Malawi lowers tax for select non-resident companies

The Malawi government has abolished the 5% repatriation tax for non-resident companies, increased withholding tax on gambling winnings to 10%, and exempted bread from the 16.5% VAT. Malawi has implemented new tax laws through the Taxation

See MoreRussia: Parliament proposes zero VAT on lightweight drones

The initiative seeks to enhance domestic drone manufacturing, and the zero VAT rate is expected to remain until 31 December 2027. Russia’s parliament has proposed draft law no. 962796-8 aimed at boosting domestic drone production. It proposes

See MoreRussia: Parliament proposes VAT reduction on food products

This proposed legislation aims to lower the VAT rate on certain food items from 10% to 5%. Russia’s parliament has proposed draft law No. 955850-8, which seeks to reduce the VAT rate on specific food products from 10% to 5%. The initiative aims

See MoreEC urges several nations to fully implement VAT rates, SME scheme directive

The European Commission has urged several EU countries, including Cyprus, Belgium, Bulgaria, Greece, Spain, and Romania, to fully implement VAT-related directives and new SME VAT rules. The European Commission, in its July 2025 infringements

See MoreBelgium: Chamber of Deputies approve participation exemption changes, exit tax rules, other tax reforms

From 2026, Belgium's tax changes include stricter participation exemption rules, exit tax on cross-border reorganisations, a permanent 6% VAT for residential demolition/reconstruction, and higher VAT on coal and fossil fuel boilers. The Belgian

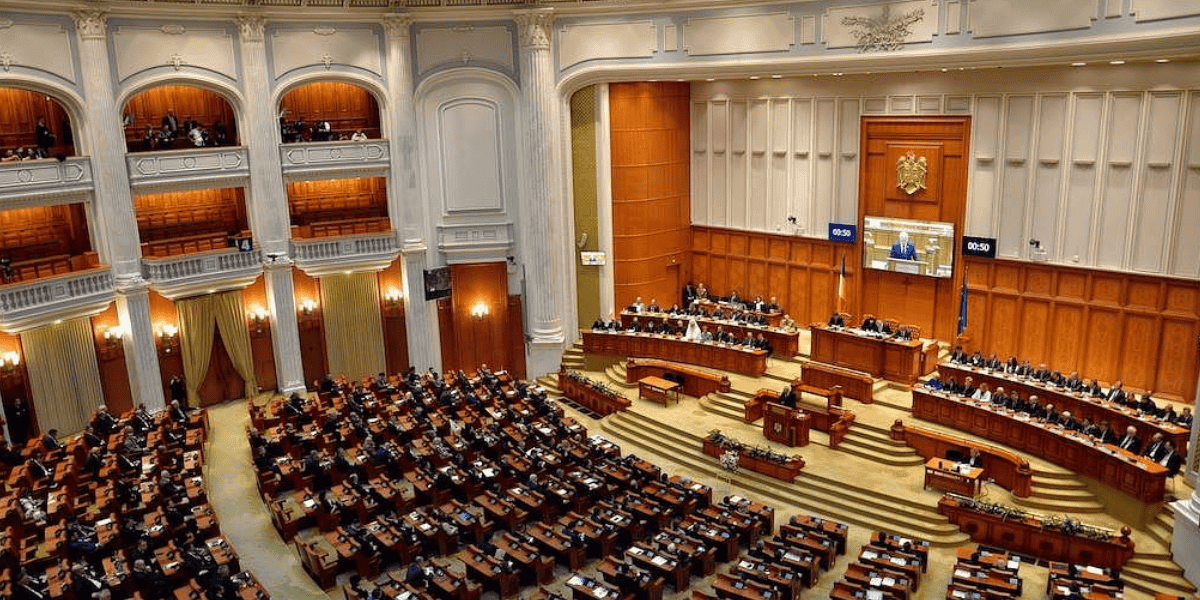

See MoreRomania: Parliament approves increases to VAT, bank levy, and dividend tax

The law introduces significant tax reforms, including increased VAT rates, a new reduced VAT rate, higher turnover tax for banks, and an increased dividend tax rate. Romania's parliament has passed the Law on certain fiscal-budget measures on 14

See MoreBelgium extends 6% VAT rate for residential demolition and reconstruction pending legal implementation

Due to a delay in the approval of the reform law, the standard 21% VAT rate will apply from 1 July 2025, with a potential adjustment to 6% once the law is enacted. Belgium's Federal Public Service (SPF) Finance announced on 10 July 2025 that the

See MoreRomania 2025–28 tax reforms include increased VAT, dividend tax

The proposed draft bill aims to simplify VAT rates from three (19%, 9%, and 5%) to two, starting 1 August 2025. Romania’s government submitted an amended draft bill to parliament on 4 July 2025, proposing changes to the VAT provisions of the

See MoreTanzania enacts 2025-26 budget measures, includes new transfer pricing penalty

The measures will apply from 1 July 2025, unless otherwise specified. Tanzania's Finance Act 2025 was enacted on 30 June 2025, implementing tax measures from the 2025-26 Budget Speech with some adjustments to the initially announced

See MoreEgypt amends VAT law to broaden tax base and target key sectors

The amended VAT law focuses on expanding the tax base, addressing sectoral imbalances, and improving fiscal sustainability, while maintaining the current VAT rate. Egypt’s House of Representatives approved a series of amendments to VAT Law

See MoreSlovak Republic: Parliament rejects proposal to cut VAT rate

The bill aimed to cut VAT from 23% to 20%. The Slovak Republic parliament has turned down several bills, including measures to reduce VAT rates. The bill proposed lowering the standard VAT rate from 23% to 20%. This means the planned change,

See MorePoland: Parliament approves amendments to the CIT Act, VAT exemption threshold increase

Poland's Sejm approved amendments to the Corporate Income Tax Act and raised the VAT exemption threshold during sessions from 24-26 June 2025. Poland’s lower chamber of the parliament (Sejm) approved amendments to the Corporate Income Tax (CIT)

See MoreKenya enacts Finance Act 2025, reduces corporate tax rates

The Finance Act 2025 allows NIFCA-certified companies to benefit from reduced corporate tax rates, tax exemptions on dividends with reinvestment conditions. Kenya’s President William Ruto signed the Finance Act 2025 into law on 26 June

See MoreNigeria: President approves four new tax reform bills

The new legislation comprises the Nigeria Tax Act, the Nigeria Tax Administration Act, the National Revenue Service (Establishment) Act, and the Joint Revenue Board (Establishment) Act. Nigeria’s President Bola Tinubu has signed four major tax

See MoreSlovak Republic: President signs DAC8, excise duty, and tax rate amendments

The President signs DAC8 bill, streamlines excise registration, standardises CNG/LNG tax, adjusts product tax rates, and cuts VAT on select goods. The Slovak Republic’s President has signed a bill amending the Act on Automatic Exchange of

See MoreRomania announces 2025–28 tax reforms, raises dividend tax

The proposed tax reforms target increased taxes on dividends, reduced incentives, stricter expense deductions, and simplified VAT rates. Romania published its decision approving the 2025-2028 Government Programme in the Official Gazette on 23

See MoreRomania announces plan to streamline VAT to two rates

Romania’s parliament has approved the new government and its Government Plan, published in Official Gazette No. 580 on 23 June 2025. The plan proposes VAT system changes, including removing VAT incentives on real estate transactions and reducing

See MoreItaly: Council of Ministers extends sugar tax suspension, lowers VAT on art and antiques

The effective date has been delayed from 1 July 2025 to 1 January 2026. Italy’s Council of Ministers approved a decree-law on 20 June 2025, delaying the sugar tax's effective date from 1 July 2025 to 1 January 2026. Additionally, the law

See More