South Africa: SARS extends deadlines for global minimum tax filings

Regfollower Desk The South African Revenue Service (SARS) has extended several initial compliance deadlines under the Global Minimum Tax (GloBE) requirements. The announcement was made in Government Notice No. 6763, published in the Government

See MoreTurkey: Grand National Assembly to review draft omnibus bill with wide tax, social security changes

The bill proposes major amendments to income tax, social security, fees, and sector-specific regulations. Regfollower Desk Turkey presented a draft omnibus bill on 17 October 2025 to the Grand National Assembly, containing several proposed

See MoreTurkey revises special consumption tax for mobile phones

Turkey raised mobile phone SCT thresholds to cut prices for devices up to TRY 9,000. Regfollower Desk Turkey has revised the special consumption tax (SCT) base thresholds for mobile phones under Presidential Decision No. 10521, published in

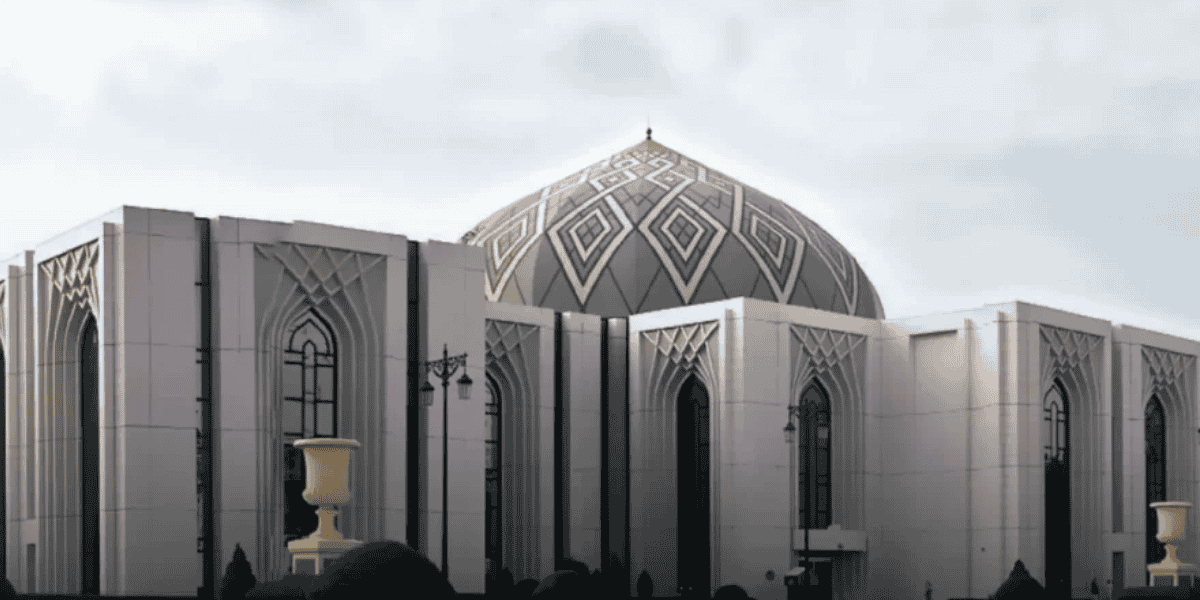

See MoreEstonia: Parliament approves tax treaty with Oman

Parliament ratified the 2024 income tax treaty with Oman to prevent double taxation and fiscal evasion. The Estonian Parliament approved the Estonia - Oman Income Tax Treaty (2024), by way of Bill No. 692 SE on 23 October 2025. Signed on 27

See MoreNew tax treaty between India, Qatar enters into force

The treaty became effective upon the exchange of ratification instruments and superseded the 1999 tax treaty between the two countries. India issued Notification No. 154/2025/F on 24 October 2025, signaling that the updated income tax treaty

See MoreFATF removes South Africa from grey list

Revenue Service welcomed FATF’s decision to delist the country, marking progress in combating financial crime and strengthening the financial system. The South African Revenue Service (SARS) welcomed the decision by the Financial Action Task

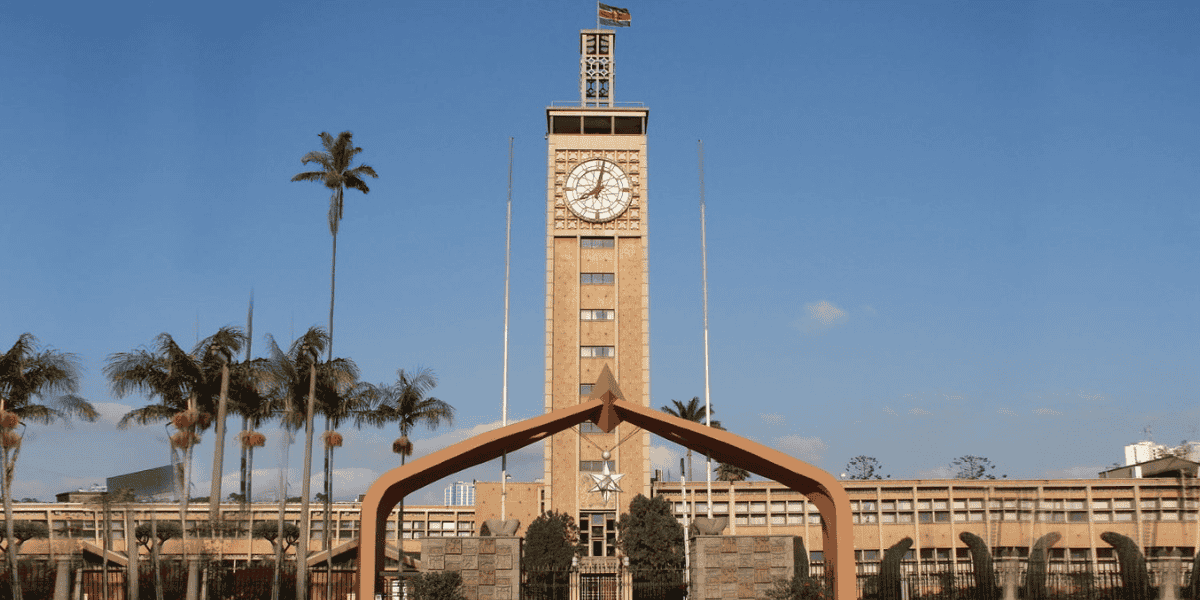

See MoreKenya: KRA announces tax compliance certificate (TCC) enhancements

To obtain a TCC, taxpayers must be registered in eTIMS/TIMS, file and pay all taxes on time, settle outstanding liabilities or have an approved payment plan, and maintain VAT compliance. The Kenya Revenue Authority (KRA) issued a public notice on

See MoreIsrael: MoF issues draft law to implement global Pillar 2 rules

This draft legislation outlines the framework for establishing a local minimum tax on multinational corporations, ensuring alignment with international agreements to implement a global minimum tax. Israel’s Ministry of Finance has taken a

See MoreZambia: ZRA introduces 10% excise duty on gaming, betting

Revenue Authority introduced a 10% excise duty on gaming and betting, effective from September 2025, with payments due by the 15th of the following month. The Zambia Revenue Authority (ZRA) has confirmed the introduction of a 10% excise duty on

See MoreUAE: MoF publishes list of recognised commodity reporting agencies

MoF listed 13 approved agencies for trading qualifying commodities. The UAE Ministry of Finance (MoF) published Ministerial Decision No. 230 of 2025 on 22 October 2025, listing the recognised reporting agencies for trading qualifying

See MoreTurkey: Revenue Administration sets 2025 third-period revaluation rate

The third provisional tax period of 2025 in accordance with paragraph (B) of Article 298-bis of the Tax Procedure Law No. 213. The Turkish Revenue Administration issued Corporate Tax Law Circular No. 5520/70 on 16 October 2025, announcing the

See MoreEgypt drops special register requirement for tax accountants

Egypt cancels special register rule for tax accountants to ease procedures. The Egyptian Ministry of Finance cancelled Ministerial Decision No. 481 of 2023 on 19 October 2025, which mandated accountants to be included in a special register to

See MoreIsrael opens consultation on draft Law for local minimum tax aligned with OECD Pillar Two

Ministry of Finance invites public comments on a draft law introducing a local minimum tax for multinationals under the OECD’s Pillar Two framework. The Israeli Ministry of Finance has opened a public consultation on draft legislation to

See MoreIsrael, India sign bilateral investment agreement

This is India's first-ever investment agreement with Israel. Israel and India have signed a new bilateral investment agreement aimed at bolstering economic ties and encouraging mutual investments. The agreement, signed in New Delhi by Israel's

See MoreSaudi Arabia: ZATCA urges businesses to file Q3 VAT returns

ZATCA urged Saudi businesses to file Q3 VAT returns on time. The Saudi Arabian Zakat, Tax and Customs Authority (ZATCA) has urged businesses subject to Value Added Tax (VAT), with annual goods and services revenues exceeding SAR 40 million, to

See MoreKenya: KRA announces fringe benefit, deemed interest rates for Q4 2025

The Kenya Revenue Authority has announced the applicable market and deemed interest rates for the final quarter of 2025, outlining the corresponding withholding tax obligations for employers under the Income Tax Act. The Kenya Revenue Authority

See MoreMorocco: Government presents 2026 Finance Bill to the parliament

The 2026 Finance Bill introduces broad tax reforms, including expanded corporate and personal income tax withholding, new VAT exemptions for specific goods and investments, the launch of a petroleum product marking system, and the introduction of a

See MoreZambia extends relief on copper concentrate exports

Zambia extended 10% copper export tax relief to deadline to address the growing stockpile of unprocessed copper concentrates resulting from disruptions at local smelters. Zambia has extended the suspension of its 10% export tax on copper

See More