Ghana and Mauritius signed a tax treaty for the avoidance of double taxation and the prevention of fiscal evasion in Port Louis on 11 March 2017.

Panama, Vietnam DTA enters into force

Related Posts

OECD: Mauritius joins CARF MCAA, addendum to CRS MCAA

The OECD announced, on 12 December 2025, that Mauritius signed the Multilateral Competent Authority Agreement on Automatic Exchange of Information under the Crypto-Asset Reporting Framework (CARF MCAA). The CARF MCAA establishes a framework for

Read More

Czech Republic, Mauritius conclude tax treaty talks

Officials from the Czech Republic and Mauritius finalised negotiations by initialling an income tax treaty on 16 January 2026, This agreement aims to prevent double taxation and reduce the risk of tax evasion. It will take effect only after it

Read More

Czech Republic, Mauritius holds second round of tax treaty talks

Officials from the Czech Republic and Mauritius are meeting for the second round of talks on a potential income tax treaty from 13 to 16 January 2026. If an agreement is reached it will prevent double taxation and fiscal evasion between the two

Read More

Ghana: GRA confirms major VAT reforms in 2025 Act

Ghana’s tax authority, the Ghana Revenue Authority (GRA), on 31 December 2025 issued a notice to all VAT-registered taxpayers outlining the VAT reforms enacted under the Value Added Tax Act, 2025, which will take effect from 1 January

Read More

World Bank: Data-driven policies can transform tax compliance

An event held at the World Bank Group Office in Rome from 1 to 5 December 2025 was attended by experts from the World Bank, the Ghana Revenue Authority (GRA) and some Italian institutions. The participants examined the effect of data-driven risk

Read More

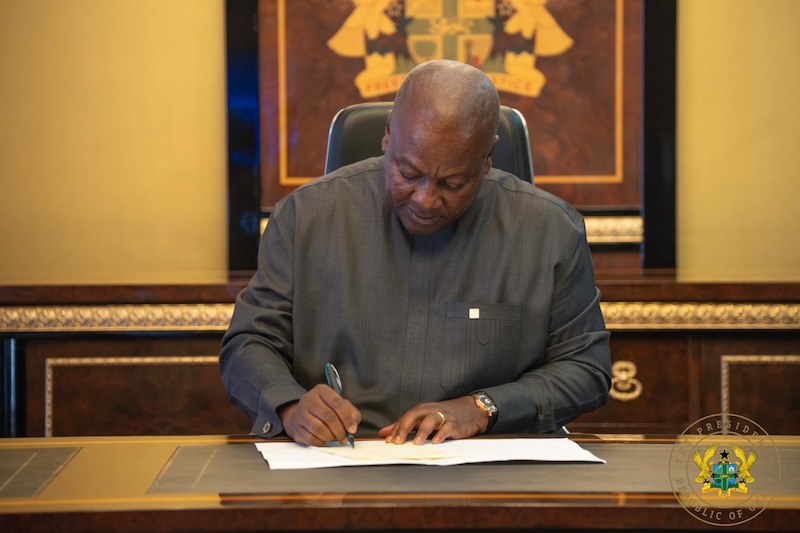

Ghana abolishes COVID-19 health recovery levy

Ghana’s President John Dramani Mahama signed the COVID-19 Health Recovery Levy Repeal Act 2025 into law on 10 December 2025, ending the 1% levy on goods, services, and imports from January 2026. The repeal fulfills a key campaign promise, as

Read More