The Council of Ministers approved transfer pricing regulations on September 12, 2017 that present the methods for the assessment of the transfer pricing transactions between related entities. It allows amendments to the taxable profit by the tax authorities and corrections in documentation requirements. The regulations are expected to be entered into force during January 2018.

Related Posts

Mozambique enacts 2026 tax reforms, introduces VAT on digital services

Mozambique's President signed into law and ordered the official publication of the Economic and Social Plan and State Budget (PESOE) for 2026, along with a package of tax reform legislation on 29 December 2025. Effective from 1 January 2026, the

Read More

Mozambique: Government adopts amendments to VAT law

Mozambique’s government adopted a draft Value Added Tax (VAT) law during the 41st Session of the Council of Ministers on 2 December 2025. The VAT law is designed to modernise and streamline the electronic submission of invoices and similar

Read More

Mozambique restores VAT exemption on soap, sugar, and oil

The VAT exemption will be effective from 30 May 2025 to 31 December 2025. Mozambique has published Law No. 3/2025 in the Official Gazette on 21 May 2025, amending the VAT Code to reintroduce a VAT exemption for soap, sugar, and cooking

Read More

Mozambique updates procedures for monthly VAT invoice reporting

Mozambique’s tax authority (MTA) announced on 27 March 2025 that VAT taxpayers must submit a certified monthly invoice data file via its electronic declaration website, starting May 2025. The VAT invoice file must include party details,

Read More

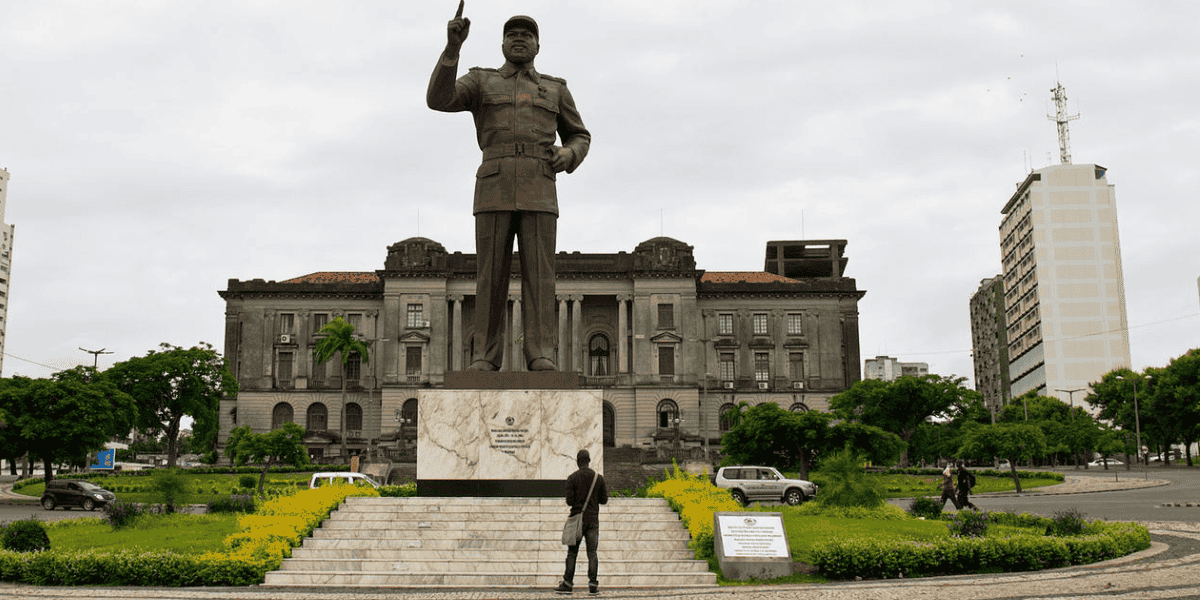

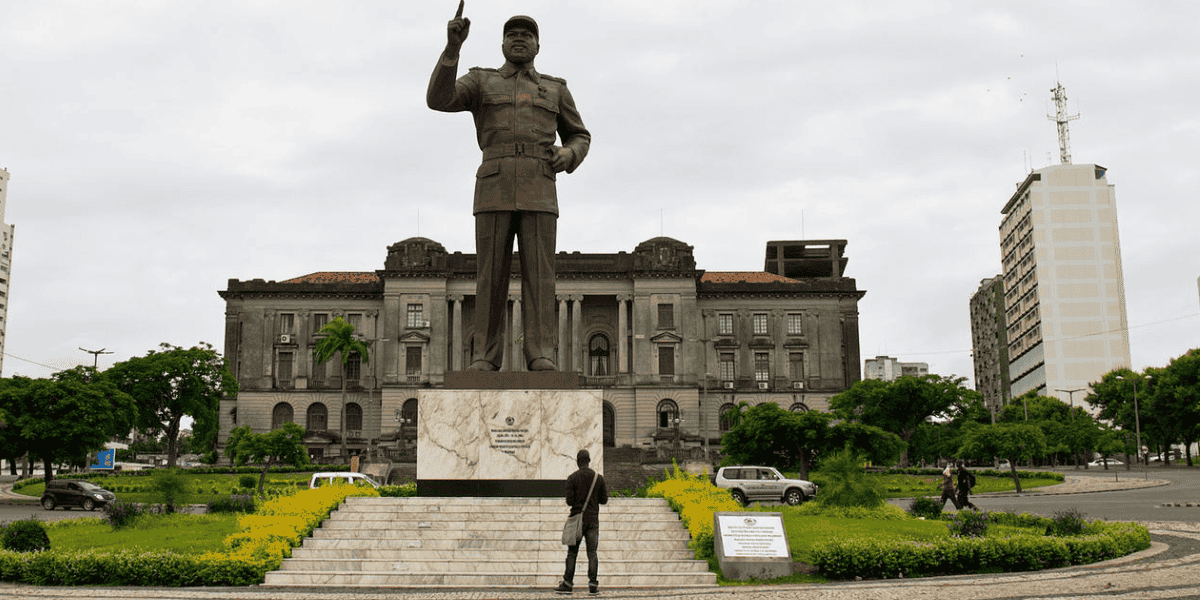

Mozambique: President announces new tax proposals in inauguration speech

Mozambique's new president, Daniel Chapo, announced new tax measures, including renegotiating deals with foreign investors, in his inauguration speech on 15 January 2025. The measures aim to eliminate poverty and improve the country's business

Read More

IMF Working Paper: Is Tax Policy Supporting a Costly Industrial Policy in Mozambique

An IMF working paper written by Santos Bila, Utkarsh Kumar and Alexis Meyer-Cirkel with the title Is Tax Policy Costly Industrial Policy in Mozambique? Finds that tax advantages do not compensate for shortcomings in economic conditions. The

Read More