In October 2021, over 135 jurisdictions joined OECD’s two-pillar solution to reform the international taxation rules and ensure that multinational enterprises pay a fair share of tax wherever they operate and generate profits.

The global minimum tax, together with the Subject to Tax Rule (STTR) constitute the second pillar of the Two-Pillar Solution for addressing the tax challenges arising from the globalization and digitalization of the economy. The STTR is a treaty-based rule that allows source jurisdictions to “tax back” where certain defined categories of cross-border intra-group covered income are subject to nominal corporate income tax rates below 9%. The global minimum tax, is based on the Global Anti-Base Erosion (GloBE) Model Rules that a jurisdiction can introduce to impose a top-up tax on the low-taxed income of in-scope taxpayers up to 15%.

The GloBE rules introduced in domestic law are designed to work together with those of other jurisdictions to create a coordinated and comprehensive system of minimum taxation that ensures large multinational enterprise (MNE) groups pay a minimum level of tax on their income in respect of every jurisdiction where they operate. These rules require in-scope Groups to calculate their income, and the taxes on that income, on a jurisdictional basis. Where this calculation results in an effective tax rate (ETR) that is below 15%, the rules require the MNE Group to pay a top-up tax that will bring the total amount of tax on the MNE Group’s excess profits in that low-tax jurisdiction up to the 15% rate.

This top-up tax is either collected by the low-tax jurisdiction itself, under a so called Qualified Domestic Minimum Top-up Tax (QDMTT), or, where no QDMTT applies, by another implementing jurisdiction through the imposition of either an Income Inclusion Rule (IIR) which imposes top-up tax on a parent entity in respect of the low-taxed income of a constituent entity; or, a UTPR which denies deductions or requires an equivalent adjustment in a subsidiary jurisdiction in order to produce an equivalent incremental increase on the taxes paid by the MNE Group.

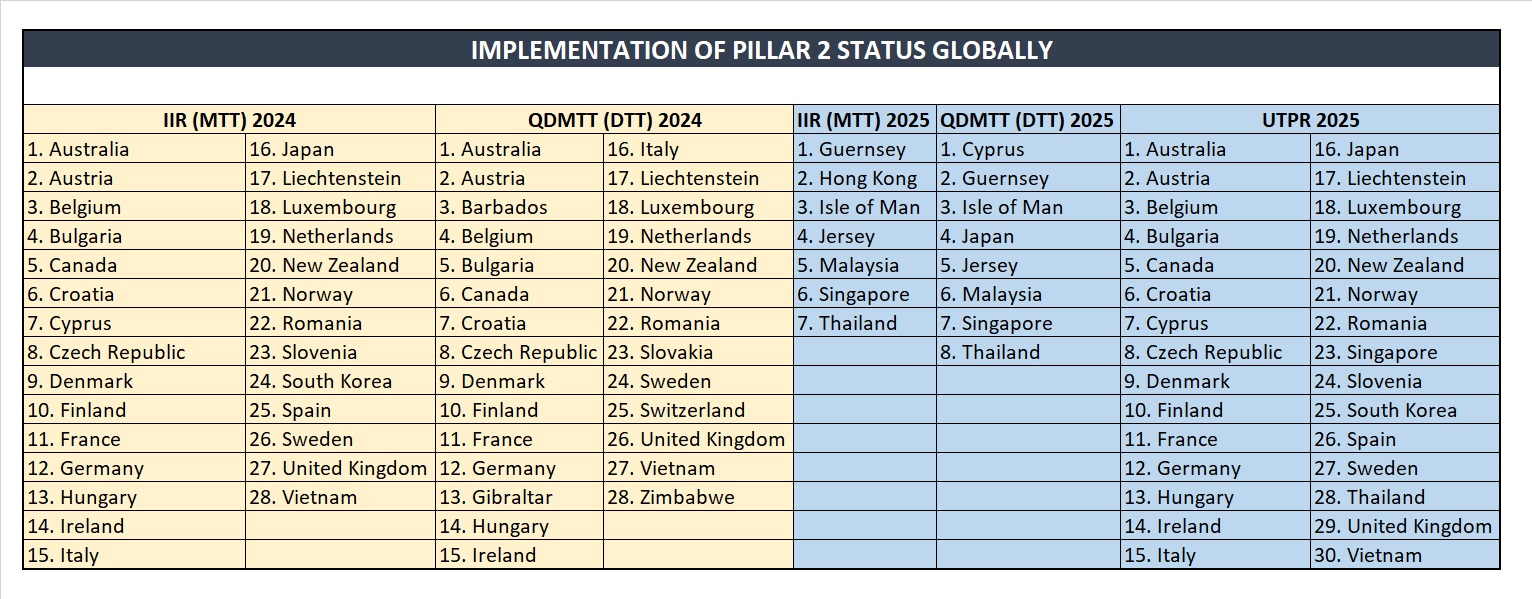

Here is a summary of the latest Global minimum tax implementation status of key jurisdictions below: