The law introduces significant tax reforms, including increased VAT rates, a new reduced VAT rate, higher turnover tax for banks, and an increased dividend tax rate.

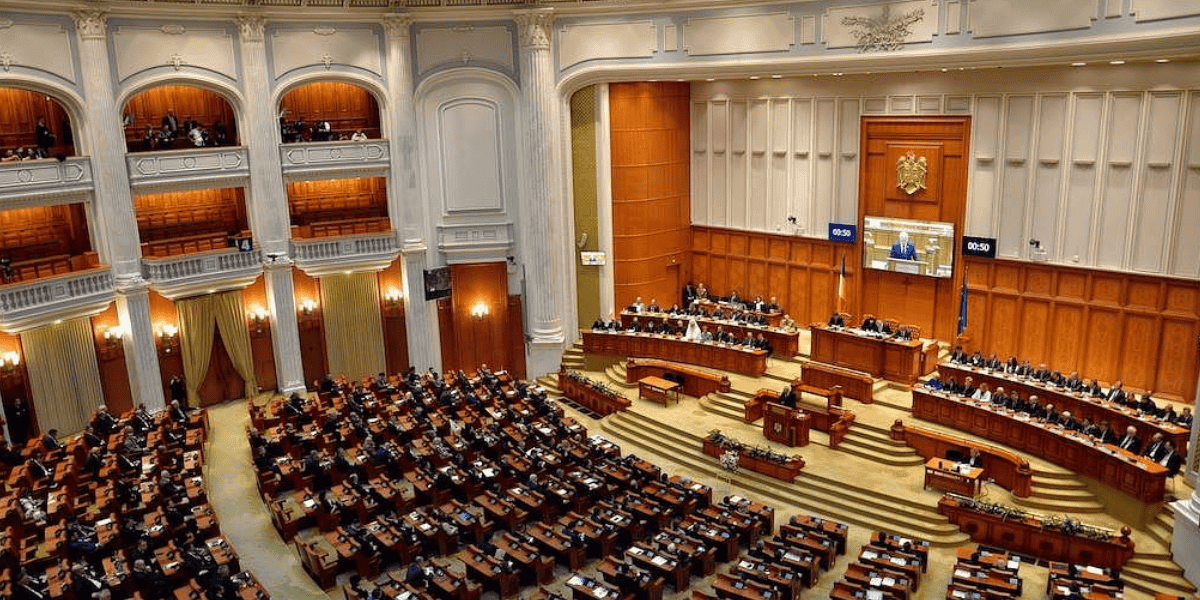

Romania’s parliament has passed the Law on certain fiscal-budget measures on 14 July 2025, after it was rejected following a no-confidence motion. The draft was initially submitted by the government on 4 July 2025.

The law was sent to the President for promulgation on 16 July 2025.

This follows the government’s submission of an amended draft proposal, which includes changes to the VAT provisions of the Fiscal Code (Law 227/2015).

The main measures concern VAT, bank turnover tax, and dividend tax, such as:

Standard VAT rate

- Increasing the standard VAT rate from 19% to 21%.

Reduced VAT rate

A new reduced VAT rate of 11%, replacing the previous 5% and 9% rates. The new reduced VAT rates apply to a limited scope of supplies, including:

- Medicines for human use.

- Foodstuffs (excluding alcoholic beverages, certain sugary/non-alcoholic beverages, and dietary supplements).

- Water and sewerage services, agricultural irrigation water.

- Agricultural inputs (fertilisers, pesticides, seeds, and services), with chemical fertilisers/pesticides included until 31 December 2031.

- Educational materials (textbooks, books, newspapers, magazines), excluding those with video/audio content or primarily for advertising.

- Access to cultural and historical sites (e.g., castles, museums, zoos).

- Firewood and wood-based heating materials for individuals and entities (until 31 December 2029).

- Thermal energy during the cold season (1 November–31 March) for specific groups (e.g., households, hospitals, schools, NGOs).

- Social housing includes retirement homes, foster homes, and rehabilitation centres.

- Hotel accommodations and restaurant/catering services (excluding alcoholic beverages and certain non-alcoholic beverages).

Repeal of VAT exemptions

Zero-rate VAT for goods/services provided to non-profits and their wholly owned companies is repealed. This rate takes effect on 1 August 2025.

Transitional provisions

The 9% VAT rate remains for certain housing (e.g., subsidised rental housing, housing up to 120 square metres and valued up to RON 600,000) until the transition period ends. This rate takes effect on 1 August 2025.

Turnover tax on banks

The additional turnover tax for Romanian banks and foreign bank branches will increase from 2% to 4% (effective 1 July 2025 to 31 December 2026). However, smaller banks with a market share below 0.2% of total net assets will continue to pay a 2% rate.

Dividend tax

The tax rate on dividends will increase from 10% to 16%, effective 1 January 2026, applying to both residents and non-residents.