The parliament of Ghana approved the Acts for the implementation of the 2020 Budget and published on 30 December 2019. The Act introduces tax holidays (exemptions) for the income of a manufacturer or assembler in respect of the manufacture or assembling of semi-knocked down vehicles, which is exempt from tax for a period of 3 years from the date of commencement of the manufacturing or assembling business; and fully-knocked down vehicles, which is exempt from tax for a period of 10 years from the date of commencement of the manufacturing or assembling business. The measures are generally effective from 1 January 2020.

Related Posts

Ghana: GRA confirms major VAT reforms in 2025 Act

Ghana’s tax authority, the Ghana Revenue Authority (GRA), on 31 December 2025 issued a notice to all VAT-registered taxpayers outlining the VAT reforms enacted under the Value Added Tax Act, 2025, which will take effect from 1 January

Read More

World Bank: Data-driven policies can transform tax compliance

An event held at the World Bank Group Office in Rome from 1 to 5 December 2025 was attended by experts from the World Bank, the Ghana Revenue Authority (GRA) and some Italian institutions. The participants examined the effect of data-driven risk

Read More

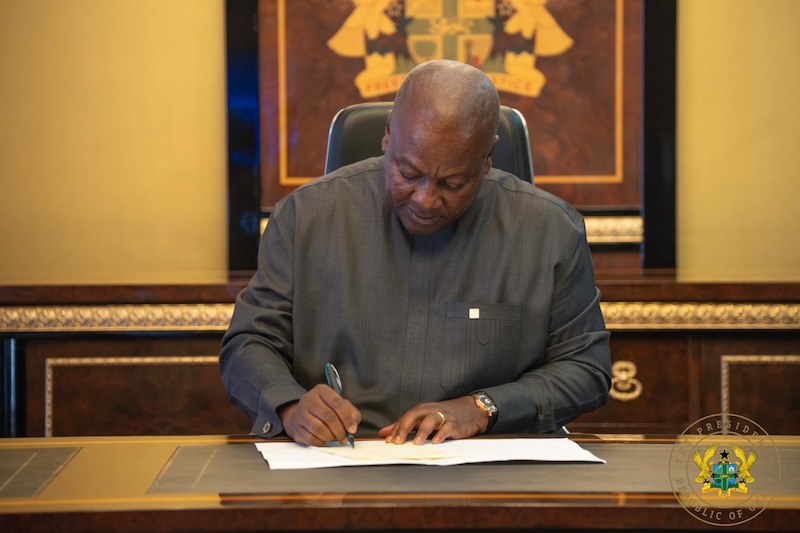

Ghana abolishes COVID-19 health recovery levy

Ghana’s President John Dramani Mahama signed the COVID-19 Health Recovery Levy Repeal Act 2025 into law on 10 December 2025, ending the 1% levy on goods, services, and imports from January 2026. The repeal fulfills a key campaign promise, as

Read More

Ghana: Parliament approves Value Added Tax Bill 2025

Ghana’s Parliament has passed the Value Added Tax 2025 on 27 November 2025. The purpose of the Bill is to revise and consolidate the framework governing the Value Added Tax. Presenting the Finance Committee’s report to Parliament, the

Read More

Ghana: MoF presents 2026 budget, proposes VAT reforms

Ghana's Ministry of Finance has presented the 2026 Budget Speech to parliament on 13 November 2025, introducing various tax measures, including VAT reforms. The key tax measures are as follows: VAT reforms Ghana's government is proposing

Read More

Ghana: GRA issues reminder on tax applicable to asset and liability gains

The notice mentions that a 25% tax applies to gains, with residents able to choose between the flat rate or regular income tax rates, while non-residents pay a final 25% tax on the gross proceeds. The Ghana Revenue Authority (GRA) has issued a

Read More