Turkey caps tax incentives, R&D exemptions under new law

Turkey’s Law No. 7555 limits corporate income tax incentives to 10 years and caps R&D income tax exemptions starting July 2025. Turkey enacted Law No. 7555 introducing new limits on corporate tax incentives and income tax exemptions. The

See MoreAngola: Financial sector to face higher corporate tax from 2026

Angola's new Corporate Income Tax Code, effective 1 January 2026, includes 35% for financial institutions, insurance, and telecoms, 25% for most sectors, and 10% for agriculture. Angola will introduce a new Corporate Income Tax (IRPC) Code,

See MoreMalawi lowers tax for select non-resident companies

The Malawi government has abolished the 5% repatriation tax for non-resident companies, increased withholding tax on gambling winnings to 10%, and exempted bread from the 16.5% VAT. Malawi has implemented new tax laws through the Taxation

See MoreZambia advances 2025 tax reform, proposes 1% minimum alternative tax for businesses

Key proposals include a 1% MAT on turnover, 15% to 20% withholding tax on government securities, and excise duty hikes on cigarettes, alcohol, sugary drinks, and betting services. Zambia's National Assembly has advanced the Income Tax

See MoreRwanda: Government approves tax treaty with Nigeria

The agreement will enter into force after the exchange of ratification instruments. The government of Rwanda approved the ratification of the income tax treaty with Nigeria on 16 July 2025. Earlier, on 27 June 2025, Nigeria’s Federal

See MoreCzech Republic, Iraq to negotiate for tax treaty

The first round of negotiations will be held from 21 - 24 July 2025. Officials from the Czech Republic and Iraq will hold the first round of negotiations for a new income tax treaty from 21 - 24 July 2025. The treaty aims to prevent double

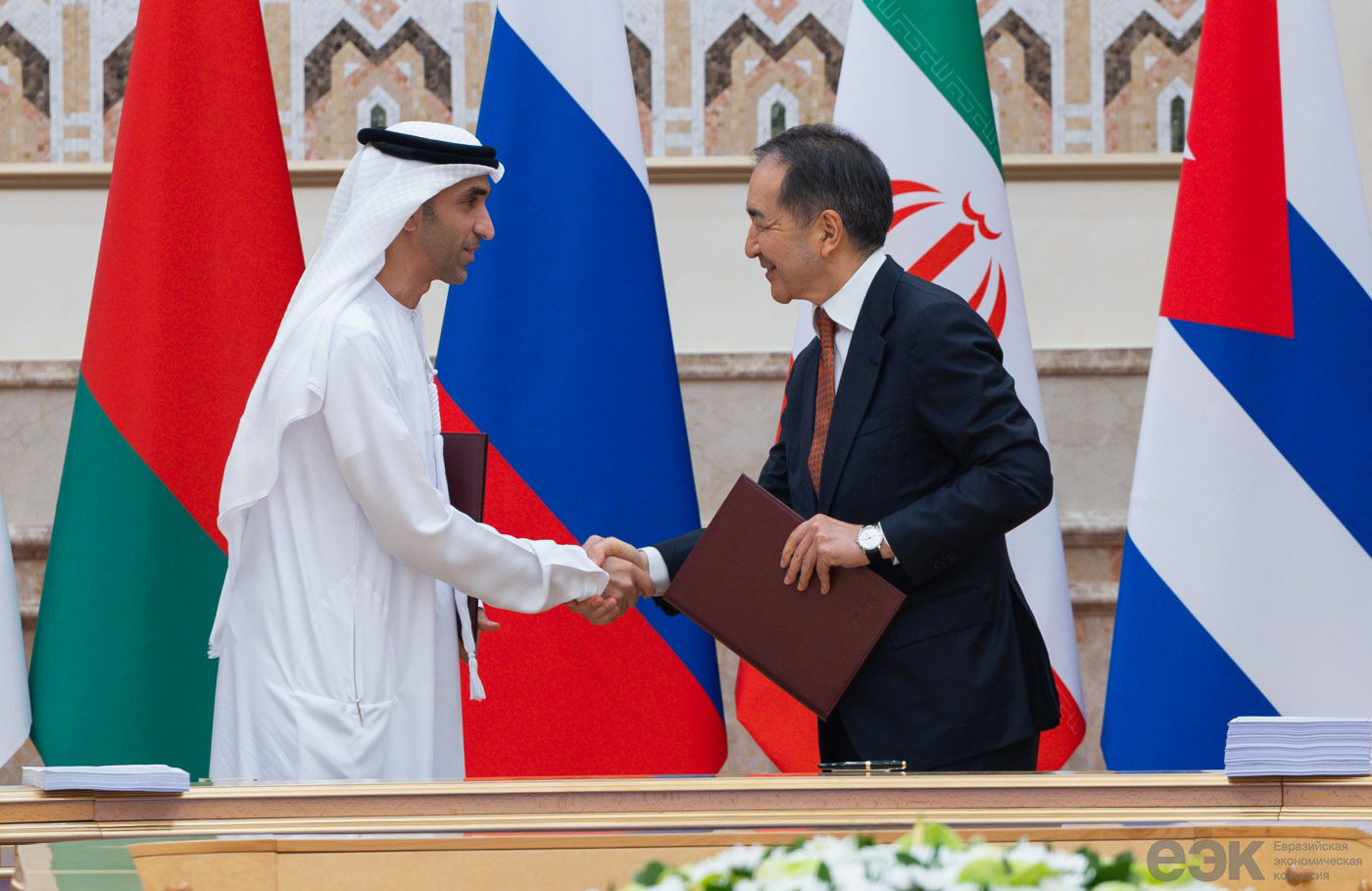

See MoreBelarus, UAE sign free trade in services and investments agreement

The agreement complements the EPA between the Eurasian Economic Union and the UAE, signed on the same day. Belarus and the UAE formalised an agreement in Minsk focusing on free trade in services and investments on 27 June 2025. This agreement

See MoreBotswana to roll out mandatory e-invoicing for VAT in 2025

The new Electronic VAT Invoicing Solution will operate under a Continuous Transaction Control (CTC) model, requiring all VAT-registered taxpayers to issue invoices through a centralised system. The Botswanan government has confirmed the

See MoreKuwait launches online registration service for multinational entities subject to DMTT

Kuwait’s Ministry of Finance has launched an online registration service for companies subject to the 15% Domestic Minimum Top-up Tax under Law No. (157) of 2024, effective from 1 January 2025. Kuwait’s Ministry of Finance has launched a new

See MoreZambia announces broad tax reforms in 2025 budget

Zambia’s 2025 Budget introduces wide-ranging tax reforms across income, turnover, VAT, property transfer, and excise duties to boost revenue and compliance. Zambia has introduced a range of tax changes in its 2025 Budget, affecting income tax,

See MoreNigeria enacts law renaming FIRS to National Revenue Service (NRS)

The law aims to enhance tax compliance, increase revenue, and streamline administration to eliminate inefficiencies. Nigeria’s President Bola Tinubu signed the Nigeria Revenue Service (Establishment) Act, 2025 on 17 July 2025, which rebrands

See MoreFrance, Uganda begin negotiations on income tax treaty

French and Ugandan officials started negotiations in June 2025 for their first bilateral income tax treaty to prevent double taxation. French and Ugandan officials held the first round of negotiations for an income tax treaty in Kampala, Uganda,

See MoreUAE clarifies VAT requirements on SWIFT charges for financial institutions

The Public Clarification outlines the VAT obligations and input tax documentation requirements for financial institutions incurring SWIFT-related interbank charges. The UAE Federal Tax Authority (FTA) issued Public Clarification VATP041 on 28

See MoreKenya, Cyprus negotiating income tax treaty

An income treaty from these negotiations will be the first between Kenya and Cyprus. Kenya’s Ministry of Foreign Affairs announced that officials from Kenya and Cyprus convened on 7 July 2025 to discuss strengthening bilateral relations,

See MoreTurkey extends tax payment deadlines in earthquake-hit regions

Turkey delays tax debt repayments for earthquake-affected taxpayers until after November 2025. Turkey's Revenue Administration announced the enactment of Presidential Decision No. 10700 on 14 July 2025, extending the payment periods for

See MoreBelarus, Zimbabwe tax treaty enters into force

The treaty applies from 1 January 2026. The Belarus Ministry of Taxes and Duties announced that the income and capital tax treaty between Belarus and Zimbabwe came into effect on 2 July 2025. Signed on 31 January 2023, this is the first tax

See MoreTurkey issues updated 2025 tax guide on passenger vehicles

The guidance updates the tax rules for business-use passenger vehicles and sets limits on deductible expenses and depreciation for the 2025 fiscal year. Turkey’s Revenue Administration has published an updated guide on the tax treatment of

See MoreNigeria: FIRS enacts e-invoicing system for large taxpayers

Businesses with an annual turnover of NGN 5 billion or more are required to register for e-invoicing, effective August '25. Nigeria’s Federal Inland Revenue Service (FIRS) announced the launch of a national electronic invoicing (e-invoicing)

See More