Saudi Arabia: ZATCA urges VAT-registered business to file October returns

Saudi Arabia’s Zakat, Tax and Customs Authority (ZATCA) has urged VAT-registered businesses with goods and services revenues over SAR 40 million to file their October 2025 tax returns by 30 November 2025. This announcement was made on 20

See MoreGhana: MoF presents 2026 budget, proposes VAT reforms

Ghana's Ministry of Finance has presented the 2026 Budget Speech to parliament on 13 November 2025, introducing various tax measures, including VAT reforms. The key tax measures are as follows: VAT reforms Ghana's government is proposing

See MoreJordan, Kuwait sign amending protocol to tax treaty

Jordan and Kuwait signed an amending protocol to update the 2001 income tax treaty on 13 November 2025. The protocol aims to strengthen tax cooperation between the two countries, prevent double taxation, and combat tax evasion. It also seeks to

See MoreQatar ratifies protocol amending tax treaty with Norway

Qatar issued a decree on 13 November 2025 approving the amending protocol to its 2009 income tax treaty with Norway. The protocol, signed on 4 September 2024, is the first amendment to the agreement. It will take effect 30 days after

See MoreKuwait ratifies amending protocol to tax treaty with Luxembourg

Kuwait has ratified the 2021 amending protocol to its 2007 Income and Capital Tax Treaty with Luxembourg through Decree Law No. 138 of 2025 on 1 September 2025. The protocol was published in the Official Gazette No. 1755 of 7 September

See MoreMorocco: Government approves draft decree updating transfer pricing documentation, filing rules

Morocco's Council of Government approved draft Decree No. 2.22.1020 on 13 November 2025, introducing updated transfer pricing documentation and filing rules. The decree specifies the content required for both the master and local files and sets

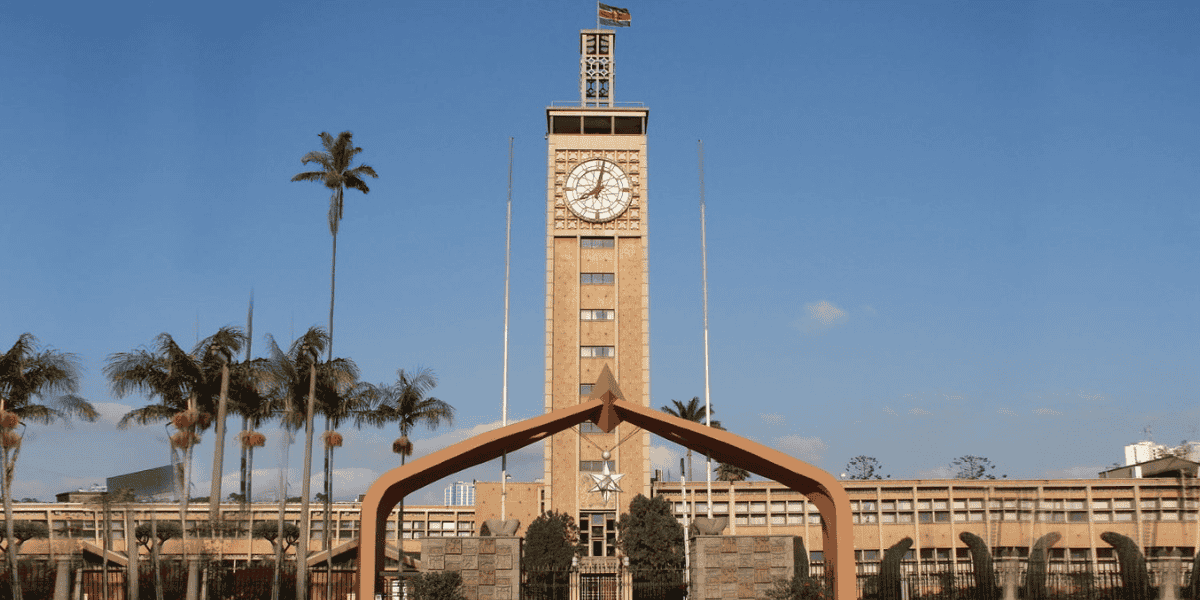

See MoreKenya: KEBS imposes standards levy on manufacturers

The Kenya Bureau of Standards (KEBS) issued a notice to manufacturers on 4 November 2025 regarding the implementation of the Standards (Standards Levy) Order 2025, dated 8 August 2025. Under the Order, all manufacturers are required to pay a

See MoreRussia: Ministry of Finance proposes removing UAE from offshore zones list

Russia’s Ministry of Finance has proposed removing the UAE from its Special List of jurisdictions considered offshore zones for the period 2024 to 2026. The list covers countries and territories with preferential tax regimes or limited

See MoreAlgeria: MoF announces extended deadlines for global income tax, wealth tax filing declarations

Algeria’s Directorate General of Taxes under the Ministry of Finance has issued Circular No. 69/MF/DGI/LF.2025 on 10 November 2025, notifying taxpayers and tax offices of updated filing deadlines introduced by the Finance Law for 2025 for filing

See MoreLebanon: MoF extends CIT, income tax deadlines for 2023–24

Lebanon’s Ministry of Finance (MoF) issued Decision No. 899/1 and related measures on 29 October 2025, extending key filing and payment deadlines for corporate income tax (CIT) and income tax obligations for fiscal years 2023 and 2024. The

See MoreOECD publishes tax information exchange peer review findings for Eswatini, Jordan, Vietnam

The OECD has unveiled new peer review reports on tax information exchange for Eswatini, Jordan, and Vietnam on 10 November 2025. The Global Forum on Transparency and Exchange of Information for Tax Purposes (Global Forum) published the peer

See MoreUAE: Government conducts first digital dirham transaction

The Ministry of Finance and Dubai Finance (DOF) have announced the execution of the UAE’s first government financial transaction using Digital Dirham, in collaboration with the Central Bank of the UAE. The transaction marks a significant step

See MoreTurkey: Revenue Administration cuts late payment, deferred tax interest rates

Turkey’s Revenue Administration announced on 13 November 2025 that it had reduced both the monthly interest on late tax payments and the annual interest on deferred taxes. Under Presidential Decision No. 10556, the monthly interest rate for

See MoreUAE: MoF to adopt updated Common Reporting Standard 2.0

The UAE’s Ministry of Finance (MoF) announced, on 8 November 2025, that the country is committed to implement the updated Common Reporting Standard (CRS 2.0) issued by the Organisation for Economic Co-operation and Development (OECD). The

See MoreMadagascar implements amended OECD-Council of Europe Tax Assistance Convention

Madagascar’s participation in the OECD–Council of Europe Convention on Mutual Administrative Assistance in Tax Matters, as amended by the 2010 Protocol, took effect on 1 November 2025. The Convention will generally be applicable in Madagascar

See MoreLiberia: Government announces 2026 draft budget, introduces presumptive corporate income tax

Liberia’s Ministry of Finance and Development Planning delivered the draft national budget for 2026, on 11 November 2025, focusing on fostering an inclusive economy, safeguarding stability, and delivering real, tangible improvements for its

See MoreUAE: MoF updates administrative penalties for tax violations

The UAE Ministry of Finance has issued a consolidated version of Cabinet Decision No. 40 of 2017, which outlines administrative penalties for tax law violations, as updated by Cabinet Decision No. 129 of 9 October 2025. The updated decision

See MoreKenya: KRA to cross-check tax returns against official data sources

The Kenya Revenue Authority announced on 11 November 2025 that, beginning 1 January 2026, it will start cross-checking income and expenses reported in both individual and non-individual tax returns against specific data sources. Validation of

See More