Angola: National Assembly approves 2026 budget, proposes several tax law modifications

Angola’s parliament has approved the General State Budget for 2026 on 19 November 2025, introducing amendments to several tax laws. The key amendments are: Corporate Tax Reforms Electronic filing mandate: General and simplified regime

See MoreGhana: MoF presents 2026 budget, proposes VAT reforms

Ghana's Ministry of Finance has presented the 2026 Budget Speech to parliament on 13 November 2025, introducing various tax measures, including VAT reforms. The key tax measures are as follows: VAT reforms Ghana's government is proposing

See MoreHungary: Parliament adopts revised global minimum tax, reporting regulations

Hungary’s parliament approved two bills (T/12802/7 and T/12801/12) on 18 November 2025 that introduce significant updates to the country's tax framework and reporting obligations. Among the key changes, the legislation revises Hungary’s

See MoreUruguay: Economy, Tourism Ministries reintroduce VAT cut for foreign tourists

The Ministry of Economy and Finance and the Ministry of Tourism issued a joint decree on 23 October 2025, announcing the reintroduction of a significant tax benefit for foreign tourists. The measure provides for a reduction of the Value Added Tax

See MoreFrance: Tax Authority clarifies VAT rate on biocontrol macro-organisms

RF Report The French tax authorities issued a rescript BOI-RES-TVA-000227 on 29 October 2025, clarifying the value-added tax (VAT) treatment for pollinating macro-organisms used in organic farming, gardens, green spaces, and public

See MoreLatvia: Government approves 2026 budget

The 2026 budget aims to boost revenue through excise taxes while easing living costs via a temporary VAT reduction on essential foods from July 2026. Latvia’s government has approved the 2026 state budget measures on 14 October 2025 and the

See MoreLatvia: Finance minister outlines key priorities in 2026 draft budget, initiates discussions with social partners

The 2026 budget proposes diversifying revenue sources through higher gambling and excise taxes, while supporting investment and easing living costs with tax law amendments and a temporary VAT cut on basic foods starting July 2026. Latvia's

See MoreSweden: Government proposes simplified business and capital taxation in 2026 budget

The proposed tax measures include business tax credits and simplified forestry and shipping rules, temporary VAT cuts and fraud controls, changes to excise taxes on alcohol and tobacco, permanent tax-free EV workplace charging, and reduced energy

See MoreFinland: Government presents 2026 budget to parliament, proposes reduced corporate taxes

The 2026 budget proposal lowers corporate and CO2 fuel taxes while tightening crypto reporting, adjusting VAT, and raising taxes on vehicles, tobacco, alcohol, and soft drinks. Finland’s government has presented the 2026 budget proposal (HE

See MoreRomania gazettes revised VAT reporting requirement

Order No. 2194/2025 has been issued approving the revised format of Romania’s Statement 394 for reporting goods, services, and acquisitions. Romania has published Order No. 2194/2025 in Official Gazette No. 852 of 17 September 2025. This

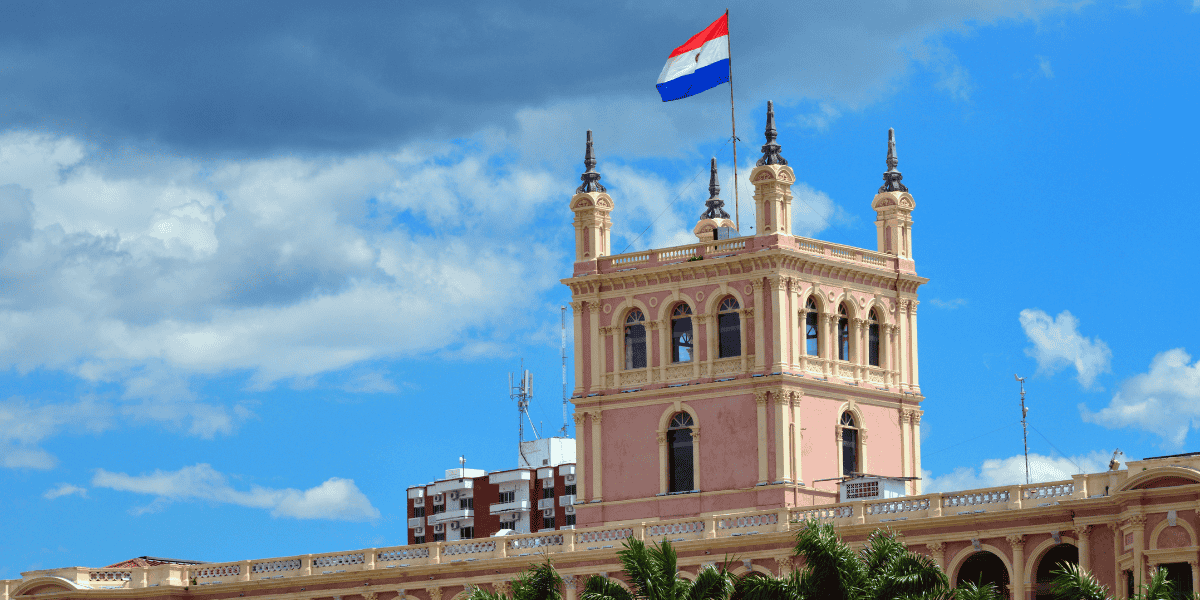

See MoreParaguay introduces tax incentives for electronics manufacturing, digital equipment

Paraguay’s Law No. 7546/2025 boosted investment and jobs in electronics and digital equipment. Paraguay has enacted Law No. 7546/2025, published on 8 September 2025 and effective from 9 September 2025, to promote investment and formal

See MoreSweden: Government considers reducing VAT on dance events in 2026 budget

The government plans to reduce the VAT rate for admission to dance events to 6% from the existing 25%. The Swedish government, in a press release on 13 September 2025, announced plans to lower the VAT rate for dance events as part of its 2026

See MoreThailand: Cabinet extends 7% VAT rate until September 2026

Normally, the VAT rate is 10% in Thailand, but it was reduced to 7% as part of economic measures after the 1997 financial crisis. The Thai Cabinet has extended the reduced VAT rate of 7% until 30 September 2026. This announcement was made by

See MoreRussia proposes reduced VAT on essential goods

Russia proposes VAT cut on essential food items, children’s products, periodicals, and medical items. The Russian State Duma received draft law No. 1011590-8 on 8 September 2025, proposing a reduction of the value-added tax (VAT) rate from 10%

See MoreTanzania: TRA introduces 16% VAT on B2C online payments

The Tanzania Revenue Authority (TRA) has announced that a reduced VAT rate will apply to B2C online purchases made through banks or approved electronic payment platforms, effective 1 September 2025. TRA will implement a new VAT rate of 16%

See MoreColombia: MoF proposes major tax reforms for 2026 budget

The proposed 2026 budget legislation introduces significant reforms to corporate surtax, VAT, personal income tax, net wealth tax, and capital gains tax, with new tax rules for crypto-asset transactions. Colombia’s Ministry of Finance submitted

See MoreRomania increases standard and reduced VAT rates, effective starting tomorrow

Starting 1 August 2025, Romania will unify the 5% and 9% VAT rates into a single 11% rate and raise the standard VAT rate from 19% to 21%. Effective from tomorrow, 1 August 2025, Romania’s reduced VAT rates of 5% and 9% have been unified and

See MoreKazakhstan adopts new tax code, introduces additional R&D tax deduction to 200%

The Tax Code, effective 1 January 2026, introduces a standard CIT rate of 20%, adjusted CIT rates for various sectors, a VAT increase from 12% to 16%, with various exemptions. Kazakhstan has introduced a new Tax Code, as per Law No. 214-VIII,

See More