Egypt: MoF increases transfer pricing documentation threshold

Egypt’s Ministry of Finance (MoF) has issued Minister of Finance Decision No. 534 of 2025 of 17 December 2025, revising the rules for transfer pricing (TP) documentation. Under the decision, the annual related-party transaction threshold for TP

See MoreSouth Africa: SARS to launch global minimum tax registration on efiling in March 2026

The South African Revenue Service (SARS) will roll out registration and notification functionality for the Global Minimum Tax (GMT) through its eFiling platform on 16 March 2026. This announcement was made on 19 December 2025. The move forms

See MoreKenya: KRA releases list of jurisdictions for common reporting standards

The Kenya Revenue Authority (KRA) advised in a public notice on 19 December 2025 that under Regulation 2 of the Tax Procedures (Common Reporting Standards) Regulations, 2023, and the Commissioner’s powers under the Tax Procedures Act, Cap 469B,

See MoreUAE: MoF confirms cabinet approval of reverse charge VAT for scrap metal trade

UAE’s Ministry of Finance (“MoF”) has announced on 19 December 2025 the issuance of Cabinet Decision No. 153 of 2025 regarding the application of the reverse charge mechanism on trading of metal scrap between registrants in the UAE, effective

See MoreOman ratifies income tax treaty with Iraq

Oman issued the Royal Decree No. 105/2025 on 14 December 2025 ratifying the income tax treaty with Iraq. Iraq and Oman signed the income and capital tax treaty on 3 September 2025. The agreement aims to eliminate double taxation and prevent

See MoreSouth Africa consults REIT qualification of unlisted companies

South Africa’s National Treasury and the Revenue Service (SARS), on 11 December 2025, published a draft notice outlining requirements for unlisted companies to qualify as real estate investment trusts (REITs). The rules follow the 2024 Taxation

See MoreBelarus, Jordan sign income tax treaty

Belarus and Jordan signed an income tax treaty during the Belarus-Africa Forum in Moscow on 16 December 2025. The agreement seeks to eliminate double taxation on income and prevent tax evasion between Belarus and Jordan. Before the signing,

See MoreEgypt unveils second tax facilitation package to ease procedures, boost compliance

The Egyptian Ministry of Finance announced a second tax facilitation package on 15 December 2025, aimed at simplifying tax procedures, expanding the tax base, and strengthening trust with taxpayers, investors, and the business community. The

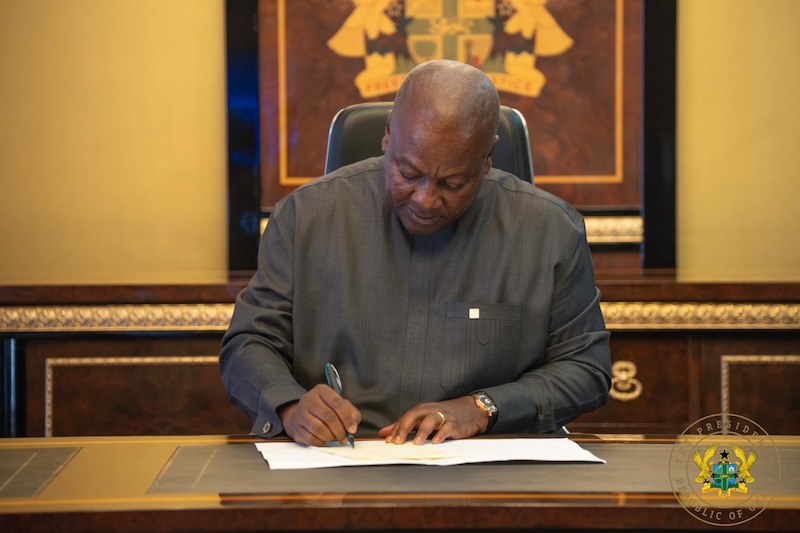

See MoreGhana abolishes COVID-19 health recovery levy

Ghana’s President John Dramani Mahama signed the COVID-19 Health Recovery Levy Repeal Act 2025 into law on 10 December 2025, ending the 1% levy on goods, services, and imports from January 2026. The repeal fulfills a key campaign promise, as

See MoreEgypt: ETA issues new rules to offset tax credits against liabilities

The Egyptian Tax Authority (ETA) issued Instruction No. 46 of 2025, on Tuesday, 2 December 2025, establishing a formal procedure for registered taxpayers to offset credit balances, including VAT credits, against their outstanding tax

See MoreZambia: ZRA opens voluntary disclosure programme to taxpayers

The Zambia Revenue Authority (ZRA) has issued a Public Notice to inform taxpayers about the availability of the Voluntary Disclosure Programme (VDP) on 12 December 2025, offering relief from penalties and interest on amounts voluntarily

See MoreSouth Africa: SARS announces trust, provisional tax filing deadline

The South African Revenue Service (SARS) has reminded trustees and provisional taxpayers that the deadline for submitting both ITR12T trust returns and provisional tax returns is 19 January 2026. This announcement was made on 15 December

See MoreItaly, Libya income tax treaty enters into force

The Italy–Libya income tax treaty of 2009 entered into force on 10 December 2025, following the exchange of ratification instruments, as confirmed by a memorandum of understanding signed in Tripoli on the same day. Signed on 10 June 2009, this

See MoreZambia: ZRA announces signing of international tax co-operation pact

Zambia's Revenue Authority (ZRA) announced that Zambia had signed the Yaoundé Declaration on International Tax Co-operation and the fight against Illicit Financial Flows (IFFs) in Africa on 4 December 2025. ZRA Commissioner General Dingani Banda

See MoreTunisia gazettes 2026 Finance Law, includes presumptive tax regime for small businesses

Tunisia has published the Finance Law for 2026 (Law No. 2025-17) in the Official Gazette on 12 December 2025, setting out a wide-ranging package of tax and fiscal measures aimed at strengthening public finances while supporting targeted sectors of

See MoreTurkey: Government revises population thresholds for simple method taxation

The Turkish government has revised exemptions under the upcoming individual income tax (IIT) real taxation regime through Presidential Decision No. 10679, published on 11 December 2025. The change updates population thresholds for settlements that

See MoreTurkey: Revenue Administration finalises Pillar 2 Global Minimum tax rules

The Turkish Revenue Administration finalised the implementation rules for the Pillar 2 Global Minimum Tax (GMT) and submitted the General Communiqué to the Presidency for signature and publication. This announcement was made on 12 December

See MoreTurkey extends withholding provisions related certain capital market earnings until 2030

Turkey’s President has extended the tax withholding rules on certain capital market earnings for another five years. The decision was made under Presidential Decree No. 10680, published in the Official Gazette on 11 December 2025 (No.

See More