Finance Law revises tax rules for non-residents and PEs, adds green incentives

Algeria's Ministry of Finance has gazetted the Finance Law for 2026 on 31 December 2025. The Finance Law for 2026 sets out the national budget, defining projected revenues, spending limits, and the overall financial framework for state

See MoreAlgeria gazettes mutual assistance convention

Algeria published in the Official Gazette the decree ratifying the OECD–Council of Europe Convention on Multilateral Convention on Mutual Administrative Assistance in Tax Matters (the Convention) as amended by the 2010 protocol on 30 November

See MoreAlgeria revises stamp duties, vehicle taxes effective from January 2025

Algeria’s Ministry of Finance has issued Circular No. 73/LF25 on 23 November 2025, detailing revisions to various stamp duties and taxes as part of the 2025 Finance Law. The circular addresses the increase in the minimum perception of stamp

See MoreAlgeria launches online service for fuel consumption tax payments

Algeria’s General Directorate of Taxes has introduced a new online service allowing vehicle and truck owners travelling to neighbouring countries to pay the fuel consumption tax via the “Tabioucom” platform. The service enables users to pay

See MoreAlgeria: MoF announces extended deadlines for global income tax, wealth tax filing declarations

Algeria’s Directorate General of Taxes under the Ministry of Finance has issued Circular No. 69/MF/DGI/LF.2025 on 10 November 2025, notifying taxpayers and tax offices of updated filing deadlines introduced by the Finance Law for 2025 for filing

See MoreAlgeria: NTA raises penalties for failure to meet registration duty requirements

Algeria’s tax authority (NTA) issued a circular on 29 October 2025 announcing higher fines for failing to comply with registration duty requirements, effective from 1 January 2025. The circular communicates modifications introduced by Articles

See MoreAlgeria: NTA clarifies tax relief for sovereign Sukuk (bonds)

Algeria’s National Tax Administration (NTA) issued Circular No. 65 MF/OGV F.2025 on 29 October 2025, establishing the tax exemption framework for sovereign Sukuk (Islamic bonds) to support the growth of Islamic finance and the development of

See MoreAlgeria presents draft finance bill for 2026 in parliament

The 2026 draft Finance Bill proposes comprehensive fiscal reforms, including amendments to corporate and personal income taxes, VAT, customs and excise duties, environmental taxes, and other administrative measures. Algeria's government has

See MoreAlgeria launches UNCTAD eTrade Readiness Assessment to strengthen small business growth

Algeria initiated the UNCTAD’s eTrade Readiness Assessment to strengthen small enterprises and advance regional integration. Micro, small and medium-sized enterprises (MSMEs), the backbone of Africa’s economy, continue to face persistent

See MoreAlgeria extends 2024 transfer pricing filing deadline

The deadline has been further extended to 5 June 2025. Algeria's Directorate General of Taxes announced on 28 May 2025 an extension of the 2024 transfer pricing declaration deadline for the 2024 financial year. Algeria’s tax authorities have

See MoreAlgeria extends 2024 corporate income tax filing deadline

Algeria’s National Tax Administration (NTA) announced an extended deadline for corporate income tax (CIT) filing on 14 April 2025. The new deadline is set for 31 May 2025. However, since 31 May falls on a holiday, the revised deadline is set for 1

See MoreAlgeria extends 2024 transfer pricing and individual income tax filing deadlines

Algeria's Directorate General of Taxes announced on 14 April 2025 that it had extended the deadline for the annual transfer pricing declaration, which must be submitted electronically, for the 2024 fiscal year. Taxpayers now have until 31 May

See MoreAlgeria clarifies flat-rate tax regime measures under 2025 Finance Law

Algeria’s National Tax Administration (NTA) announced new measures on 31 March 2025 affecting the Unique Flat-Rate Tax (IFU) regime under the 2025 Finance Law. These amendments will enhance tax compliance while streamlining the IFU regime. The

See MoreAlgeria clarifies transfer pricing documentation and asset depreciation rules

Algeria’s Ministry of Finance has issued two key orders: the Order of 15 February 2024, outlining transfer pricing documentation requirements, and the Order of 25 February 2024, setting depreciation periods for fixed assets to calculate taxable

See MoreAlgeria gazettes Finance Law 2025, introduces amendments to CIT and VAT

Algeria’s Ministry of Finance published the Finance Law 2025 in the Official Gazette on 26 December 2024, providing amendments for corporate taxation and VAT amongst various direct and indirect taxation policies. Corporate income tax The

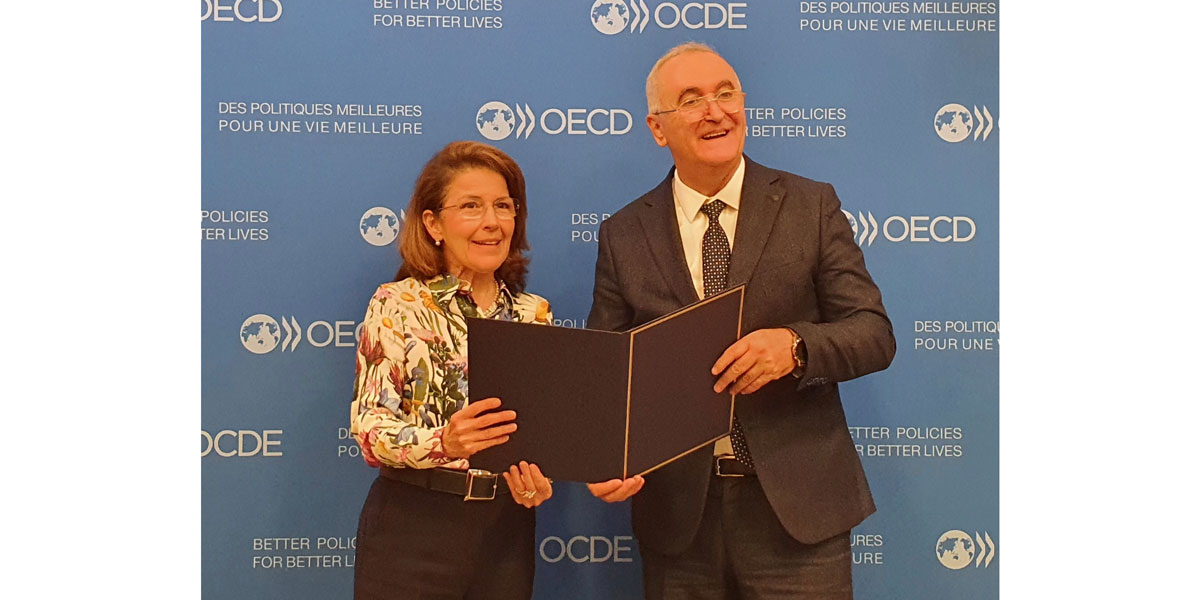

See MoreAlgeria joins mutual assistance convention to combat tax evasion

Amel Abdellatif, Tax Commissioner of Algeria signed the Multilateral Convention on Mutual Administrative Assistance in Tax Matters (the Convention), as amended by the 2010 protocol, on 10 October 2024. The Convention must first be ratified

See MoreAlgeria joins BEPS MLI

The OECD, in an announcement, confirmed that Algeria signed the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting (BEPS Convention) on 27 June, 2024. Algeria has become the 103rd

See MoreAlgeria announces June deadline for annual transfer pricing declaration form

The Algerian government announced that taxpayers must complete and submit the annual transfer pricing declaration (e-form) for the fiscal year of 2023 by Sunday, 30 June, 2024. The annual transfer pricing declaration form, enacted by the

See More