Brazil, Nigeria sign trade and investment framework agreement

The trade and investment framework agreement is aimed to strengthen economic and agricultural cooperation between the two jurisdictions. Brazil and Nigeria signed a Trade and Investment Promotion Framework (TIPF) agreement on 24 June 2025

See MoreChad: Senate approves ratification of income tax treaty with UAE

Chad's upper house of Parliament (Senate) approved the law ratifying the income tax treaty with the UAE on 10 July 2025. Chad and the UAE signed their income tax treaty on 4 September 2018. It will enter into force after the exchange of

See MoreUAE: FTA offers penalty waiver for late tax registration

The FTA clarified conditions for waiving or refunding penalties for late corporate tax registration, requiring returns or declarations to be filed within seven months of the first tax period. The UAE Federal Tax Authority (FTA) has released

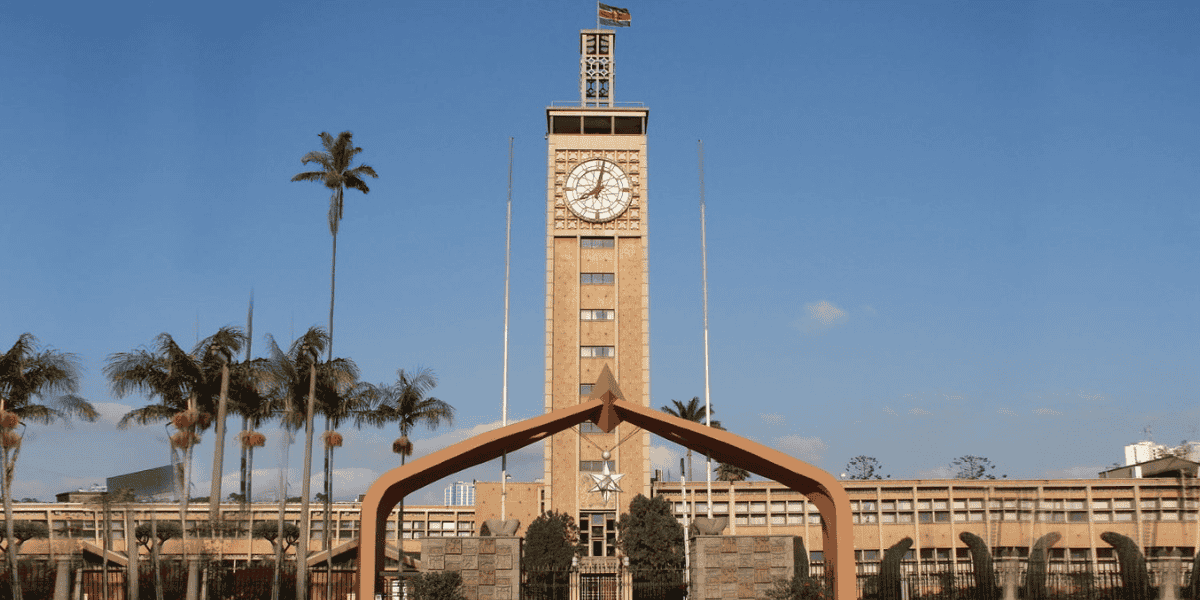

See MoreKenya repeals digital assets tax, expands economic presence tax under Finance Act 2025

The Finance Act 2025 introduces a 10% excise duty on virtual asset transaction fees, expanded SEP tax, a 5-year loss carry forward limit, AMT, and new APA guidelines. Kenya’s President William Ruto signed the Finance Act 2025 into law on 26

See MoreKenya reduces market rates for fringe benefit tax, non-resident loans

For July to December 2025, the rate has been reduced to 8% (from 9%), and the low-interest loan benefit rate has dropped to 9% (from 14%). The Kenya Revenue Authority (KRA) released a public notice on 10 July 2025 regarding updates to the market

See MoreTurkey raises withholding tax rates on lira accounts and investment funds

The Presidential Decision raises withholding tax rates on income from TRY-denominated deposit and participation accounts and mutual funds. Turkey’s Revenue Administration has announced Presidential Decision No. 10041 on 8 July 2025, which

See MoreTurkey consults on draft rules for payment systems

The draft communiqué is aimed at regulating physical and virtual payment systems to strengthen tax compliance. The Turkish Revenue Administration has issued a draft General Communiqué on the Tax Procedure Law (TPL) to regulate the use of

See MoreUganda enacts 2025–26 budget measures

The changes took effect on 1 July 2025. Ugandan President Yoweri Museveni signed several tax amendment bills into law to implement the tax measures of the 2025-2026 Budget on 30 June 2025. The newly signed laws include the Value Added Tax

See MoreTanzania enacts 2025-26 budget measures, includes new transfer pricing penalty

The measures will apply from 1 July 2025, unless otherwise specified. Tanzania's Finance Act 2025 was enacted on 30 June 2025, implementing tax measures from the 2025-26 Budget Speech with some adjustments to the initially announced

See MoreKuwait ratifies income tax treaty with Saudi Arabia

Kuwait ratifies first income tax treaty with Saudi Arabia via Decree-Law No. 80 of 2025. Kuwait issued Decree-Law No. 80 of 2025 in its Official Gazette on 6 July 2025 ratifying the tax treaty with Kuwait. The agreement applies to Kuwaiti

See MoreBelgium revises CRS list, adds Armenia and Uganda

The updated CRS exchange list for 2024 now includes Armenia and Uganda. Belgium’s government has published the Royal Decree of 2 July 2025 in Official Gazette No. 2025004947 of 8 July 2025. The Royal Decree updates the list of jurisdictions

See MoreNigeria, Netherlands to amend income tax treaty

Both countries have agreed to either negotiate a new treaty or amend the existing treaty. Officials from Nigeria and the Netherlands met on 7 July 2025 to discuss revising the 1991 income and capital tax treaty between the two nations,

See MoreKuwait: Council of Ministers approves income tax treaty with Saudi Arabia

Kuwait’s Council of Ministers approved the 2025 income tax treaty with Saudi Arabia Kuwait's Council of Ministers issued Decree-Law No. 80 of 2025 on 29 June 2025, formally approving the income tax treaty with Saudi Arabia. The treaty was

See MoreRussia: Federation Council ratifies new income and capital tax treaty with UAE

Russia’s Federation Council ratifies law for new income and capital tax treaty with UAE, replacing 2011 agreement. The Russian Federation Council approved the law ratifying the income and capital tax treaty with the UAE on 2 July 2025. The

See MoreChad approves ratification of income tax treaty with UAE

Chad approves ratification of its first income tax treaty with the UAE. Chad’s lower house of Parliament (National Assembly) passed legislation authorising the President to ratify the income tax treaty with the UAE on 24 June 2025. Chad and

See MoreEgypt amends VAT law to broaden tax base and target key sectors

The amended VAT law focuses on expanding the tax base, addressing sectoral imbalances, and improving fiscal sustainability, while maintaining the current VAT rate. Egypt’s House of Representatives approved a series of amendments to VAT Law

See MoreHong Kong, Morocco end first round of tax treaty talks

Negotiations for the tax treaty began on 23 June 2025 and ended on 27 June 2025. Hong Kong and Morocco concluded the first round of negotiations of their first-ever income tax treaty on 27 May 2025. Negotiations for the tax treaty began on 23

See MoreSaudi Arabia: ZATCA sets criteria for 23rd wave of e-invoicing integration

ZATCA will require businesses with VAT revenues over SAR 750,000 from 2022–2024 to join the 23rd e-invoicing integration phase starting 27 June 2025. The Saudi Zakat, Tax and Customs Authority (ZATCA) has announced the criteria for selecting

See More