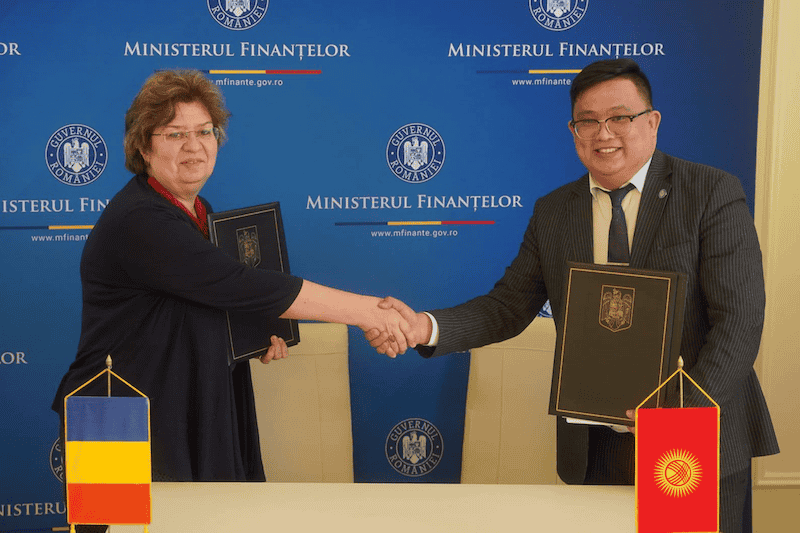

The Government of the Hong Kong Special Administrative Region signed an agreement on the avoidance of double taxation with Romania on November 18, 2015.

Under the agreement, Romania’s withholding tax rate on royalties, currently at 16 per cent, will be capped at 3 per cent. Romania’s dividend withholding tax on Hong Kong residents will be reduced from the current rate of 16 per cent to 3 per cent or 5 per cent, depending on the percentage of their shareholdings. Romania’s interest withholding tax rate on Hong Kong residents, currently at 16 per cent, will be reduced to zero as long as Hong Kong levies no withholding tax on interest. If Hong Kong levies withholding tax on interest, Romania’s interest withholding tax rate on Hong Kong’s residents will be capped at 3 per cent.

The Hong Kong/Romania CDTA has incorporated an article on exchange of information, which enables Hong Kong to fulfil its international obligations on enhancing tax transparency and combating tax evasion. The CDTA will come into force after the completion of ratification procedures on both sides. In the case of Hong Kong, an order is required to be made by the Chief Executive in Council under the Inland Revenue Ordinance. The order is subject to negative vetting by the Legislative Council.