Slovak Republic gazettes bill amending corporate tax and VAT, and bill introducing financial transaction tax

The Slovak Republic has gazetted the bill that amends various tax laws, including corporate tax and VAT rate changes, and the bill enacting the financial transaction tax. The bills are aimed at improving the country’s public finances. The

See MoreHungary to amend local and EU tax laws, achieve social and policy objectives

Hungary’s government concluded a public consultation on a draft bill proposing changes to various tax laws on 24 October 2024. The proposal seeks to amend tax laws in response to EU and Hungarian legislation changes, targeting global minimum tax,

See MoreEcuador to reduce VAT for tourism services in November

Ecuador has announced a temporary VAT reduction on tourism-related services, lowering the rate from 15% to 8% from 1 to 4 November 2024. This initiative aims to promote tourism during the upcoming national holidays. The measure, outlined in

See MoreCroatia: EU Council to authorise extending Croatia’s 50% VAT deduction on passenger car purchases

The General Secretariat of the Council of the European Union has requested the Permanent Representatives Committee to encourage the Council to adopt a Proposal for a Council Implementing Decision on 24 October 2024. This Proposal seeks to

See MorePortugal proposes several VAT measures in draft state budget law 2025

Portugal released the state budget law for 2025 (Law No. 26/XVI/1) on 10 October 2024, proposing various VAT measures. The draft Budget Law for 2025 proposes reduced corporate tax rates for companies and SMEs and revised personal income tax rates,

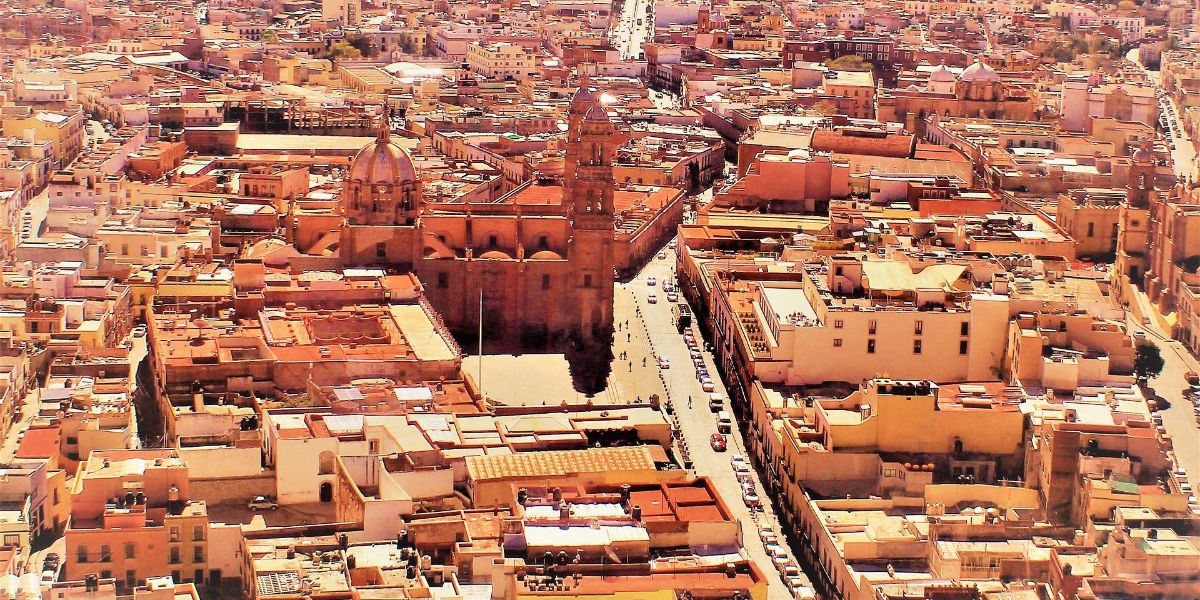

See MoreMexico introduces new withhold income tax, VAT obligations for crowdfunding platforms

The Mexican tax administration (SAT) released the Second Resolution of Modifications to the Miscellaneous Fiscal Resolution for 2024 on 11 October 2024, which mandates that crowdfunding platforms provide specific information to the SAT concerning

See MoreGermany publishes final guidance on mandatory e-invoicing

The German Ministry of Finance has published the final guidance on mandatory e-invoicing on 15 October 2024. The principles of the guidance are to be applied to all sales made after 31 December 2024. As established by the Growth Opportunities

See MoreIMF/World Bank Annual Meetings: World Economic Outlook

The October 2024 update of the World Economic Outlook was launched during the IMF/World Bank annual meetings. The report notes that global growth is expected to remain stable but at relatively low levels. The growth projection of 3.2% in 2024 and

See MoreUK: HMRC publishes guidance on VAT for private education providers

The UK tax authority, His Majesty's Revenue and Customs (HMRC), has issued a guidance for private education providers regarding the upcoming obligation to charge value added tax (VAT) on school and boarding fees on 10 October 2024. This guidance

See MoreArgentina dissolves tax authority, removes select VAT exemptions

Argentina’s government announced in a release on 21 October 2024 that the Federal Administration of Public Revenue (Administración Federal de Ingresos Públicos —AFIP) will be abolished, and the Tax Collection and Customs Control Agency

See MoreIMF and World Bank Group Annual Meetings: Fiscal Monitor Press Briefing

On 23 October 2024 the IMF held a press briefing on the launch of the latest issue of the Fiscal Monitor. On the panel for the press briefing were Vítor Gaspar, Director of the IMF Fiscal Affairs Department; Era Dabla-Norris, Deputy Director of the

See MoreUN Tax Committee: Indirect Tax Issues

On 18 October 2024 the subcommittee on indirect tax issues presented a series of papers on VAT guidance for developing countries. The papers had been presented to the Tax Committee for comment at the previous session and were now submitted in their

See MoreRomania issues registration forms for non-resident payment service providers

Romania’s tax authorities issued Order No. 6508/2024, which introduces Form 709 for requesting tax registration for non-resident Payment Service Providers with reporting obligations in Romania under the Amending Directive to the VAT Directive

See MoreItaly releases company list subject to VAT split-payment next year

Italy's Department of Finance has released the updated lists of companies subject to the value-added tax (VAT) split-payment system in 2025. The lists will be updated throughout the year. The revised lists include companies or entities controlled

See MoreMorocco: 2025 draft finance law introduces new tax rules for joint ventures and economic groups

Morocco’s Ministry of Finance released the draft Finance Law 2025 on 19 October 2024, proposing various measures for corporate income tax, focusing on taxing joint ventures and economic interest groups. Corporate tax rules change for joint

See MoreGreece introduces new VAT code to enhance clarity

The government has implemented VAT Code A 162/2024, published in the Official Gazette on 11 October 2024, to ensure clarity and uniformity in provisions without introducing any significant changes. This comprehensive update simplifies VAT

See MoreBolivia revises payment document rules for transactions over BOB 50,000

Bolivia's National Tax Service released Normative Resolution No. 102400000021 of 20 September 2024, which updated rules for documentation on transactions over BOB 50,000, effective for all individuals and entities. The Normative Resolution No.

See MoreSerbia: No electronic input VAT recording needed for September 2024 tax period

Serbia’s Ministry of Finance announced on 9 October 2024 that users of the electronic invoicing system (SEF) will not be required to record input VAT electronically for the September 2024 tax period, citing technical issues. The ministry

See More