UAE: FTA urges Resident Juridical Persons with licences issued in August and September to register for corporate tax before end of October

The UAE Federal Tax Authority (FTA) has urged Resident Juridical Persons with licences issued in August and September to submit their Corporate Tax registration applications by 31 October 2024 to avoid administrative penalties. The announcement

See MoreUAE amends executive regulations on VAT

The Ministry of Finance announced that the UAE Cabinet has approved Decision No. 100 of 2024, which amends certain provisions of the Executive Regulations of Federal Decree-Law No. 8 of 2017 on Value Added Tax (VAT) on 5 October 2024. These

See MoreNigeria gazettes new withholding tax regime

Nigeria’s Federal Ministry of Finance has announced the Deduction of Tax at Source (Withholding) Regulations 2024 has been published in the official gazette on Wednesday 2 October 2024. The commencement date of the new Regulations is 30

See MoreSouth Africa publishes guidance for taxation of small businesses

The South African government has released a revised tax guide for small businesses for the 2023/24 fiscal year on 26 September 2024. It deals with the taxation of small businesses such as sole proprietors, partnerships and companies not part of

See MoreEthiopia introduces VAT exemptions on water, electricity, mass transport services for low-income groups

The Ethiopian Ministry of Finance published VAT Directive No. 1341/2024, outlining the application of VAT on water, electricity, and transport services on 29 August 2024. The South African government has updated the value-added tax (VAT) policy

See MoreTurkey ends requirement for purchase, sales notifications

Turkey has abolished the necessity of submitting the Notification on Purchases of Goods and Services (Form Ba) and the Notification on Sales of Goods and Services (Form Bs) starting from the September 2024 reporting period. The initiative aims to

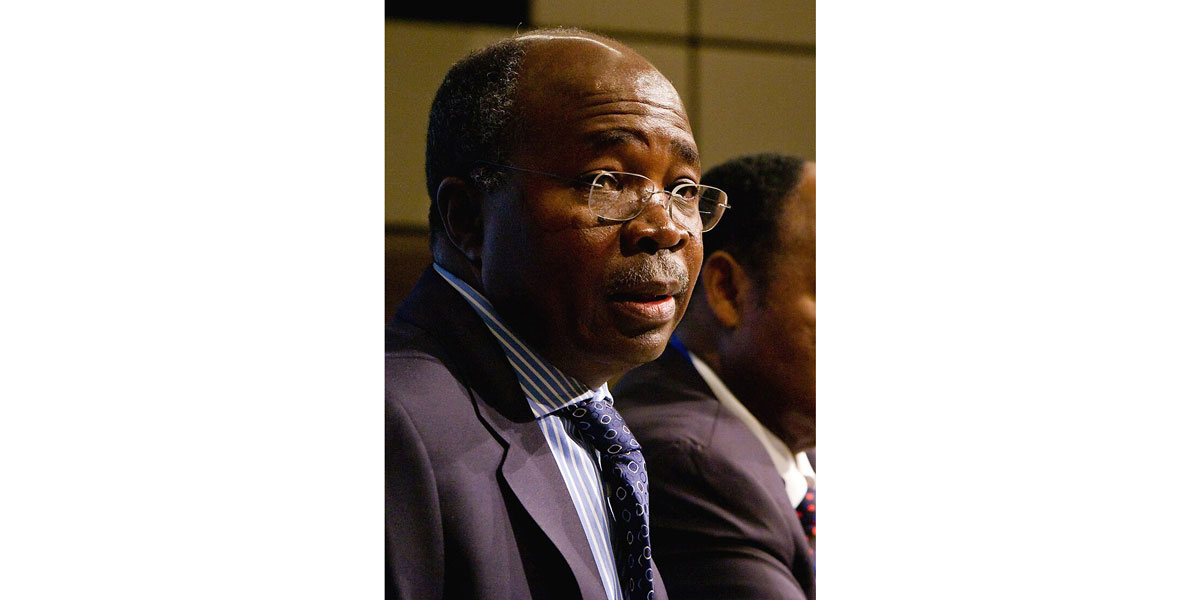

See MoreZambia presents 2025 budget, introduces limited tax measures

Zambia's Ministry of Finance and National Planning Minister Situmbeko Musokotwan presented the 2025 Budget Speech to the National Assembly on 27 September 2024. The budget focuses on revenue generation through limited tax measures without

See MoreKuwait, San Marino sign income and capital tax treaty

Kuwait's Ministry of Foreign Affairs announced that officials from Kuwait and San Marino signed an income and capital tax treaty on 27 September 2024. HE Abdullah Ali Al-Yahya, Minister of Foreign Affairs of Kuwait, met with HE Luca Beccari,

See MoreKuwait ratifies tax treaty with Iraq, amending treaty protocol with South Africa and Switzerland

Kuwait ratified income tax treaty with Iraq and amending protocol to the treaty with South Africa and Switzerland on 18 September 2024, published in Official Gazette No. 1705 on 22 September 2024. The income and capital tax treaty with Iraq was

See MoreZambia presents 2025 budget

Zambia’s Minister of Finance and National Planning, Situmbeko Musokotwane, presented the 2025 National Budget to the National Assembly on Friday, 27 September 2024. “The 2025 budget is premised on economic recovery and promoting growth to

See MoreSouth Africa updates corporate income tax return form, allows additional allowance for renewable energy production

The South African Revenue Service (SARS) has updated the corporate income tax return form (ITR14 form), allowing taxable entities to claim section 12BA allowances on 16 September 2024. The 12BA allowance offers a 125% enhanced allowance for

See MoreTurkey clarifies electronic notification rules in tax procedure law

Turkey’s Ministry of Treasury and Finance has clarified taxpayers' obligations under the Electronic Notification Process in the Tax Procedure Law (TPL), published General Communiqué No. 568 in the Official Gazette, on Wednesday, 25 September

See MoreSaudi Arabia: ZATCA sets criteria for selecting taxpayers for wave 16 of e-invoicing, compliance starts 1 April 2025

Saudi Arabia’s Zakat, Tax and Customs Authority (ZATCA) announced the criteria for selecting the targeted taxpayers in the Sixteenth Wave for implementing the "Integration Phase" of E-invoicing on 27 September 2024. ZATCA also clarified that

See MoreKuwait ratifies tax treaty with Iraq

Kuwait ratified the income and capital tax treaty with Iraq on 18 September 2024. The agreement aims to eliminate double taxation, curb tax evasion, and strengthen economic ties between the two nations. Article 1 of the agreement specifies that

See MoreMalawi to introduce VAT e-billing system in 2024

Malawi will implement a mandatory VAT e-invoicing system under its 2024/25 budget policy to combat VAT fraud and evasion, as announced by the Minister of Finance on 23 February 2024. The new system will replace existing electronic fiscal devices

See MoreTurkey, Hong Kong sign income tax treaty

Turkey's Revenue Administration announced that Turkey and Hong Kong have signed an income tax treaty on 24 September 2024. The agreement was signed by Bekir Bayrakdar, Director, Revenue Administration, on behalf of Turkey and Christopher Hui,

See MoreSingapore, Kenya sign income tax treaty

Singapore’s government announced signing a new income tax treaty (DTA) with Kenya on 24 September 2024. This new DTA replaces the previous agreement signed on 12 June 2018 which never entered into force. The agreement establishes a 10%

See MoreJapan, UAE initiates negotiations for CEPA

Japan’s Ministry of Foreign Affairs announced that it has launched negotiations with Japan for a comprehensive economic partnership agreement (CEPA) on 18 September 2024. “I hope that concluding an ambitious, balanced, and comprehensive EPA

See More