Bulgaria: Council of Ministers proposes VAT amendments for small enterprises

Bulgaria’s Council of Ministers has submitted a draft amendment to the VAT Act to parliament, aiming to implement the European Union’s small enterprises VAT scheme. Any small enterprise with a total annual turnover of no more than EUR 100 000

See MoreCosta Rica: DGT introduces new monthly tax reporting form for transactions not supported by electronic vouchers

Costa Rica’s tax authority (DGT) issued Resolution MH-DGT-RES-0055-2025 on 3 November 2025, introducing a new monthly tax reporting form for businesses and organisations that conduct transactions not covered by electronic invoices. The new

See MoreBulgaria plans dividend tax hike, faster write-offs for electric vehicles in 2026 budget

Bulgaria's Ministry of Finance has released the draft State Budget Act for 2026 and updated the medium-term budget forecast for 2026-2028, which were published on the Ministry’s website on 3 November 2025. Draft State Budget Act for

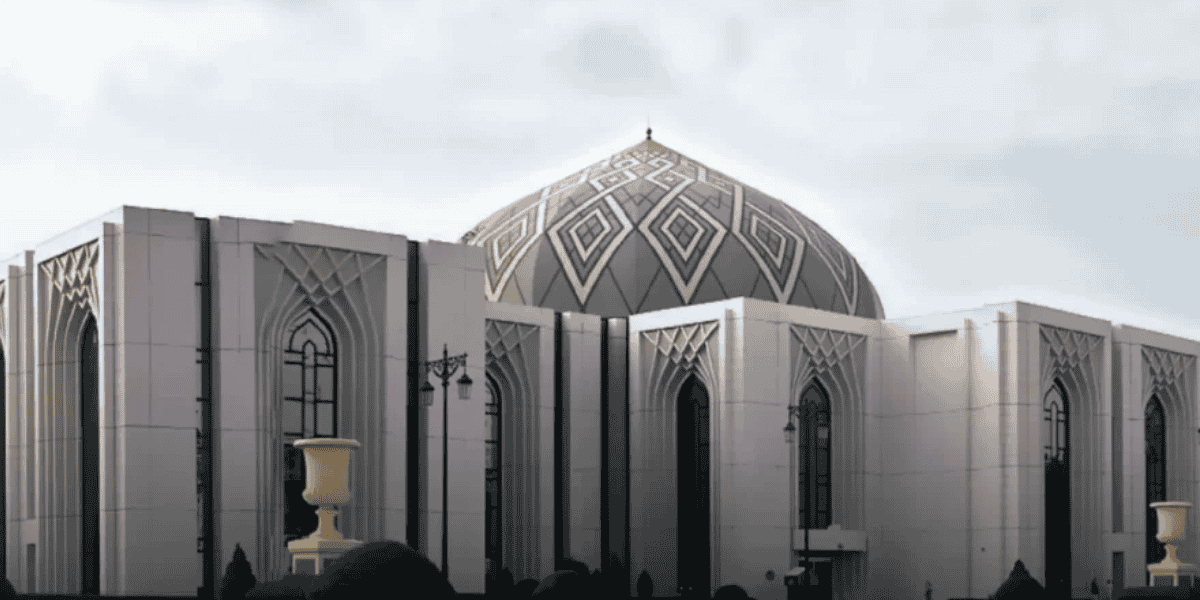

See MoreSaudi Arabia: ZATCA urges use of fine exemption initiative by year-end

The Saudi Zakat, Tax, and Customs Authority (ZATCA) has urged all taxpayers to take advantage of the “Cancellation of Fines and Exemption of Penalties Initiative," which ends on 31 December 2025. This announcement was made on 2 November

See MoreSlovenia: MoF mandates e-invoicing for domestic B2B transactions

Slovenia's Ministry of Finance (MoF) announced that the National Assembly had passed the Law on the Exchange of Electronic Invoices and Other Electronic Documents, introducing mandatory electronic invoicing (e-invoicing) for domestic

See MoreSouth Africa: SARS updates VAT guide for foreign e-service suppliers

The South African Revenue Service (SARS) has released an updated version of VAT-REG-02-G02: Supply of Electronic Services by Foreign Suppliers and Foreign Intermediaries guide, reflecting recent legislative amendments to the Value-Added Tax (VAT)

See MoreEU releases report on the strategic dialogue on the VAT in the Digital Age (ViDA) package

On Tuesday, 28 October 2025, Commissioner Wopke Hoekstra hosted a strategic dialogue on the VAT in the Digital Age (ViDA) package in Brussels. The ViDA initiative represents one of the most significant reforms to the EU’s Value-Added Tax (VAT)

See MoreEcuador: SRI extends VAT, withholding tax filing deadlines for Imbabura taxpayers

The Internal Revenue Service of Ecuador (SRI) has issued Resolution NAC-DGERCGC25-00000033, extending the deadlines for filing September 2025 Value Added Tax (IVA) and Withholding at the Source (retenciones en la fuente) returns, including their

See MoreChile: Tax Authority updates IVA rules for digital platform operators

RF Report The Chilean Tax Authority (Servicio de Impuestos Internos, SII) issued Resolution Ex. SII No. 145-2025 on 16 October 2025, setting out the obligations of digital platform operators with residence or domicile in Chile regarding Value

See MoreRomania updates RO E-VAT compliance notice

Regfollower Desk Romania has published Order No. 2394/2025 in the Official Gazette No. 977 on 23 October 2025, updating the RO e-VAT Compliance Notice form originally introduced under Order No. 6234/2024 by the President of the National Authority

See MorePortugal mandates parent entity responsible for reporting, paying group’s consolidated VAT

Regfollower Desk Portugal’s parliament has enacted Law No. 62/2025, published in the Official Gazette on 27 October 2025, establishing a Value Added Tax (VAT) Group regime. The parent entity is responsible for reporting and paying the

See MoreTunisia: Government to widen scope of mandatory e-invoicing under 2026 Finance Bill

Regfollower Desk Tunisia's government has proposed significant updates to its electronic invoicing (e-invoicing) framework under the 2026 Finance Bill, announced on 14 October 2025. At present, the obligation applies only to B2G transactions

See MoreTaiwan: NRNTB mandates e-invoicing requirements for sales returns, purchase returns, discounts

Taiwan businesses must issue and upload electronic credit notes for returns or discounts to comply with tax rules. Regfollower Desk The National Taxation Bureau of the Northern Area (NRNTB) in Taiwan, a regional branch of the Ministry of

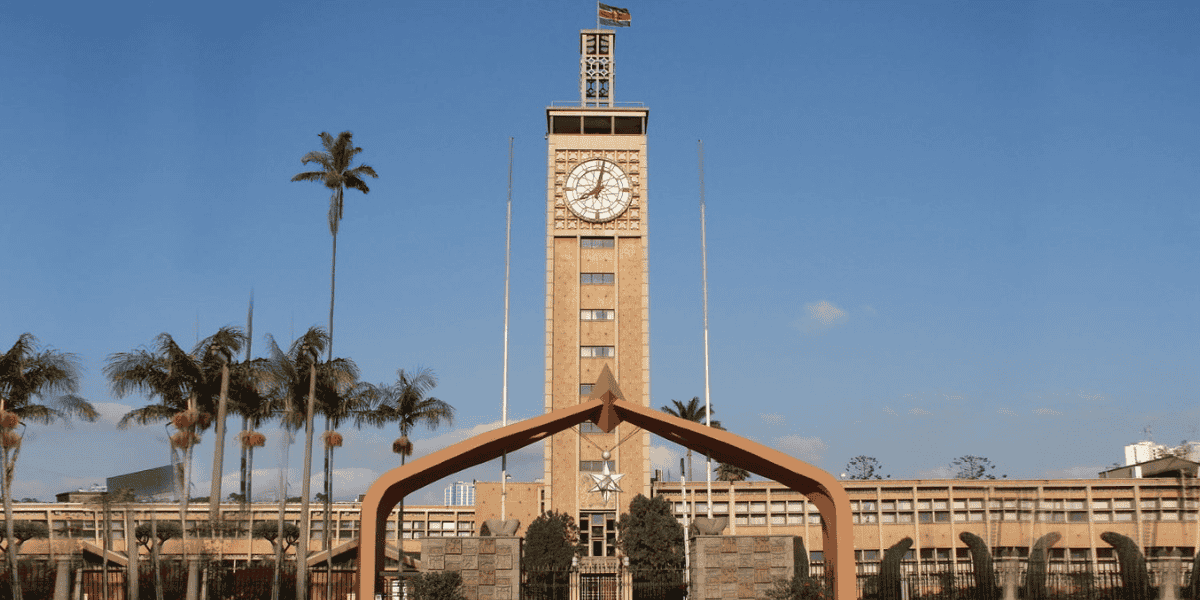

See MoreKenya: KRA announces tax compliance certificate (TCC) enhancements

To obtain a TCC, taxpayers must be registered in eTIMS/TIMS, file and pay all taxes on time, settle outstanding liabilities or have an approved payment plan, and maintain VAT compliance. The Kenya Revenue Authority (KRA) issued a public notice on

See MoreSingapore: IRAS updates GST error correction guidance with new FAQs

IRAS updates GST F7 guidance, clarifying when minor errors need not be corrected. The Inland Revenue Authority of Singapore (IRAS) has updated its guidance on correcting errors in Goods and Services Tax (GST) returns through Form F7, adding six

See MoreColombia: DIAN closes businesses for electronic invoice non-compliance

DIAN closed 47 Bogotá businesses in October for failing to issue electronic invoices and meet tax obligations. Colombia’s Tax Authority (DIAN) continues to strengthen its control measures in the capital. As part of the operations carried out

See MoreItaly: MoF releases 2026 VAT split-payment company lists

Under the split-payment system, buyers pay suppliers only the taxable amount, while the VAT portion is transferred directly to a designated VAT account. Italy's Department of Finance has released updated lists of companies required to comply with

See MoreSaudi Arabia: ZATCA urges businesses to file Q3 VAT returns

ZATCA urged Saudi businesses to file Q3 VAT returns on time. The Saudi Arabian Zakat, Tax and Customs Authority (ZATCA) has urged businesses subject to Value Added Tax (VAT), with annual goods and services revenues exceeding SAR 40 million, to

See More