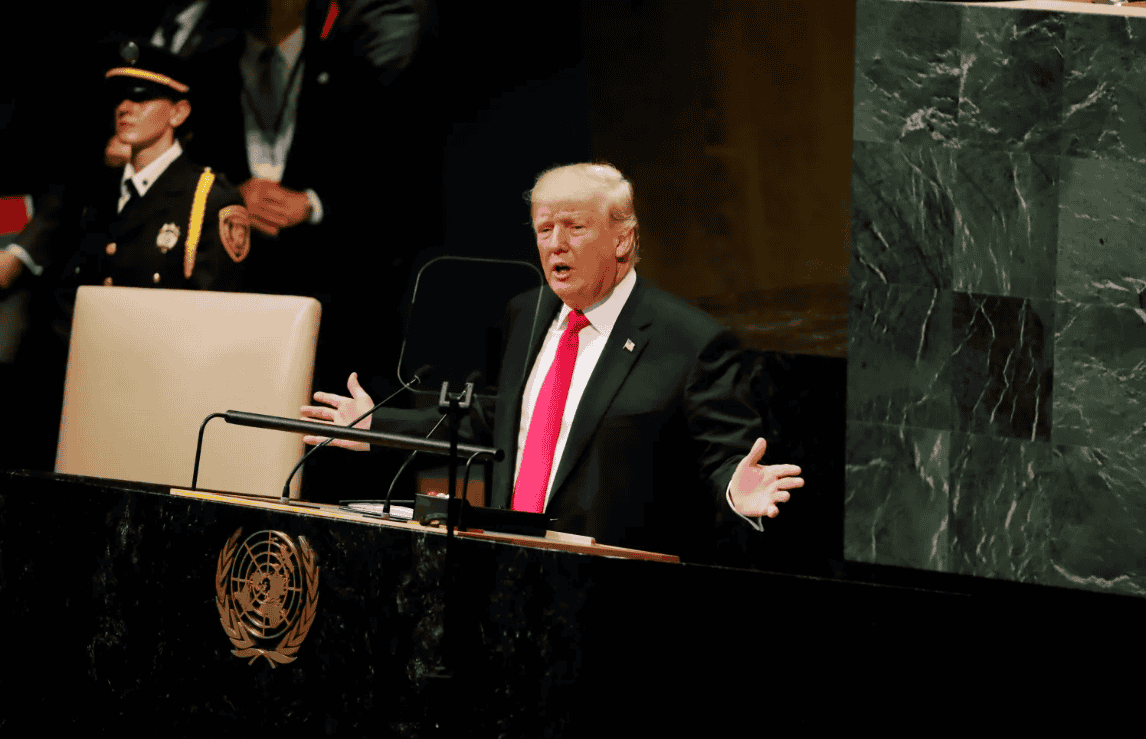

US: Appeals Court rules most Trump tariffs illegal, administration advances trade deals despite ruling

The US Appeals Court ruled that most Trump-era tariffs are illegal but allowed them to remain in place until 14 October pending a possible Supreme Court appeal. Despite the ruling, the administration continues trade talks with other

See MoreAngola, UAE sign CEPA to strengthen trade

Angola and the UAE signed a CEPA on 25 August 2025 to boost trade, investment, and sectoral cooperation. Angola and the UAE signed a Comprehensive Economic Partnership Agreement (CEPA) on 25 August 2025 in Angola. The agreement aims to reduce

See MoreUS: Trump administration permanently ends low-value package tariff exemption

CBP guidance states parcels will incur fees of USD 80, USD 160, or USD 200 based on Trump-era duty rates: under 16% (e.g., UK, EU), 16-25% (e.g., Indonesia, Vietnam), and over 25% (e.g., China, Brazil, India, Canada), respectively. The Trump

See MoreMexico plans tariffs on Chinese imports

Mexico plans higher tariffs on Chinese imports to protect domestic industries and support a US-backed “Fortress North America” strategy. Mexico is planning to raise tariffs on Chinese imports as part of its 2026 budget proposal, aiming to

See MoreUS: 50% tariffs on Indian imports enters into force

US to impose extra 25% tariffs on Indian imports from 27 August 2025, raising total duties to 50%. The US’ tariffs on Indian imports under Executive Order 14329 is taking effect today, 27 August 2025, starting 12:01 AM EDT. Most Indian

See MoreUS: Trump threatens China with 200% tariffs if rare-earth magnets remain on restricted export list

In response to US tariff hikes, China, which dominates 90% of global rare-earth magnet production, added magnets to its export restriction list in April. US President Donald Trump stated that China must supply the US with rare-earth magnets or

See MoreUS: Trump warns of additional tariffs on nations imposing digital taxes

President Donald Trump warned that countries maintaining digital taxes on major US tech firms such as Google and Amazon would face additional tariffs. US President Donald Trump has threatened countries with additional tariffs if they do not

See MoreIndia defends trade negotiations as US tariffs loom

India’s Foreign Minister says trade talks with the US are continuing, but New Delhi will defend key “redlines” as additional tariffs of up to 50%. India’s Foreign Minister Subrahmanyam Jaishankar stated on 23 August 2025 that trade

See MoreUS: Trump administration launches tariff review on furniture imports

This investigation mirrors previous probes into various industries like wind turbines, semiconductors, and critical minerals, all citing national security concerns under Section 232. President Donald Trump has announced, on Truth Social, a

See MoreCanada to exempt retaliatory tariffs on US imports under CUSMA

Canada’s government decision to abolish all tariffs on US goods under CUSMA will take effect on 1 September 2025. Canada’s Prime Minister Mark Carney announced on 22 August 2025 that Canada will eliminate tariffs on US goods covered under the

See MoreUS: Commerce Department expands steel and aluminium tariffs to include 407 more products

The steel and aluminum used in these products will be subject to a 50% duty rate. The US Department of Commerce’s Bureau of Industry and Security has expanded the steel and aluminium tariffs to include 407 additional product categories covered

See MoreBrazil unveils Sovereign Plan to shield exports from US tariffs

Brazil’s Sovereign Brazil Plan introduces measures including BRL 30 billion in affordable credit, extended export compliance deadlines, and increased REINTEGRA refund rates to protect exporters, preserve jobs, attract investment, and support

See MoreVenezuela prolongs state of economic emergency amid US tariff concerns

The state of emergency is set to remain in effect for 60 days, with the option to extend it for an additional 60 days. Venezuela published Executive Decree No. 5.157 in the Official Gazette on 8 August 2025, declaring a state of national

See MoreSouth Africa to submit revised trade deal to US to address 30% tariff

South Africa has submitted a revised trade offer to the US on 12 August 2025 to seek a reduction of the 30% tariff imposed on its exports. South Africa plans to present a revised trade proposal to the US to reduce the 30% tariff recently

See MoreUS imposes 15% tariff on goods from Trinidad and Tobago

The US has imposed a 15% tariff on Trinidad and Tobago’s key exports like ammonia and methanol, but exempts tariffs on crude oil and natural gas. The US has implemented a 15% reciprocal tariff on imports from Trinidad and Tobago on 7 August

See MoreUS suspends de minimis duty exemption on low-value imports

The Trump administration has ended the duty-free treatment for imports valued at USD 800 or less, effective 29 August 2025. US President Trump signed an executive order on 30 July 2025, suspending the duty-free de minimis treatment for

See MoreMexico increases tariffs on goods via simplified customs scheme

The ad valorem tariff for goods imported by courier under the simplified regime has increased to 33.5%, while USMCA goods over USD 117 face a 19% tariff, effective 15 August 2025. Mexico’s tax authority (SAT) has updated tariffs for imported

See MoreChina pauses 24% tariff on US goods for 90 days, keeps 10% levy

China extends the suspension of 24% additional tariffs on US imports for 90 days, keeping 10% tariffs intact. China’s Customs Tariff Commission of the State Council announced on 14 August 2025 that it has temporarily suspended its additional

See More