Netherlands issues new decree on VAT exemption for share transactions

The Netherlands has published a new Decree on 15 October 2025 regarding the VAT exemption for share transactions. The Decree clarifies the scope of “intermediary services” in securities transactions and provides a broad application of the VAT

See MoreChile: SII clarifies offshore software tax exempt from non-resident income tax

Offshore software licenses in Chile exempt from income tax, VAT applies. The Chilean Tax Administration (SII) has clarified the tax treatment of software licensing services provided from abroad. According to Ruling No. 2066-2025 on 16 October

See MoreNorway: Government presents 2026 Budget Bill, corporate income tax to remain at current levels

The 2026 Budget Bill prioritises welfare, health, defence, reducing electric car subsidies, cutting income and electricity taxes to boost purchasing power, and closing tax loopholes. Norway’s government has presented its proposal for the state

See MoreRussia: State Duma approves VAT exemption for precious metal deposits

State Duma approved a draft law exempting banks from VAT on interest paid in precious metals, aiming to boost deposits and reduce legal disputes. Russia's lower house of the Federal Assembly (State Duma) approved at first reading a draft law that

See MoreGreece implements EU small business VAT scheme

The measures apply retroactively from 1 January 2025. Greece adopted Law No. 5222, published on 28 July 2025, introducing the EU small business scheme for cross-border supplies, in line with Council Directive (EU) 2020/285 of 18 February

See MoreEuropean Commission releases reports on member states’ VAT rate exemptions

This report reviews how Member States apply VAT rate derogations, revealing an uneven distribution. The European Commission has released a report examining the VAT rate exemptions utilised by EU Member States, accompanied by annexes detailing

See MoreZambia: Government presents 2026 budget, proposes VAT refund incentives for energy sector

The national budget for 2026 proposes amendments to key tax laws to enhance revenue, provide targeted relief, promote equity, support economic formalisation, and align with international standards. Zambia’s Minister of Finance and National

See MorePortugal: Parliament grants VAT relief for farmers affected by rural fires

Portugal approves six-month VAT exemption on animal feed for farmers in fire-affected areas. Portugal's parliament approved Law no. 57-A/2025 on 25 September 2025, amending Decree-Law no. 98-A/2025, to introduce a temporary VAT exemption on the

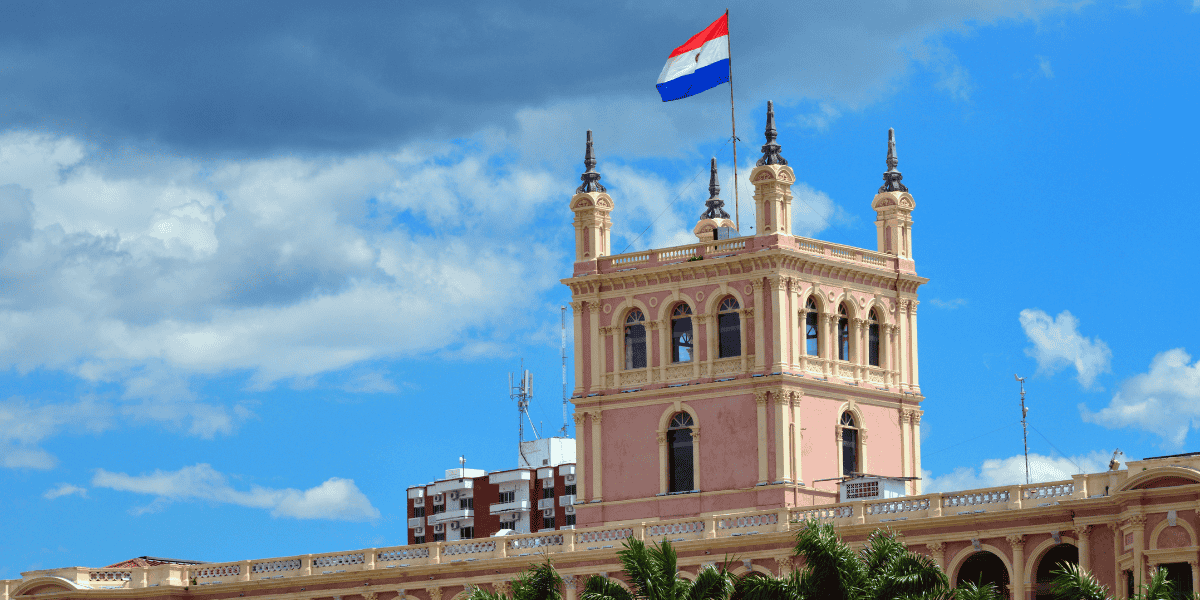

See MoreParaguay unveils new tax incentives for local, foreign investors

Key incentives include exemptions on customs duties, VAT, nonresident income tax, and dividend/profit tax for substantial investments in capital goods, industrial or agricultural production, and large-scale tourism or entertainment projects, subject

See MoreColombia: MoF proposes major tax reforms for 2026 budget

The proposed 2026 budget legislation introduces significant reforms to corporate surtax, VAT, personal income tax, net wealth tax, and capital gains tax, with new tax rules for crypto-asset transactions. Colombia’s Ministry of Finance submitted

See MorePoland: Government adopts 2026 budget law, increases corporate tax for banks

The draft 2026 budget law increases the corporate tax rate for the banking sector, a rise in the VAT exemption threshold from PLN 200,000 to PLN 240,000, and a 15% hike in excise rates on alcoholic beverages. Poland's government has adopted the

See MoreTurkey: Revenue Administration issues guidance on sports sponsorship tax

The guide outlines sponsorship expenses, eligible areas, agreement essentials, distinctions from advertising, documentation, tax deductions, professional versus amateur sports, and VAT applications. Turkey's Revenue Administration announced the

See MoreChile: SII issues rules on VAT exemption for low-value imports purchased via remote sellers, online platforms

The new rules exempt low-value imports (CIF value under USD 500) from VAT at import when purchased from non-resident remote sellers or DPIs registered under the simplified VAT regime, ensuring VAT is only charged at the sale stage, not at the time

See MoreChina: Finance Ministry consults on draft VAT law regulations

The new draft VAT law aligns with existing VAT policies while introducing key adjustments, organised into six chapters covering provisions, rates, payable taxes, incentives, administration, and supplementary rules. China's Ministry of Finance has

See MoreArgentina eases advance VAT collection rules for select sectors

General Resolution 5738 exempts certain economic activities from advance VAT collection on transactions under ARS 10 million, effective 1 August. Argentina has issued General Resolution 5738/2025 amending General Resolution 2126 on 29 July

See MoreVenezuela updates VAT exemptions, designations of withholding agents

Venezuela’s Decree No. 5.145 suspends VAT exemptions on essential goods like food, medicines, and books, effective 30 June 2025, while Administrative Ruling SNAT/2025/000054 designates special taxpayers as VAT withholding agents from 16 July

See MoreTurkey consults amendments to VAT refunds, exemptions, and procedures

The draft communiqué provides clarification on VAT exemptions, fraud-related loss, property sales rules, special consumption tax, and proportional VAT refunds on assets. The Turkish government issued a draft Communiqué on 31 July 2025 to amend

See MoreFrance publishes revised VAT exemption lists for overseas departments

France updates VAT exemption lists for overseas departments with region-specific measures effective from March 2025 to December 2027. The French tax authorities released updated guidance (BOFiP, ACTU-2025-0010) on 23 July 2025, establishing

See More