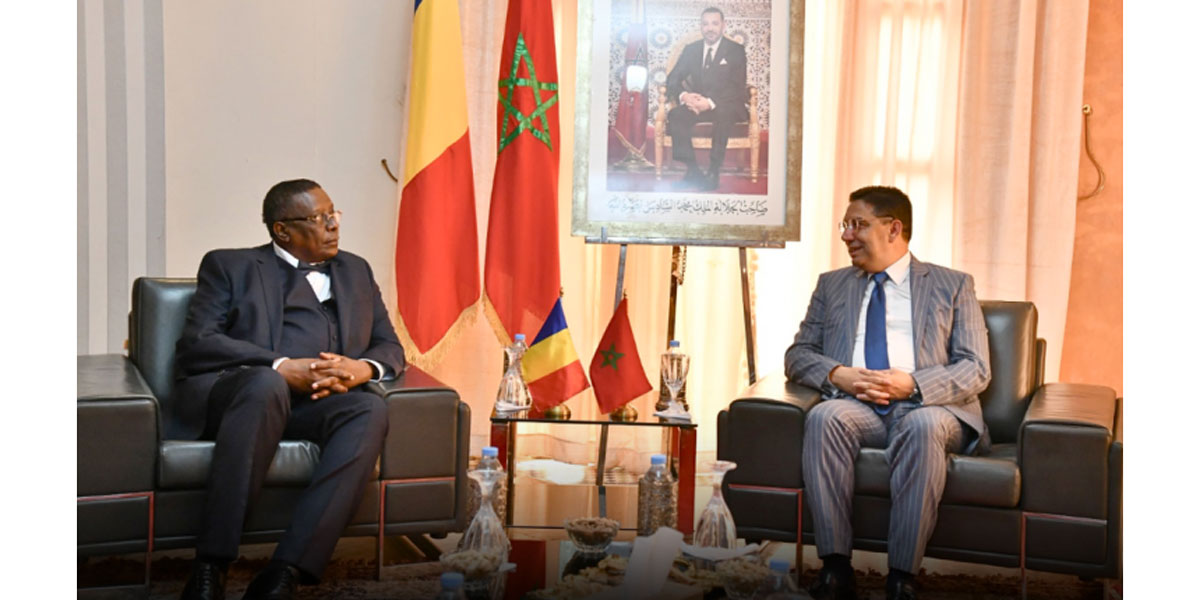

Morocco, Chad sign income tax treaty

Morocco and Chad have signed an income tax treaty on 14 August, 2024. This agreement is the first between the two nations. The tax treaty was signed by Minister of Foreign Affairs, African Cooperation and Moroccan Expatriates, Nasser Bourita, and

See MoreSouth Africa to impose VAT on low-value parcels

The South African Revenue Services (SARS) has issued interim tax changes on the importation of clothing through e-commerce by several importers on 8 August 2024. SARS observed that many importers have been evading the mandatory customs duties and

See MoreUAE releases new corporate tax guide on determining taxable income

The UAE Federal Tax Authority (FTA) has released a new Corporate Tax Guide titled "Determination of Taxable Income" (CTGDTI1)”, which provides detailed guidance on calculating the taxable income base for corporate tax purposes in the UAE. The

See MoreSaudi Arabia approves updated investment law

The Saudi Press Agency announced the approval of a new Updated Investment Law, published on 11 August 2024. Set to come into effect in early 2025, the law aims to attract foreign investors, enhance the competitiveness of the investment

See MoreSouth Africa updates guidance on PBO funding to associations of persons

The South African Revenue Service (SARS) has released an updated guidance concerning the provision of funds, assets, or other resources by a public benefit organisation (PBO) to any association of persons. This Note offers guidance on several key

See MoreIndonesia, GCC announce launch of FTA negotiations

Indonesia’s Minister of Trade, Zulkifli Hasan, and Secretary General of the Gulf Cooperation Council (GCC), Jasem Mohamed Albudaiwi, launched the Indonesia-GCC Free Trade Agreement (I-GCC FTA) negotiations on 31 July, 2024. The event was marked

See MoreTurkey, Mauritius begin income tax treaty negotiations

Turkey's Revenue Administration announced that the first round of negotiations for an income tax treaty with Mauritius took place via video conference between 30 July to 1 August, 2024. The negotiations, which were held under Deputy Chairman of

See MoreTurkey extends Q2 2024 provisional tax return deadline

Turkey's Revenue Administration has announced an extension for the submission of the provisional tax return for the second quarter of the 2024 accounting period. The deadline has been moved from 19 August 2024 to 27 August 2024. Normally,

See MoreGhana: 2024 mid-year budget introduces digital solutions, indirect tax measures

Ghana’s Minister of Finance, Mohammed Amin Adam, presented the 2024 mid-year budget review to the parliament on 23 July 2024. The key provisions of this year’s budget review aim to effectively implement existing tax policies, particularly those

See MoreUAE urges corporate tax registration for June-License holders by August

The UAE Federal Tax Authority (FTA) has issued a press release urging juridical persons (legal entities) that are Resident Persons subject to Corporate Tax and were issued licences in June, to promptly submit their Corporate Tax registration

See MoreSouth Africa consults draft guide on tax incentives for renewable energy investments

The South African Revenue Service (SARS) has published a draft guide concerning allowances and deductions for assets used in generating electricity from specified renewable energy sources. This guide outlines several tax incentives aimed at

See MoreSaudi Arabia extends penalty exemption

The Saudi Zakat, Tax, and Customs Authority (ZATCA) has announced an extension of the penalty exemption initiative until 31 December 2024. ZATCA urges all taxpayers to leverage from the “Cancellation of Fines and Exemption of Penalties

See MoreAngola extends tax compliance deadline for July

Angola’s General Tax Administration (AGT) announced that it has extended the deadline for tax compliance obligations that expire on 31 July of this year to 18 August 2024, due to various computer system constraints. This includes obligations on

See MoreKenya to revise tax treaties with Zambia, Germany, Iran

Kenya’s government has shown interest in restarting negotiations to revise its 1968 tax treaty with Zambia, the 1977 tax treaty with Germany, and the 2012 tax treaty with Iran. This follows after the Kenyan government decided to align its tax

See MoreSaudi Arabia releases third edition of transfer pricing guidelines

The Zakat, Tax and Customs Authority (ZATCA) in Saudi Arabia published the third edition of its Transfer Pricing (TP) Guidelines on 29 July 2024, introducing several changes. Key updates include: Exemptions for group companies: Group

See MoreKenya keeps market and deemed interest rates, raises low-interest loan rate

The Kenya Revenue Authority has released a public notice regarding the market interest rate applicable to fringe benefit tax and the deemed interest rate for specific non-resident loans for July, August, and September, 2024. Additionally, the

See MoreSouth Africa consults tax reform measures in 2024 budget

The South African National Treasury has initiated a public consultation process on 1 August 2024, seeking input on a series of draft bills and regulations aimed at implementing key tax reforms outlined in the 2024 budget. The consultation

See MoreTurkey enacts tax reform law, includes Pillar Two global minimum tax

The Turkish Revenue Administration has officially published Law No. 7524 in the Official Gazette, on 2 August 2024, introducing significant tax reforms aimed at aligning with international standards. This legislation encompasses various measures,

See More