On 17 June 2017, the Double Taxation Agreement between China and Romania was entered into force and it will apply from 1 January 2018. From this date, the new treaty will replace the existing DTA of 1991. The agreement contains Dividends rate 3%, Interest rate 3% and Royalties rate 3%.

Belgium, Switzerland protocol to DTA enters into force

Andorra, UAE DTA enters into force

Related Posts

Romania: Emergency Ordinance targets R&D, green tech, strategic investments

Romania has published Emergency Ordinance No. 8 of 24 February 2026 in the Official Gazette, which introduced a comprehensive package of fiscal and investment measures aimed at supporting economic recovery. Emergency Ordinance no. 8/2026

Read More

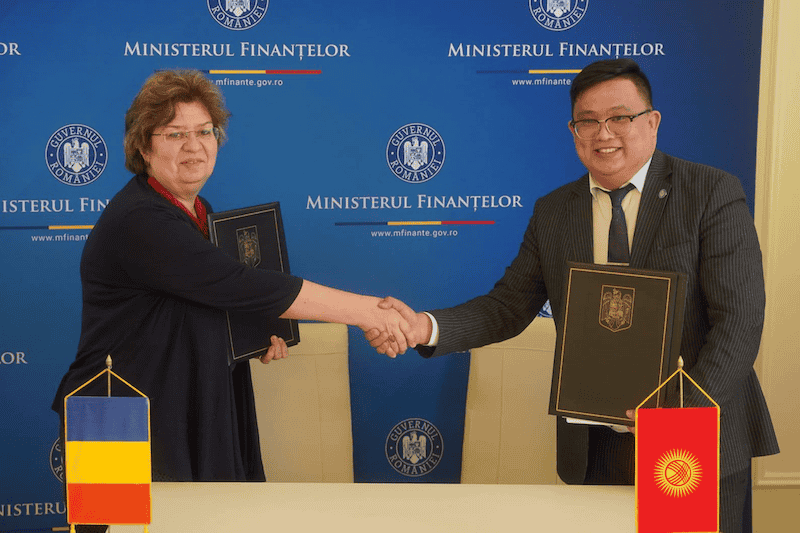

Kyrgyzstan, Romania agree on income tax treaty

Kyrgyzstan's Ministry of Economy and Commerce announced on 27 February 2026 that officials from Kyrgyzstan and Romania reached an agreement in principle on a new income tax treaty during negotiations held in Bucharest from 23 to 26 February 2026.

Read More

Romania: MoF launches blockchain-based fiscal receipt system to combat tax fraud

Romania’s Ministry of Finance, in a press release on 26 February 2026, announced that it is rolling out BF-CHAIN, an innovative project using blockchain technology to revolutionise how fiscal receipts from electronic cash registers are managed and

Read More

Romania mandates GloBE information return, notification requirements

Romania published Order No. 218, issued by the National Agency for Fiscal Administration (ANAF) on 16 February 2026, in its Official Gazette on 24 February 2026. The order sets out the official templates and procedural rules for two key forms

Read More

Romania: ANAF to revise withholding tax reporting requirements

Romania’s tax authority, the National Agency for Fiscal Administration (ANAF), has issued an Order No. 179/2022 on 16 February 2026 to modify the reporting requirements for Form 205, the "Informative Declaration on Withholding Tax and Investment

Read More

IMF Recommends Tax and Social Security Reforms in China

On 18 February 2026 an IMF Country Focus was published, generally based on the report issued by the IMF following consultations with China under Article IV of the IMF’s articles of agreement. China’s economy has remained resilient through

Read More