Mozambique's 2026 tax reforms introduce a comprehensive digital economy VAT framework, stricter refund requirements, and revised simplified tax thresholds for small businesses. The legislation, signed on 29 December 2025, also extends consumption taxes, establishes special VAT treatment for mining and petroleum sectors, and updates customs tariffs under the African Continental Free Trade Area agreement.

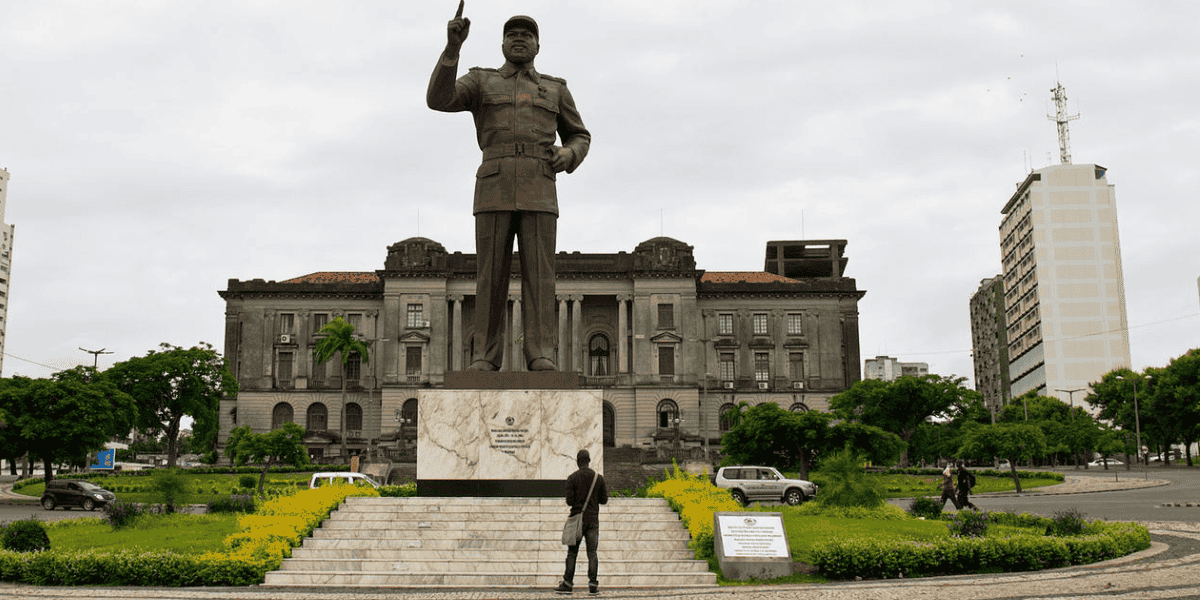

Mozambique’s President signed into law and ordered the official publication of the Economic and Social Plan and State Budget (PESOE) for 2026, along with a package of tax reform legislation on 29 December 2025.

Effective from 1 January 2026, the reforms significantly reshape the corporate tax, VAT, and customs landscape, tightening permanent establishment rules, expanding the taxation of the digital economy, overhauling simplified regimes for small taxpayers, and introducing stricter VAT refund and compliance requirements, alongside targeted measures for the mining, petroleum, and foreign trade sectors, including updates aligned with the African Continental Free Trade Area framework.

Permanent establishment threshold

Permanent establishment thresholds have been lowered significantly. Construction activities now trigger PE status after 90 days (down from 6 months), while consultancy and professional services create PE obligations after 90 days within any 12-month period.

Capital gains

Capital gains face a new ring-fenced flat rate of 32%, taxed separately from regular business income. A 10% withholding tax applies to digital goods/services income and electronic money agent commissions. All simplified corporate tax regimes are eliminated, requiring organised accounting for all businesses.

Digital economy VAT framework

Mozambique now taxes digital services, including software, cloud computing, streaming platforms, and digital financial services at the standard 16% rate. Non-resident providers must have Mozambican purchasers handle VAT through self-assessment. All entities that acquire digital services from abroad must review their compliance procedures and submit monthly declarations by the 10th of each month. Electronic invoice submission to tax authorities becomes mandatory.

Input VAT deduction

Input VAT deduction rights face new restrictions—taxpayers using reduced tax bases can only claim proportional deductions, while those benefiting from the 5% reduced rate cannot claim deductions at all. The tax authority now has 150 days (up from 30 days) to process refund requests, though the 12-month submission deadline has been removed. Both simplified VAT and exemption regimes are abolished.

Stricter VAT refund requirements

The VAT refund system now demands comprehensive documentation, including customer statements, monthly balance sheets, and signed contracts. The tax authority may suspend the statutory refund period if additional verification is required. In such cases, a formal notice must be issued explaining the reasons for suspension, identifying the legal basis, specifying the additional information required, and granting the taxpayer 30 days to regularise the situation.

Simplified tax overhaul for small taxpayers (ISPC)

The annual turnover limit increases to 4,000,000 MT with tiered rates based on activity type. Commercial and industrial activities face progressive rates of 3% on turnover up to MZN 1,000,000, 4% on turnover between MZN 1,000,001 and MZN 2,500,000, and 5% on turnover from MZN 2,500,001 MT to MZN 4,000,000.

Technical services are taxed at a flat rate of 12%, while professional services are taxed at a 15% rate. Any amounts exceeding the maximum threshold are subject to a 20% tax rate.

Freelance professionals face a maximum 5-year participation period.

Under the regime, taxpayers are required to issue invoices or equivalent documents, submit periodic information to the Tax Administration, and make quarterly tax payments. Even where the payable amount is less than 500 MT and no payment is due, reporting obligations remain in force.

Specific consumption tax (ICE)

The application of ICE rates has been extended until 2027. The tax continues to apply to products such as alcoholic and non-alcoholic beverages, tobacco, fuels, and related derivatives. Revenue collected from ICE is allocated to priority sectors, including health, infrastructure, energy, transport, housing, culture, and sport.

Special regime for the mining and petroleum sector

A special VAT refund mechanism has been introduced for the mining and petroleum sectors, covering research, prospecting, development, and production phases. Tacit approval applies where no express decision is issued within 90 days, a period that will be reduced to 60 days from 2028.

Eligibility depends on a minimum investment of USD 25 million during research or development phases, or exports exceeding 60% of turnover during the production phase. Prior registration with the Tax Administration is mandatory, valid for 12 months, and renewable annually.

Customs and foreign trade

The package introduces new tariff codes, updates the tariff dismantling schedule under the African Continental Free Trade Area (AfCFTA) framework, and strengthens protective measures for the domestic industry. Businesses must reassess import classifications, costs, and supply strategies.

Businesses should assess their tax positioning, update internal procedures, and ensure compliance with new digital service obligations to avoid penalties.