Poland: MoF implements rules for national electronic invoicing system

Poland’s Ministry of Finance announced four implementing regulations governing the use of the National e-Invoicing System (Krajowy System e-Faktur – KSeF) on 16 December 2025. 1. Cases Exempt from Structured Invoices The regulation of 7

See MoreItaly: Revenue Agency sets single deadline for VAT advance payments

Italy’s Revenue Agency, with approval from the Ministry of Economy and Finance and the Bank of Italy, has established a single deadline for intermediaries to transfer VAT advance payments to the Treasury on 16 December 2025. Banks, post

See MoreSri Lanka: IRD postpones adoption of new VAT invoice format

The Inland Revenue Department (IRD) has announced, on 12 December 2025, that the effective date for the new VAT Tax Invoice format has been postponed. Following requests from numerous VAT registered persons, the Commissioner General of Inland

See MoreItaly introduces fiscal measures for third sector, amateur sports, VAT, business crisis procedures, digital platforms

Italy’s Revenue Agency announced that it has published Legislative Decree No. 186 of 4 December 2025 in the Official Gazette on 15 December 2025. This decree introduces a coordinated package of fiscal measures affecting the third sector, amateur

See MorePortugal: Parliament publishes 2026 state budget law, expands scope of reduced VAT rate

Portugal’s parliament has published the final text of the 2026 State Budget Law on 12 December 2025, after it was approved by the parliament on 27 November 2025. The final version of the budget law largely mirrors the initial proposals;

See MoreDenmark: Economic Council prioritises emission taxes

Denmark’s Economic Council Chairmanship released its 2025 environmental economic report on 9 December 2025, highlighting that taxes on greenhouse gas emissions are a more cost-effective and precise tool for promoting the green transition than

See MoreTunisia gazettes 2026 Finance Law, includes presumptive tax regime for small businesses

Tunisia has published the Finance Law for 2026 (Law No. 2025-17) in the Official Gazette on 12 December 2025, setting out a wide-ranging package of tax and fiscal measures aimed at strengthening public finances while supporting targeted sectors of

See MoreItaly: Revenue Agency clarifies reduced 10% VAT for waste services, educational buildings

Italy’s Revenue Agency issued two rulings on 11 December 2025 to clarify when the reduced 10% VAT rate may be applied in the areas of municipal waste services and construction of buildings used for educational purposes. Waste-Management

See MoreGreece enacts law introducing strategic investment incentives, 100% deduction for defence

Greece has passed Law 5246/2025, “Tax Reform for Demographics and the Middle Class – Support Measures for Society and the Economy”, following parliamentary approval on 7 November 2025. The law introduces broad tax reforms, including

See MoreHungary enacts 2026 autumn tax reforms, additional measures

Hungary has enacted several significant tax measures through legislative acts to reduce administrative burdens, promote business investment, and align domestic rules with EU directives. The measures are scheduled to take effect in 2026 unless

See MoreSlovak Republic: Parliament approves mandatory e-invoicing, e-reporting

The Slovak Republic Parliament approved a draft law on 9 December 2025, introducing measures to tackle tax evasion, close the VAT gap, and implement the EU Directive 2025/516 on VAT in the digital era (ViDA). The law establishes mandatory electronic

See MoreArgentina: ARCA updates VAT withholding rules for digital platforms

Argentina’s tax authority (ARCA) has issued General Resolution 5794/2025, which updates the special VAT withholding rules for transactions conducted through digital platforms, initially established under General Resolution 5319/2023. The core

See MoreCroatia: Parliament adopts streamlined VAT rules, mandatory e-invoicing from January 2026

Croatia’s Parliament approved amendments to the VAT Act concerning e-invoicing. The final version of the amendments was adopted on 5 December 2025. Key legislative actions include extending the reduced 5% VAT rate for specific supplies, such as

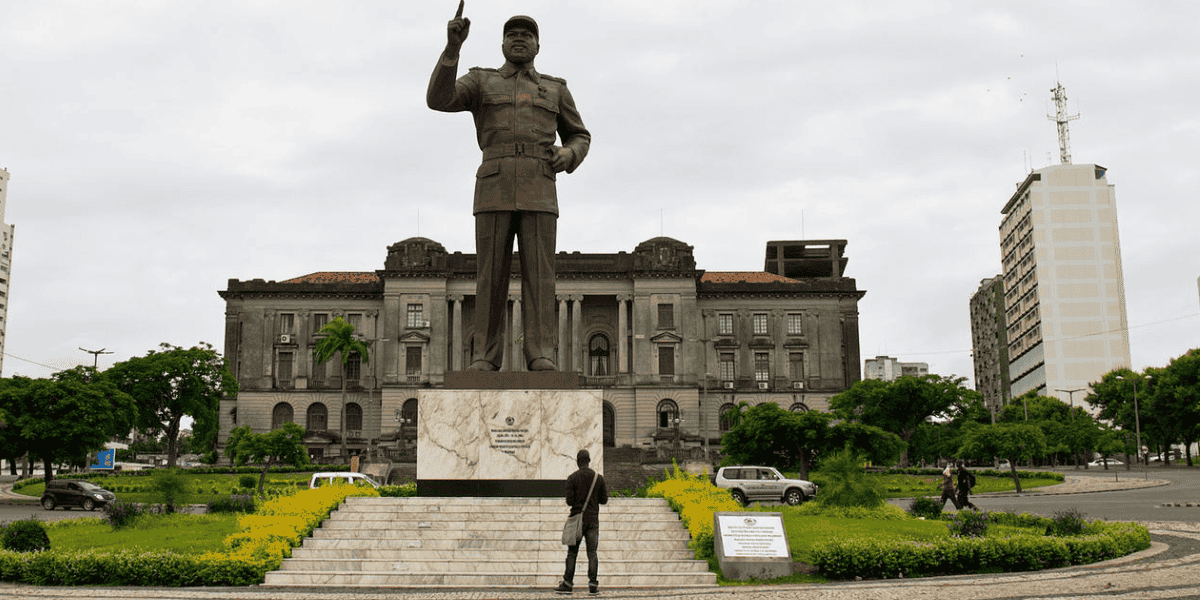

See MoreMozambique: Government adopts amendments to VAT law

Mozambique’s government adopted a draft Value Added Tax (VAT) law during the 41st Session of the Council of Ministers on 2 December 2025. The VAT law is designed to modernise and streamline the electronic submission of invoices and similar

See MoreUAE: MoF clarifies fines for e-invoicing non-compliance

The UAE’s Ministry of Finance (MoF) announced the issuance of Cabinet Resolution No. (106) of 2025 regarding violations and administrative fines resulting from non-compliance with the legislation regulating the Electronic Invoicing System, as part

See MoreUAE: FTA issues administrative exceptions VAT guide

The UAE’s Federal Tax Authority (FTA) issued the Administrative Exceptions VAT Guide on 5 December 2025. The guide explains how registrants can apply for VAT administrative exceptions, which provide concessions allowed under the VAT Law and its

See MoreCyprus: Council of Ministers extends zero VAT rate on essential goods

The Cyprus Council of Ministers issued Decree No. 337/2025 on 21 November 2025, which extended the temporary zero VAT rate on certain essential goods through 31 December 2026. The products included under this measure are baby milk, infant

See MoreSwitzerland: Federal Council consults on VAT amendments

The Swiss Federal Council opened a consultation on amendments to the Value Added Tax Act on 5 December 2025. The changes aim to implement two parliamentary motions: the extension of platform taxation to electronic services (Motion WAK-S 23.3012)

See More