Egypt: House of Representatives approve income tax treaty with Oman

The Egyptian House of Representatives approved the ratification of the income tax treaty with Oman on 7 October 2024. Both countries apply the credit method for the elimination of double taxation. The agreement specifies that dividends,

See MoreTurkey withdraws Draft Omnibus Law on motor vehicle tax

On 15 October 2024, the Turkish government withdrew a draft Omnibus Law that had been submitted to the Grand National Assembly of Türkiye (GNAT) just four days earlier, on 11 October 2024. The proposed law aimed to amend the Motor Vehicles Tax

See MoreKuwait tightens rules on fixed asset disposal

The Kuwait Tax Authority (KTA) has announced stricter regulations regarding the disposal and destruction of fixed assets, focusing on compliance with the current Executive Rules of the Kuwait tax law. Taxpayers are now required to notify the KTA

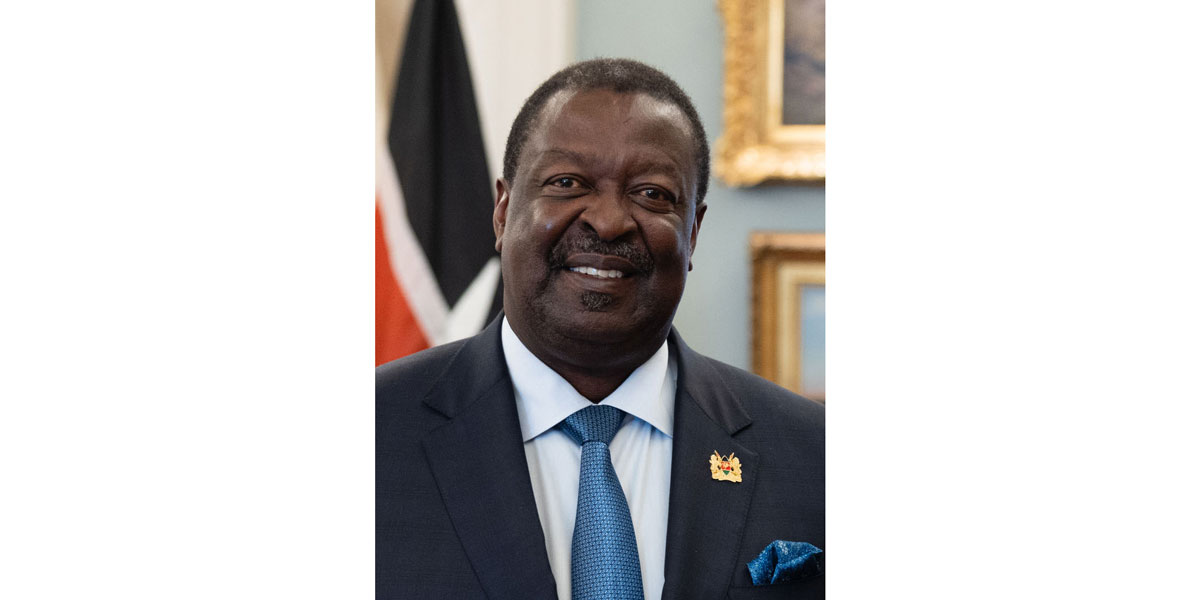

See MoreKenya: KRA to leverage AI and tech to promote tax compliance

The Kenya Revenue Authority (KRA) Commissioner General (CG) HE Dr Musalia Mudavadi plans to use artificial intelligence (AI), the Internet of things (IoT), big data, and blockchain to improve tax administration, enhance transparency, and tackle tax

See MoreSaudi Arabia introduces new real estate transaction tax regulations

Saudi Arabia has released updated regulations for its real estate transaction tax (RETT) system, published in the Official Gazette on 11 October 2024. The new rules implement a 5% tax on all real estate disposals, applying to properties without

See MoreAlgeria joins mutual assistance convention to combat tax evasion

Amel Abdellatif, Tax Commissioner of Algeria signed the Multilateral Convention on Mutual Administrative Assistance in Tax Matters (the Convention), as amended by the 2010 protocol, on 10 October 2024. The Convention must first be ratified

See MoreUAE extends corporate tax filing deadline

The UAE Federal Tax Authority (FTA) has extended the deadline for filing corporate tax returns and settling corporate tax obligations to 31 December 2024. The announcement was made in Public Clarification CTP004, clarifying the implications of FTA

See MoreTurkey clarifies application of new anti-avoidance rule

The Turkish Revenue Administration has issued Income Tax General Communiqué No. 326 in the Official Gazette, outlining application measure of Law No. 7524. The purpose of this communiqué is to introduce a general anti-avoidance rule, which

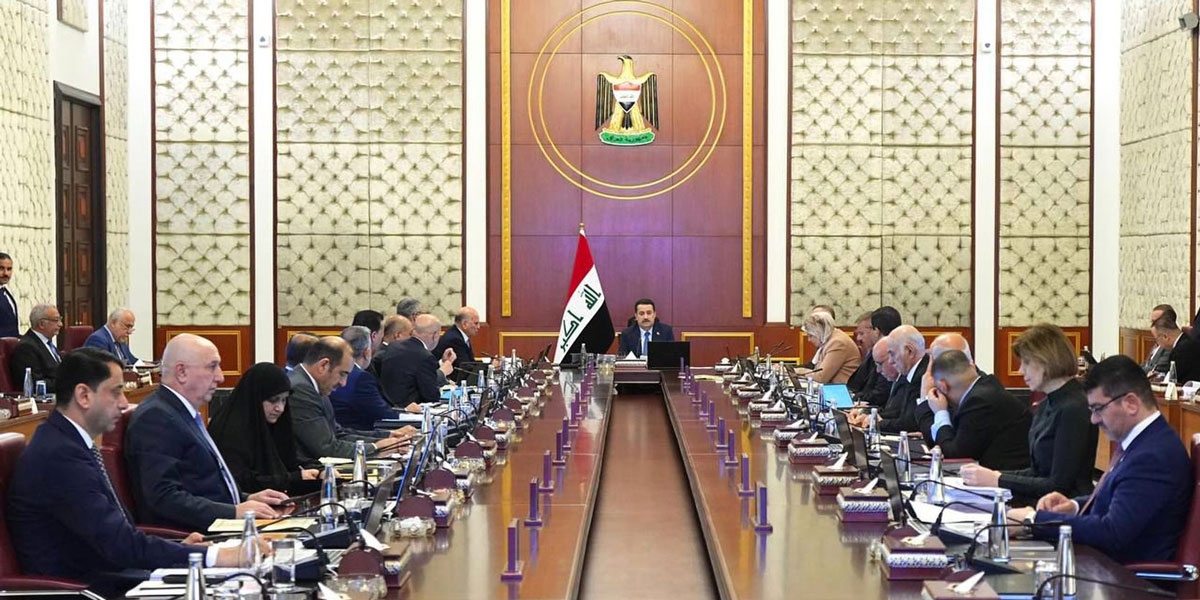

See MoreIraq: Council of Ministers terminate tax treaty negotiations with Croatia

Iraq’s Council of Ministers revoked its authorisation for tax treaty negotiations with Croatia on 1 October 2024. This decision nullifies earlier approvals granted under Decision No. 103 of 2023 and No. 23396 of 2023, which allowed the drafting

See MoreKenya consults proposed income tax treaty with Iceland

Kenya has initiated a public consultation on the proposed income tax treaty with Iceland. The announcement was made in a public notice by the National Treasury on 2 October 2024. The consultation is set to conclude on 7 November 2024. The

See MoreUS: Treasury releases list of boycott countries

The US Treasury published a notice in the Federal Register regarding the current list of countries that may necessitate participation in or cooperation with an international boycott on 1 October 2024. The countries identified include Iraq,

See MoreTurkey clarifies application and payment periods for restructuring public receivables in earthquake-affected areas

The Ministry of Treasury and Finance Turkey has issued General Communiqué No. 7 on Law No. 7440 to clarify the application and payment periods for the restructuring of public receivables in earthquake-affected areas on 4 October 2024. Law No.

See MoreSouth Africa lowers interest rate for interest-free, low-interest loans

The South African Revenue Service (SARS) has lowered the interest rate Table 3 for interest-free or low-interest loans from 9.25% to 9.00%, effective from 1 October 2024, following the Reserve Bank’s Monetary Policy Committee’s decision to

See MoreTurkey ratifies FTA with Ukraine

The President of Turkey Recep Tayyip Erdogan ratified the Free Trade Agreement (FTA) with Ukraine, published in Official Gazette No. 32682 on 4 October 2024. The FTA between the two nations was signed on 3 July 2022, in Kyiv, Ukraine. It aims to

See MoreSaudi Arabia ratifies tax treaty with Qatar

Saudi Arabia's Shura Council ratified the income tax treaty with Qatar on 2 October 2024. Previously, Qatar and Saudi Arabia signed an income tax treaty on Thursday, 30 May, 2024. The treaty, which is a first of its kind between the two Gulf

See MoreNigeria presents four tax reform bills to National Assembly

Nigeria’s President presented four bills to the National Assembly outlining measures to revise tax laws and modernise Nigeria’s tax system on 3 October 2024. The bills have been forwarded to the House Committee on Finance for review and

See MoreIreland ratifies income tax treaty with Oman

Ireland has officially released the Double Taxation Relief (Taxes on Income) (Sultanate of Oman) Order 2024, paving the way for the ratification of an income tax treaty with Oman. Previously covered, Officials from Ireland and Oman signed an

See MoreNigeria gazettes VAT modification order 2024, introduces new fiscal incentives for oil and gas sector

Nigeria’s Federal Ministry of Finance has unveiled two major fiscal incentives aimed at revitalising Nigeria's oil and gas sector on 2 October 2024. These are Value Added Tax (VAT) Modification Order 2024, which has been published in the

See More