The Double Taxation Agreement will be entered into force on February 6, 2018, between Qatar and Spain for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income. It will be applicable from January 1, 2019.

Belgian Parliament enacts corporate tax reform

Related Posts

Spain repeals Royal Decree-Law 2/2026 covering social measures, tax reforms, regional financing

Spain’s Congress of Deputies has officially repealed Royal Decree-Law 2/2026, originally issued on 3 February 2026. The repeal was formalised in a Congressional Resolution dated 26 February 2026 and published in the Official State Gazette (BOE) on

Read More

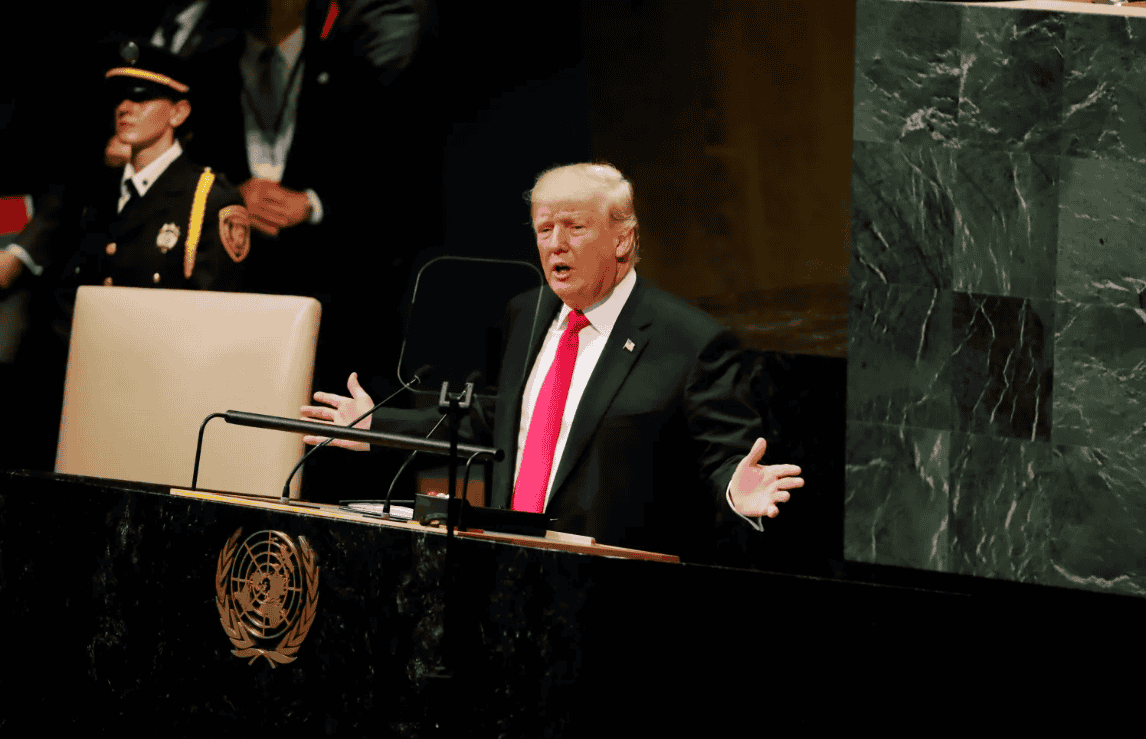

US: Trump threatens full trade embargo on Spain over Iran strikes

US President Donald Trump threatened to impose a full trade embargo on Spain on 3 March 2026. This escalation follows Spain's refusal to allow the US military to use shared bases for strikes on Iran. At a White House briefing, Trump described

Read More

Spain: Barcelona raises tourist tax to ease housing pressure

Spain’s Barcelona has increased its tourism levy, making it one of the highest in Europe, as authorities aim to curb visitor numbers and support affordable housing. From April, hotel guests will pay between EUR 10–15 per night, up from EUR 5

Read More

Qatar: GTA warns against fraudulent messages impersonating the authority

Qatar’s tax authority, the General Tax Authority (GTA), in a press release on 25 February 2026, has warned of fraudulent messages on 25 identified as being circulated via email and text messages, impersonating the Authority and containing

Read More

Qatar: GTA introduces global, domestic minimum tax framework

Qatar’s General Tax Authority (GTA) announced that it has implemented global and domestic minimum tax rules aligned with international standards through Cabinet Resolution No. (2) of 2026, published in the Official Gazette on 12 February

Read More

Spain extends select depreciation incentives, higher simplified VAT threshold through 2026

Spain issued Royal Decree-Law 2/2026 on 3 February 2026, reintroducing several measures that had been extended under the now-repealed Royal Decree-Law 16/2025 of 23 December 2025. Housing and eviction protections Eviction Suspension:

Read More